Stock Markets

Biden to meet Poland’s leaders on NATO funding against Russia

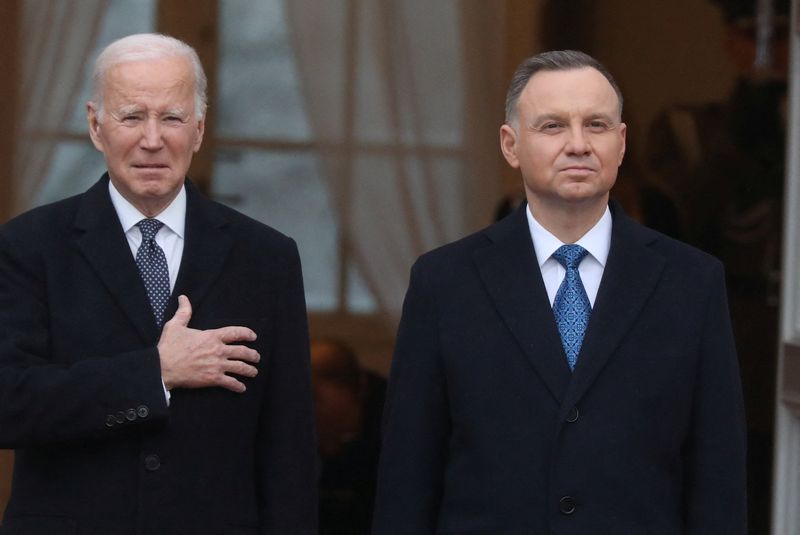

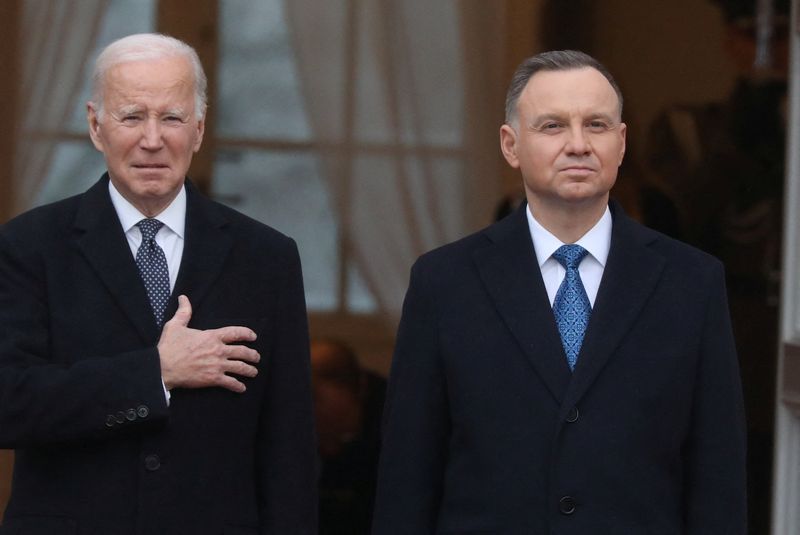

© Reuters. FILE PHOTO: U.S. President Joe Biden is welcomed by Polish President Andrzej Duda outside the Presidential Palace in Warsaw, Poland, February 21, 2023. Slawomir Kaminski/Agencja Wyborcza.pl via REUTERS/File Photo

By Steve Holland and Jonathan Landay

WASHINGTON (Reuters) – U.S. President Joe Biden on Tuesday will meet Poland’s president and prime minister to show solidarity for Ukraine in its battle against Russian invaders and discuss ways to increase funding for NATO against the ongoing threat from Moscow.

The White House meeting between Biden and Polish President Andrzej Duda and Prime Minister Donald Tusk comes as Biden presses to overcome Republican hardliners in Congress who are stalling $95 billion for Ukraine weaponry and aid to Israel.

“The leaders will reaffirm their unwavering support for Ukraine’s defense against Russia’s brutal war of conquest,” the White House said, noting the three leaders will coordinate ahead of the annual NATO summit, to be held July 9-11 in Washington.

Speaking before the talks, Polish Foreign Minister Radoslaw Sikorski urged House Speaker Mike Johnson to allow a vote on the Ukraine funds, but toned down an earlier plea in which he said Johnson would be blamed if the bill failed and Russian troops advanced.

“If the American package doesn’t arrive … Ukraine might be in difficulty, and that might eventually mean the need for more American troops in Europe,” he told reporters at a Monitor breakfast.

Sikorski also appealed to Johnson’s Baptist faith, saying that Russia “persecutes religious minorities, including Baptists” in Russian-occupied areas of Ukraine.

Sikorski said that Poland had joined a Czech-led plan to buy 800,000 rounds of ammunition for Ukraine, describing Warsaw’s financial contribution as “substantial”.

The Senate passed the bill containing $60 billion in security aid for Ukraine last month in a bipartisan vote. Johnson, an ally of former President Donald Trump who opposes more help for Ukraine, has refused to put it to a vote.

A White House official said the three leaders would celebrate the 25th anniversary of Poland joining NATO and will discuss “deepening our defense relationship which has grown closer over the past two years since Russia’s invasion of Ukraine.”

Duda set the stage for the talks by writing an opinion article for the Washington Post calling for each NATO ally to increase defense spending from 2% to 3% of GDP because Russian President Vladimir Putin has switched the Russian economy to war mode and is allocating 30% of the annual budget to arm itself.

“A return to the status quo ante is not possible. Russia’s imperialistic ambitions and aggressive revisionism are pushing Moscow toward a direct confrontation with NATO, with the West and, ultimately, with the whole free world,” Duda wrote.

Biden’s Republican opponent in the November presidential election, Donald Trump, told Hungarian Prime Minister Viktor Orban he will not give money to help Ukraine fight Russia if he wins the presidency again and that will hasten an end to the war, Orban said after meeting him.

“He will not give a penny into the Ukraine-Russia war and therefore the war will end,” Orban told state television late on Sunday. “As it is obvious that Ukraine on its own cannot stand on its feet.”

(This story has been corrected to fix the spelling of Radoslaw in paragraph 4)

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions