Stock Markets

New York state can enforce many gun restrictions, US appeals court rules

By Jonathan Stempel

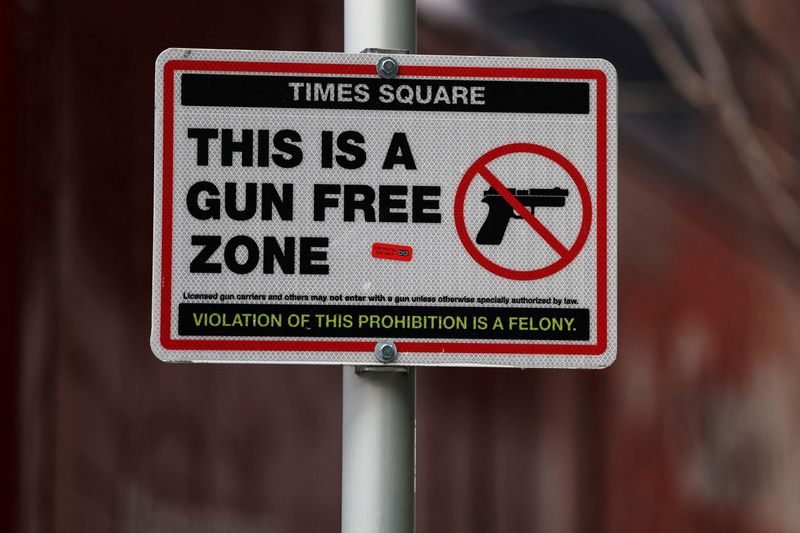

NEW YORK (Reuters) -A federal appeals court upheld large portions of an expansive New York state gun control law on Thursday, saying the state can ban people from carrying weapons in “sensitive” locations such as schools, parks, theaters, bars and Times Square.

In a 246-page decision, the 2nd U.S. Circuit Court of Appeals in Manhattan also let licensing officials prevent people they consider dangerous from using guns in public, by requiring gun applicants to show they have “good moral character.”

But the three-judge panel also rejected parts of the 2022 law, including a ban on guns in private locations that are generally open to the public, such as gas stations and supermarkets.

The panel had ruled the same way in December, but revisited the matter after the U.S. Supreme Court – in a different case – clarified the constitutional protections afforded to gun owners.

Lawyers for gun owners who challenged the law did not immediately respond to requests for comment on their behalf.

“This decision is another victory in our effort to protect all New Yorkers from the scourge of gun violence,” New York Attorney General Letitia James, a Democrat, said in a statement. “Commonsense gun safety legislation helps protect New Yorkers.”

Governor Kathy Hochul, a Democrat, signed the law passed by the state’s Democratic-controlled legislature on July 1, 2022.

The signing came one week after the Supreme Court struck down a different, more than century-old state law restricting the carrying of guns outside the home.

That decision, New York State Rifle & Pistol Association v Bruen, was a landmark that expanded Americans’ 2nd Amendment rights to arm themselves in public. It also required courts to look for historical analogues to justify new gun restrictions.

FRUSTRATION AND PRAISE

In June, however, the Supreme Court limited the Bruen decision by upholding a federal ban on gun ownership by people subject to restraining orders for domestic violence.

The Supreme Court then ordered the Manhattan appeals court to review the 2022 New York law in light of that decision, U.S. v. Rahimi.

In Thursday’s decision, the appeals court said the Supreme Court analysis in the Rahimi case “supports our prior conclusions.”

Erich Pratt, senior vice president at Gun Owners of America, whose California affiliate was involved in the case, in a statement called the decision “incredibly frustrating” and a “slap in the face” to the Supreme Court and New York gun owners.

“We will continue the fight against Governor Hochul and anti-gun legislators in Albany until New Yorkers can finally carry for self-defense without infringement,” he said.

Eric Tirschwell, chief litigation counsel for Everytown for Gun Safety, in a statement said the decision confirms that gun rights’ advocates’ “reckless efforts to dismantle public safety measures” are inconsistent with Supreme Court precedents.

The appeals court returned the case to U.S. District Judge Glenn Suddaby in Syracuse, New York, who blocked much of the New York law in October 2022.

The case is Antonyuk et al v James et al, 2nd U.S. Circuit Court of Appeals, Nos. 22-2908, 22-2972.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions