Stock Markets

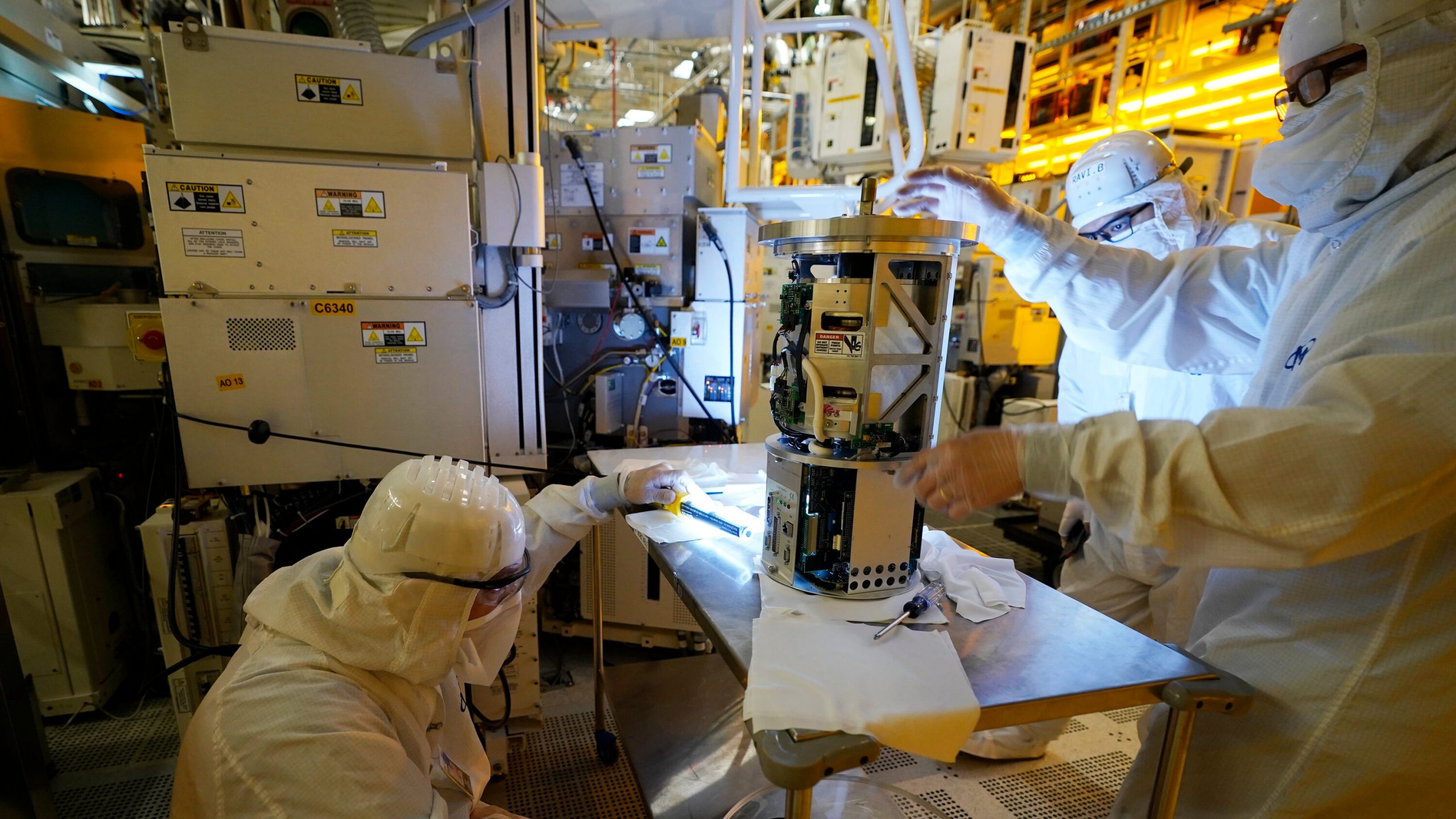

Chips making business: falling demand for gadgets has caused Apple and Qualcomm to have too many chips

Chips making business made too many chips. Total shortage of chips was replaced by their surplus, as manufacturers began to sharply increase capacity and create new enterprises to produce more components, while the demand for many gadgets, on the contrary, fell. This is reported by Forbes.

It is noted that one of the largest chip makers, TSMC, asks its employees to go on vacation, as the volume of orders decreased, and the situation is noticeable in the market of computers and smartphones. “While some chip makers are swimming in inventory, some chips remain in short supply,” the article said.

TSMC’s leading customers — Apple, AMD, Intel, MediaTek, NVIDIA and Qualcomm — are still very modest about future sales, meaning they are not going to increase chip orders. According to experts, the trend will continue into 2023. US chip production is also increasing.

Some of the experts thought that because of the pandemic and the growth in sales of new smartphones and other gadgets demand can be satisfied for years to come. As a result, for the release of new models manufacturers will need to free up warehouses from the old and wait for high demand. Experts have concluded that the abundance of chips is not fixed only at automakers.

Earlier it was reported that in the third quarter of 2022 PC and laptop manufacturers around the world delivered 71.1 million devices to the market, down 15.5% compared to the same period last year.

Earlier, we reported that Moderna covid vaccine maker’s quarterly net income more than tripled.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions