Stock Markets

El Salvador President Bukele poised for a landslide as voters cast ballots

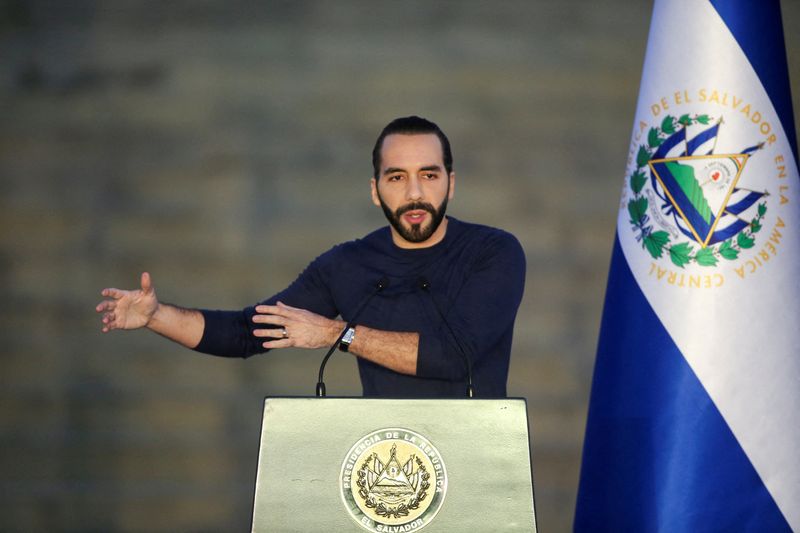

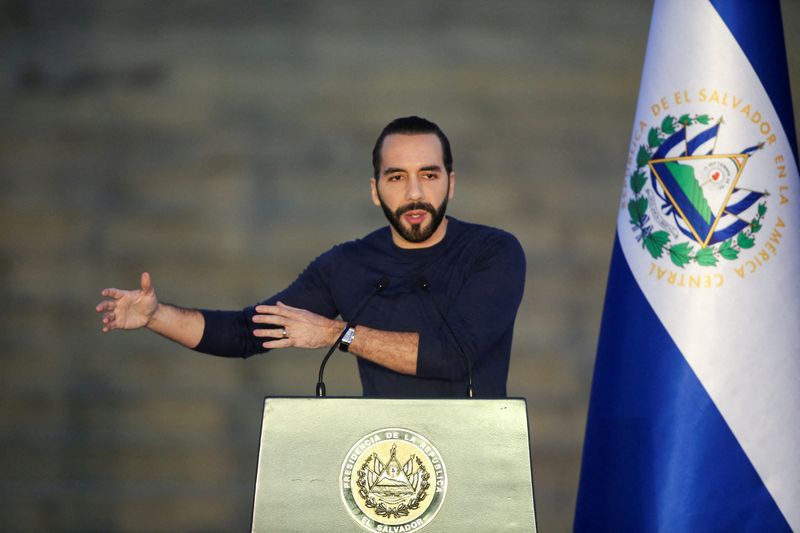

© Reuters. FILE PHOTO: El Salvador’s President Nayib Bukele speaks during the inauguration of the Vijosa pharmaceutical plant in Santa Tecla, El Salvador November 20, 2023. REUTERS/Jose Cabezas/File Photo

By Nelson Renteria and Sarah Kinosian

SAN SALVADOR (Reuters) -Salvadorans voted on Sunday in elections expected to hand President Nayib Bukele another landslide victory, with many happy to overlook the young leader’s authoritarian drift after he crushed gang violence that had paralyzed life in the poor Central American country.

Bukele, 42, appears poised to become the first Salvadoran president in more than a century to be re-elected.

Wildly popular, Bukele has campaigned on the success of his security strategy under which authorities suspended civil liberties to arrest more than 75,000 Salvadorans without charges. The detentions led to a sharp decline in nationwide murder rates and transformed a country of 6.3 million people that was once among the world’s most dangerous.

But some analysts have said the mass incarceration of 1% of the population is not a sustainable long-term strategy.

Five other presidential candidates are contesting the elections, including politicians from the former leftist guerrilla Farabundo Marti National Liberation Front (FMLN) and the right-wing Nationalist Republican Alliance (ARENA), which between them governed for 30 years until 2019.

Polls show most voters appear set to reward Bukele for decimating the crime groups that made life intolerable in El Salvador and fueled waves of migration to the United States.

Victor Lopez, a 65-year-old construction worker, was among the first 10 people lined up at a voting center on one of the capital San Salvador’s main avenues, where Bukele is scheduled to cast his vote later on Sunday.

“We have to continue the changes that are happening in our country – positive changes. We have no crime, tourism has skyrocketed and other positive things,” Lopez told Reuters.

“We cannot let the corrupt people from before have power again because then the projects that the government is executing could not be executed,” Lopez added, referring to the country’s two traditional parties, FMLN and ARENA.

Pre-election polling had put voter support in the single digits for the FMLN and ARENA candidates, with voters fed up after decades of traditional politics marked by violence and corruption.

A firebrand politician who often spars with foreign leaders and foes on social media, Bukele came to power in 2019 trouncing El Salvador’s traditional parties with a vow to eliminate gang violence and rejuvenate the country’s stagnant economy.

Since then, he has used his New Ideas party’s supermajority in the legislative assembly to reshape courts and institutions, solidifying his grip on key parts of the government. He also championed the introduction of as a legal tender, drawing criticism from the International Monetary Fund (IMF).

El Salvador’s Supreme Electoral Tribunal last year permitted him to run for a second term even though the country’s constitution prohibits it. Opponents voiced fears Bukele would seek to rule for life, following President Daniel Ortega from next-door Nicaragua.

Rights groups have said that El Salvador’s democracy is under attack. Bukele has downplayed those concerns, at one point changing his profile on X, the social media platform, to say: “World’s coolest dictator.”

Salvadorans seem unfazed, with polls showing about 80% of them support him.

“There is still a huge amount to do but, step by step, we will resolve entire decades of looting and neglect,” Bukele wrote on X this week.

Once re-elected, Bukele’s biggest challenge is likely to be a sputtering economy, Central America’s slowest growing during his time in power. More than a quarter of Salvadorans live in poverty.

Extreme poverty has doubled and private investment has tumbled. There has not been much momentum on Bukele’s highly publicized plans for Bitcoin City, a tax-free crypto haven powered by geothermal energy from a volcano.

The IMF, which is negotiating a $1.3 billion bailout with El Salvador, in late 2023 described the country’s fiscal situation as “fragile.”

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions