Stock Markets

Three US troops killed, up to 34 injured in Jordan drone strike linked to Iran

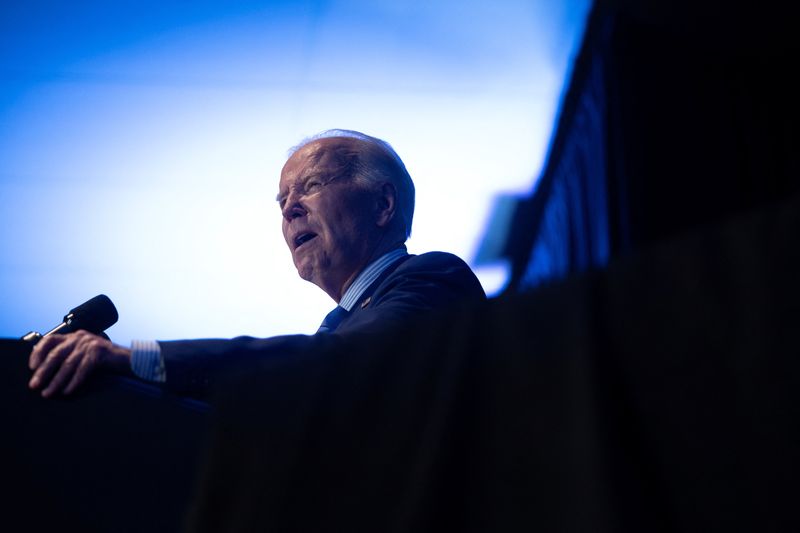

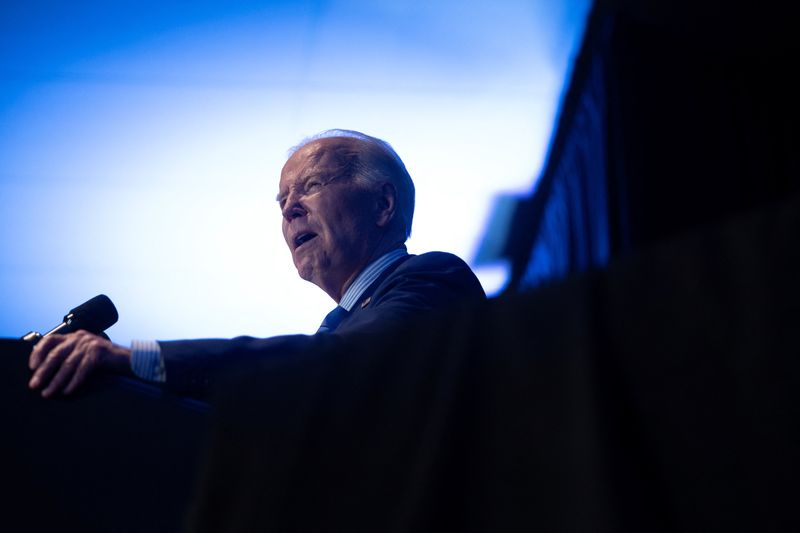

© Reuters. U.S. President Joe Biden delivers remarks at South Carolina’s First in the Nation Dinner at the State Fairgrounds in Columbia, South Carolina, U.S., January 27, 2024. REUTERS/Tom Brenner/File Photo

By Phil Stewart, Steve Holland and Idrees Ali

WASHINGTON (Reuters) -Three U.S. service members were killed and dozens wounded during an unmanned aerial drone attack on U.S. forces stationed in northeastern Jordan near the Syrian border, President Joe Biden and U.S. officials said on Sunday.

Biden blamed Iran-backed groups for the attack, the first deadly strike against U.S. forces since the Israel-Hamas war erupted in October, sending shock waves throughout the Middle East.

“While we are still gathering the facts of this attack, we know it was carried out by radical Iran-backed militant groups operating in Syria and Iraq,” Biden said in a statement.

At least 34 personnel were being evaluated for possible traumatic brain injury, a U.S. official told Reuters, speaking on condition of anonymity. Two different officials said some wounded U.S. forces were medically evacuated from the base for further treatment.

A fourth official said the drone struck near the barracks, which, if confirmed, could explain the high number of casualties.

The attack is a major escalation of the already tense situation in the Middle East, where war broke out in Gaza after Palestinian Islamist group Hamas’ attack on Israel on Oct. 7 which killed 1,200. Israel’s subsequent assault on Gaza has killed over 26,000 Palestinians, according to the local health ministry.

While the United States has thus far maintained an official line that Washington is not at war in the region, it has made strikes against targets of Yemen’s Houthi groups that have been attacking commercial vessels in the Red Sea.

“We will carry on their commitment to fight terrorism. And have no doubt – we will hold all those responsible to account at a time and in a manner of our choosing,” Biden said in his statement released by the White House.

A senior official with the Iran-backed Palestinian militant group Hamas, Sami Abu Zuhri, directly tied the attack to Israel’s campaign in Gaza.

“The killing of three American soldiers is a message to the U.S. administration that unless the killing of innocents in Gaza stops, it must confront the entire nation,” he told Reuters.

“The continued American-Zionist aggression on Gaza is capable of exploding the situation in the region.”

The U.S. military said the attack occurred at a base in northeastern Jordan, near the Syrian border. It did not name the base. U.S. military activity in Jordan can be a sensitive issue, particularly at a time of heightened tensions of the Israel-Hamas conflict.

A Jordanian government spokesman told state TV that the militants targeted a different base, outside Jordanian territory.

Washington has given Jordan around $1 billion to bolster border security since Syria’s civil war began in 2011, and has recently sent more military aid to that end, Western intelligence sources say.

It is unclear which Iran-backed group may have carried out the attack but several U.S. officials said they did not believe that Iranian military forces themselves launched the one-way attack drone.

“While we’re still gathering facts, this is most assuredly the work of an Iranian-backed militia group,” a second official said.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions