Forex

Dollar slides to four-month low after Fed signals cuts ahead; ECB, BOE up next

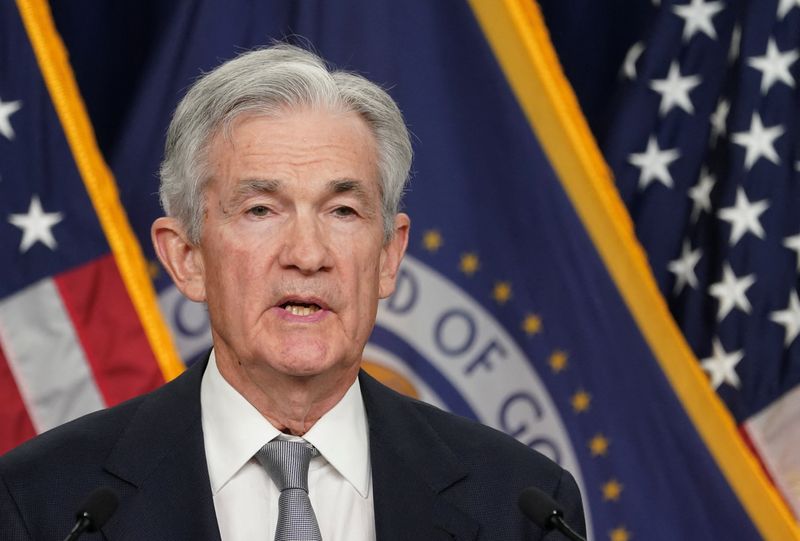

© Reuters

Investing.com – The U.S. dollar fell close to four-month lows in early European trade Thursday after the Federal Reserve signaled rate cuts next year, with the European Central Bank and the Bank of England set to meet later in the session.

At 04:05 ET (09:05 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.3% lower at 102.200, near its weakest level since mid-August.

Fed signals rate cuts next year

The kept interest rates on hold at the conclusion of its two-day meeting on Wednesday, as widely expected, while its latest economic projections indicated its lengthy hiking cycle has ended and lower borrowing costs are coming in 2024.

Additionally, Fed Chair declined to push back against rate cut expectations, saying a discussion of cuts in borrowing costs is coming “into view.”

“In a somewhat surprising move, the Fed has acknowledged recent disinflation trends and poured gasoline on the fire of easing expectations for 2024,” said analysts at ING, in a note.

Markets are now pricing in around a 75% chance of a rate cut in March, according to CME FedWatch tool, compared with 54% a week earlier.

ECB, BOE up next

Attention now turns to Europe, with rate decisions due later Thursday from the and the , and .

rose 0.2% to 1.0896, while rose 0.1% to 1.2636, with both the ECB and the BOE expected to keep interest rates unchanged as inflation remains above target.

The focus will be on “to what degree the likes of the European Central Bank or the Bank of England do a better job than the Fed in pushing back against easing expectations for next year. If indeed they do a better job, it will only add to rallies in EUR/USD and GBP/USD,” ING added.

The Norges Bank is considered to be the only bank that could potentially raise rates, but there is also a risk the SNB dials back its support for the Swiss franc in currency markets.

Yen surges ahead of next week’s BOJ meeting

In Asia, traded 0.8% lower to 141.69, with the Japanese yen climbing to an over four-month high against the dollar after the Fed comments.

Markets were now awaiting a meeting next week for more cues on monetary policy, although the BOJ is widely expected to maintain its ultra-dovish messaging.

traded 0.5% lower at 7.1353, with the yuan trading close to a four-month high, although further gains in the currency were held back by persistent concerns over the Chinese economy.

Markets were now awaiting more economic cues on China from and data due on Friday, after a string of disappointing readings for November.

rose 0.5% to 0.6694, not far from an over a four-month high after strong employment data, while rose 0.3% to 0.6194, despite data showing the New Zealand unexpectedly contracted in the third quarter.

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions