Commodities

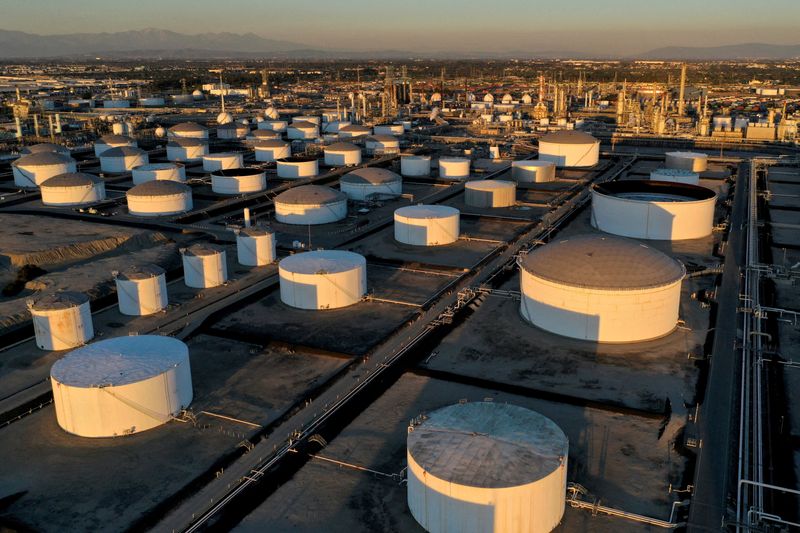

Oil edges higher as US interest rate cut counters weak demand

By Arunima Kumar

(Reuters) -Oil prices were little changed on Monday after last week’s cut in U.S. interest rates and a dip in supply in the aftermath of Hurricane Francine countered weaker demand from top oil importer China.

futures for November were down by 6 cents, or 0.1%, to $74.43 a barrel by 1253 GMT. U.S. crude futures for November were up 4 cents, or 0.1%, at $71.04.

Oil prices were buoyed last week by the U.S. Federal Reserve’s decision to cut interest rates by 50 basis points and signal further cuts by end of the year, though weaker demand from China is limiting the upside, said Charalampos Pissouros, senior investment analyst at brokerage XM.

Both oil benchmarks rose more than 4% last week.

“Oil looks rangebound despite the uplift to risky asset prices from an outsized policy rate cut by the Fed last week,” said Harry Tchilinguirian, head of research at Onyx Capital Group

“The market will look to flash purchasing managers’ index (PMI) releases in Europe and the U.S. for economic direction, and if these disappoint, then there is likely to be downward pressure developing on oil prices.”

Euro zone business activity contracted sharply and unexpectedly this month as the bloc’s dominant services industry flatlined while a downturn in manufacturing accelerated, a survey showed on Monday.

A softer economic outlook from top consumer China capped further gains.

“There was some hope earlier this morning that some additional Chinese monetary stimulus is likely in the short term, but the latest PMI out of Europe switched market sentiment from positive to negative,” said UBS analyst Giovanni Staunovo.

“I would expect oil to benefit this week from a large U.S. crude draw as result of elevated U.S. crude exports.”

However, heightened conflict in the Middle East could curtail regional supply.

The Israeli military launched its most widespread wave of airstrikes against Iran-backed Hezbollah, targeting Lebanon’s south, eastern Bekaa valley and northern region near Syria simultaneously after nearly a year of conflict.

“The market could continue to react to the escalating tensions in the Middle East as confrontations between Israel and Hezbollah continue. Heightened concerns over a broader conflict disrupting regional oil supplies could add upward pressure to the market,” said BDSwiss market strategist Mazen Salhab.

Commodities

Oil prices rise; U.S. crude inventories plunge, Russia-Ukraine truce eyed

Commodities

India’s Reliance to stop buying Venezuelan oil over US tariffs, sources say

Commodities

Oil prices climb on Venezuela supply worries

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions