Dólar Peso colombiano

Dólar Peso colombiano News

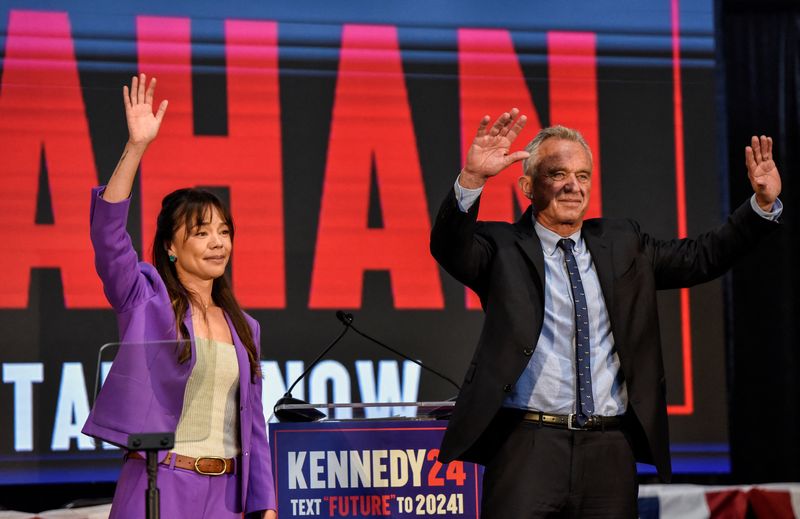

VIEW MORERFK Jr running mate injects needed cash in independent’s campaign

By Stephanie Kelly (Reuters) – The role Robert F. Kennedy Jr.’s running mate, Nicole Shanahan, will play in his White House bid is coming into…

Iran signals no plan to retaliate against Israel after drone attack

By Parisa Hafezi and James Mackenzie DUBAI/JERUSALEM (Reuters) -Explosions echoed over an Iranian city on Friday in what sources said was an Israeli attack, but…

IMF says Latam, Caribbean economies resilient but more growth is needed

By Rodrigo Campos (Reuters) – Stronger macroeconomic policy is partly behind the resilience of economies across Latin America and the Caribbean, the International Monetary Fund…

Rogers Sugar Inc.: Conference Call “ 2nd Quarter 2024 Results

VANCOUVER, British Columbia, April 19, 2024 (GLOBE NEWSWIRE) — Rogers (NYSE:) Sugar Inc. (RSI) will be holding a conference call to discuss their 2024 second…

ROSEN, A TRUSTED AND LEADING LAW FIRM, Encourages Zoetis Inc. Investors to Inquire About Securities Class Action Investigation “ ZTS

NEW YORK, April 19, 2024 (GLOBE NEWSWIRE) — WHY: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims…

Colombian Peso — currency overview

In the world of trading and investment, the USD to COP pair is becoming an increasingly attractive asset. The role of Colombia, one of the largest economies in Latin America, is becoming increasingly important, and its national currency, the peso, is attracting the attention of many traders and investors.

The factor that makes the USD to Colombian Peso pair interesting to traders and investors is Colombia’s role in the Latin American economy. Colombia is one of the largest economies in the region and shows steady economic growth.

History and features of the US Dollar to Colombian Peso

The Colombian peso (COP) has a rich history, beginning with its first introduction in 1810. Over the past two centuries, the peso has gone through various phases and evolutions, reflecting economic and political changes in Colombia.

At the beginning of its history, the Colombian peso was associated with the silver standard, where its value was determined by the weight of silver. In 1886, gold standardization was introduced, and the peso became tied to gold. However, in 1931, Colombia abandoned the gold standard, leading to a devaluation of the peso.

In the 1950s and 1960s, Colombia faced political and economic instability, leading to a significant depreciation of the Dollar against the Colombian Peso. Economic reforms in the 1990s helped stabilize the currency and attract foreign investment. In 1999, however, Colombia faced a major financial crisis, leading to further volatility.

Important economic and political events have a significant impact. For example, the prices of oil, coal, and coffee, which are Colombia’s main export commodities, can affect the exchange rate. Changes in the world economy, political reforms, inflation, central bank interest rates, and trade agreements can also have a significant impact.

An example of this impact is the 2016 Peace Agreement between the Colombian government and the armed group FARC. This agreement helped reduce political instability in the country and attracted more foreign investment, ultimately strengthening the currency.

An overview of Colombia’s main economic indicators

Colombia’s main economic indicators, such as GDP, inflation, and unemployment, are important factors affecting the Colombian peso exchange rate.

- A high GDP helps strengthen the peso because it attracts foreign investment and boosts confidence in the Colombian economy.

- High inflation can lead to a devaluation of the currency because it reduces its purchasing power. A stable inflation rate, supported by appropriate monetary policy, tends to strengthen the peso.

- High unemployment can indicate economic instability and negatively affect the currency. Conversely, low unemployment can promote appreciation.

- A positive trade balance, where exports exceed imports, can support appreciation as demand for Colombian goods and services increases.

- High interest rates can attract foreign capital and help strengthen the currency.

- Colombia is a major producer of oil, coal, coffee, and other commodities. The prices of these commodities in world markets can have a significant impact on the exchange rate.

Advantages and risks of Dollar vs Colombian Peso trading

Trading the US Dollar to Colombian Peso offers certain advantages but also involves certain risks.

Advantages of trading the US Dollar to Colombian Peso

- Volatility: Volatility creates opportunities for traders in the forex market. It can provide more chances for profits with proper analysis and the use of trading strategies.

- Economic Growth: Colombia is one of the largest economies in Latin America, and its economic growth can provide opportunities to invest in various industries and companies in the country.

- Market Accessibility: The Colombian peso is available for trading on international financial platforms, allowing traders from different countries to participate in its trading.

Risks of trading the US Dollar to Colombian Peso

- Changes in the economic and political environment can also affect USD to COP rates.

- Liquidity: Trading volume can be lower compared to some other major currencies.

- Geopolitical Risks: Colombia, like other countries, is subject to geopolitical risks such as political instability, conflicts, or changes in legislation.

USDCOP trading offers opportunities for different types of traders. Long-term investors may consider investing in Colombian stocks or bonds to participate in the country’s long-term economic growth. Day traders can use volatility for short-term transactions and quick profits. Traders using moving averages can apply technical analysis to identify trends and entry/exit points.

Analyzing Current Trends and Forecasts

Forecasting future trends is challenging and depends on many factors, including economic and political events, world markets, and the global economic environment.

Based on current trends and fundamental analysis, some general recommendations can be made:

- Monitor Colombia’s economic indicators, such as GDP, inflation, unemployment, and trade balance. Positive economic data can strengthen the economy, while negative data can weaken it.

- Consider the impact of world events and trends. Factors such as changes in trade policy, global economic events, or changes in commodity prices can significantly affect the currency.

- Keep an eye on the political environment in Colombia and its effect on the USD to COP rates. Political events such as elections, government changes, or political instability can influence the currency.

It is important not to focus solely on one currency or asset. Diversify your portfolio to include different currencies, stocks, bonds, and other assets. Manage risk by setting stop losses and profit levels, and closely monitor your investment strategies.

Remember, these are general guidelines, and each trader or investor should conduct their own research and make decisions according to their individual financial goals and level of experience. Additionally, you can find the current USD to BRL exchange rate and other currency pairs on our website.