Commodities

Factbox: China’s major germanium and gallium producers

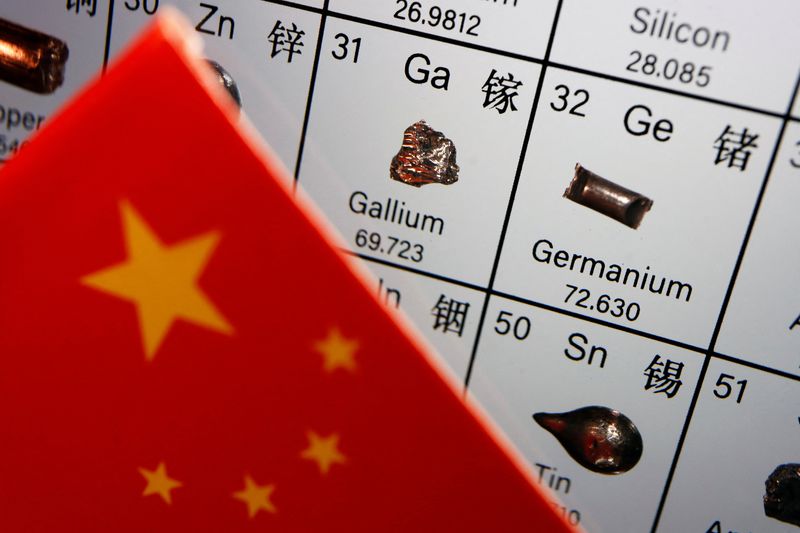

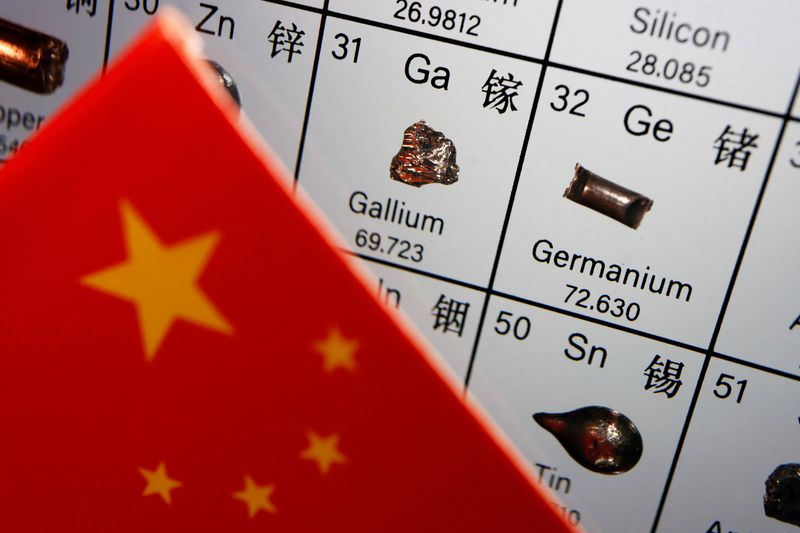

© Reuters. The flag of China is placed next to the elements of Gallium and Germanium on a periodic table, in this illustration picture taken on July 6, 2023. REUTERS/Florence Lo/Illustration

BEIJING (Reuters) – China has announced export restrictions to take effect from Aug. 1 on some gallium and germanium products, metals used in computer chips and other products, citing national security interests.

China produces around 60% of the world’s germanium, or 180 metric tons in 2022, and over 90% of the world’s gallium, about 606 tons last year, according to research firm Antaike.

Output of both metals rose 16% in 2022, the firm says.

Here are some facts about major germanium and gallium producers in China.

YUNNAN GERMANIUM, AN ESTABLISHED PRODUCER

Headquartered in southwest China’s Yunnan province, Yunnan Lincang Xinyuan Germanium Industry Co. Ltd. extracts germanium from its own germanium mines and germanium-containing lignite coal mines.

It has an annual capacity of 47.6 metric tons of germanium ingot, 60 tons of germanium tetrahydride – used to build 5G infrastructure – and 300,000 germanium wafers for solar cells.

The company, which saw its shares hit the upper trading limit three days in a row since Monday, reported a net loss of 62.4 million yuan ($8.62 million) in 2022, citing falling prices amid dwindling demand at home and abroad.

YUNNAN CHIHONG, A GROWING GERMANIUM PRODUCER

Yunnan Chihong Zinc & Germanium Co, a subsidiary of state giant Aluminum Corporation of China (Chinalco), says it is China’s top producer of primary germanium, with output of 56 metric tons of germanium products in 2022.

It has proven germanium resources linked to lead and zinc ores of over 600 metric tons, accounting for around 17% of the country’s total, it says.

The company’s main business is producing zinc, lead, silver, gold and other products but it increased germanium production by almost 10 tons last year.

It also started a production line for optical fiber ultra-high purity germanium tetrachloride, with annual output of 30 metric tons.

CHINALCO, A MAJOR GALLIUM PRODUCER

State aluminium giant Chinalco has three gallium production plants, one each in central China’s Henan and southwestern Guangxi and Guizhou provinces.

It has annual production capacity of 200 metric tons of gallium metal and produced 146 metric tons in 2022.

Chinalco Chairman Duan Xiangdong said in April the company aims to “nurture” leading minor metal companies, according to a statement on its website that did not provide further details.

OTHER GALLIUM PRODUCERS

Shanghai-based aluminium and alumina producer East Hope, Zhuzhou Keneng New Material Co Ltd based in Zhuzhou in central China’s Hunan province and Zhuhai Fangyuan based in southern Guangdong province also make the metal.

Shanxi province-based Xiaoyi Xingan Gallium Industry Co. Ltd is a joint venture between Xiaoyi Xing’an Chemical Co. and Nanjing Jinmei Gallium Industry Co. Ltd., a subsidiary of U.S.-based semiconductor wafer maker AXT (NASDAQ:) Inc.

China is the world’s top aluminium producer and gallium is made during the processing of alumina into aluminium.

($1 = 7.2355 renminbi)

Commodities

Oil prices rise; U.S. crude inventories plunge, Russia-Ukraine truce eyed

Commodities

India’s Reliance to stop buying Venezuelan oil over US tariffs, sources say

Commodities

Oil prices climb on Venezuela supply worries

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions