Commodities

Amazon rainforest gold mining is poisoning scores of threatened species

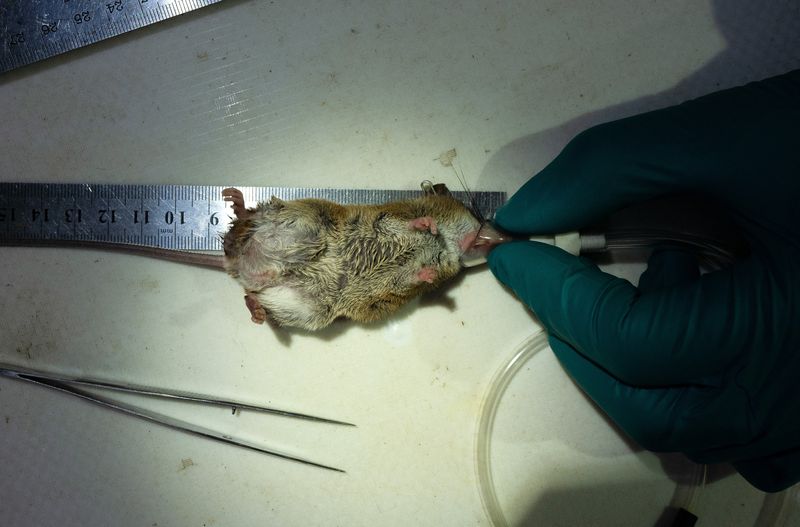

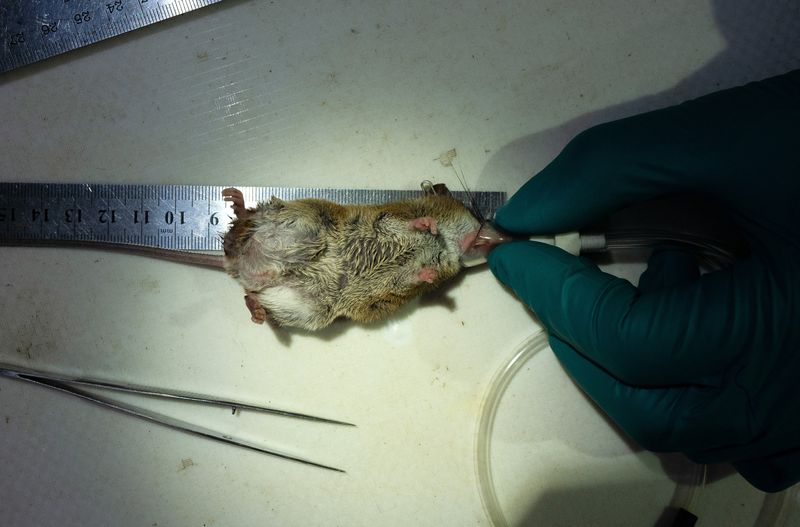

© Reuters. A scientist uses a miniature anesthesia mask to knock out a small-eared pygmy rice rat while researching for signs of mercury contamination in animals, at the Los Amigos Biological Station, in Los Amigos, in the Madre de Dios region, Peru May 24, 2023. RE

2/6

By Gloria Dickie and Jake Spring

LOS AMIGOS BIOLOGICAL STATION, Peru (Reuters) – In a camping tent in the Peruvian jungle, four scientists crowded around a tiny patient: An Amazonian rodent that could fit in the palm of a human hand.

The researchers placed the small-eared pygmy rice rat into a plastic chamber and piped in anesthetic gas until it rolled over, asleep. Removing the creature from the chamber, they fitted it with a miniature anesthetic mask and measured its body parts with a ruler before gently pulling hairs from its back with tweezers.

The hairs, bundled into a tiny plastic bag, would be carried to a nearby lab at the Los Amigos Biological Station for testing to determine whether the rat is yet another victim of mercury contamination.

Los Amigos lies in the rainforest of southeastern Peru’s Madre de Dios region where some 46,000 miners are searching for gold along river banks in the country’s epicenter of small-scale mining.

Tests like this are providing the first extensive indications that mercury from illegal and poorly regulated mining is affecting terrestrial mammals in the Amazon (NASDAQ:) rainforest, according to preliminary findings from a world-first study shared with Reuters.

Absorbing or ingesting mercury-contaminated water or food has been found to cause neurological illness, immune diseases and reproductive failure in humans and some birds.

But scientists don’t yet know its full effects on other forest animals in the Amazon, where more than 10,000 species of plants and animals are at a high risk of extinction due to destruction of the rainforest.

Reuters accompanied the researchers in Madre de Dios over three days in late May and reviewed their previously unreported findings. Their data showed mercury contamination from informal gold mining making its way into the biodiversity hotspot’s mammals — from rodents to ocelots to titi monkeys.

Leaders from the eight countries around the Amazon meeting in Brazil next week will discuss how to end illegal gold mining.

The rapid expansion of mining in the rainforest over the past 15 years is seen by regional governments as an environmental and health threat. Colombia has proposed a regional pact to end illegal mining, although has not suggested a deadline to reach that goal, a government spokesperson told Reuters.

A research team from the San Diego Zoo Wildlife Alliance, the California nonprofit Field Projects International and Peruvian partner Conservación Amazônica have collected fur and feather samples from more than 2,600 animals representing at least 260 species, including emperor tamarins and brown capuchins, in the 4.5 square kilometer (1.7 square mile) area around the Los Amigos station.

While the scientists began testing for mercury at Los Amigos in 2021, some of the samples were gathered as early as 2018.

Of the 330 primate samples tested so far, virtually all showed mercury contamination — and in some cases the levels were “astounding,” said biologist Mrinalini Erkenswick Watsa of the San Diego Zoo Wildlife Alliance.

Erkenswick Watsa said they could not share specific readings before their findings are published in peer-reviewed journals.

But a study last year led by biogeochemist Jacqueline Gerson of the University of Colorado Boulder, drawing on the same data generated at Los Amigos, found that songbirds living around the station had mercury levels as much as 12 times higher than those in a forest farther away from gold mining.

During Reuters’ visit to Los Amigos, scientists caught rodents in metal traps baited with peanut butter and snagged birds and a bat in mist nets floating through the forest.

A MINING BOOM

The vast majority of small-scale or artisanal miners in the Amazon are mining illegally in protected areas, or working informally – outside reserves but without explicit permission from the government.

Informal miners even in government-designated mining corridors, which includes much of the Madre de Dios region, operate with little regulatory oversight.

Some researchers say this means that many small-scale mining operations disregard environmental laws restricting deforestation and the use of toxic liquid mercury to separate precious metal from sediment.

Some of that mercury is then absorbed into the environment and, in some cases, into endangered species.

“When someone buys their gold engagement ring, they could be causing the Amazon to get a little bit sicker,” said Erkenswick Watsa.

Peruvians have mined gold for centuries. Artisanal mining boomed in the Madre de Dios region during the 2008 Great Recession as gold prices spiked, driven up by investors fleeing financial markets and national currencies for a safe place to put their money.

Tracking artisanal miners is notoriously difficult. It is thought to make up about a fifth of worldwide gold production and is valued between $30 billion and $40 billion, according to nonprofit Artisanal Gold Council (AGC) which promotes the sustainable development of the sector.

That’s around 500 metric tons annually as of 2023, up from about 330 metric tons in 2011, AGC data shows. Peru, the largest gold producer in Latin America, churns out around 150 metric tons of artisanal gold every year, according to the AGC.

In Madre de Dios, about 6,000 miners work with formal permission while roughly 40,000 operate informally or illegally, according to a 2022 USAID report.

The Peruvian government declared a state of emergency in Madre de Dios in 2019 and deployed 1,500 police and soldiers to the region to crack down on illegal mining.

The operation pushed many miners out of protected areas and into a government-designated mining corridor, according to satellite monitoring project MAAP.

Peru’s environment ministry did not respond to questions about mercury contamination.

In 2021, mining arrived on Los Amigos’ doorstep. The station sits on the edge of the mining corridor and overlooks a barren curve across the river where miners have stripped away the forest and replaced it with mining pits.

“This is a region in Peru where there’s been an economic boom, and it’s been associated with gold mining,” said Gideon Erkenswick, a researcher and Mrinalini’s husband, who has come to Los Amigos since 2009 to study wildlife diseases and primates. “This place is being transformed by it.”

The Peruvian government estimates that illegal miners dump about 180 metric tons of mercury in Madre de Dios annually.

The miners mix mercury with fine river silt in oil drums. The mercury binds to the gold fragments, resulting in lumps known as amalgams. Burning the amalgams turns the mercury to vapor which floats into the atmosphere, leaving only gold behind.

This gaseous mercury has been found to infiltrate the forest through pores in plant leaves, according to research published in Nature Communications last year.

Mercury vapor sticks to dust and aerosol particles, floating down through the canopy and landing on leaves. When it rains, that mercury is washed to the forest floor.

MERCURY MENAGERIE

Shortly after dawn, biologist Jorge Luis Mendoza Silva gently untangled a brilliant red, yellow and orange band-tailed manakin bird from a fine-mesh net.

Back in the sampling tent, the scientists tweezed clumps of the manakin’s breast feathers to be sent for analysis, before the bird is returned unharmed to the wild.

The machine incinerates the feathers at extremely high temperatures, measuring the emitted mercury.

Animals ingest mercury through their diet — plants, insects, or other animals. Those higher up the food chain generally have higher levels as they accumulate the mercury contained in their prey.

But scientists at the Los Amigos station are unsure where the mercury contamination in monkeys comes from, given fish or other foods traditionally high in the heavy metal aren’t typically on the menu.

Animals could be accumulating mercury from the water they drink, or the air they breathe, said Caroline Moore, a veterinary toxicologist with the San Diego Zoo Wildlife Alliance studying mercury at Los Amigos.

How this will affect their health is not clear. The effects of mercury could show up in population size, she said. If mercury levels are high enough, it could prevent animals from reproducing.

“Are we noticing any changes in the number of babies that, for example, the tamarins are having?” Moore asked.

Those kinds of questions cannot be answered without more data, she said. In the years to come, scientists hope to create a long-term dataset in Peru and other mining hotspots to understand how mercury could be affecting imperiled mammals globally.

“It is widespread throughout the Amazon Basin, it’s widespread throughout the Congo Basin and Indonesia — this is a global tropics issue,” said ecotoxicologist Chris Sayers at the University of California Los Angeles, who has studied the impact of mercury on birds in Madre de Dios.

Commodities

Oil prices rise; U.S. crude inventories plunge, Russia-Ukraine truce eyed

Commodities

India’s Reliance to stop buying Venezuelan oil over US tariffs, sources say

Commodities

Oil prices climb on Venezuela supply worries

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions