Cryptocurrency

These Crypto Traders Think PlayDoge Meme Coin Could Explode By 2025

Looks like there’s a new dog-themed meme coin going viral.

PlayDoge (PLAY), a crypto gaming project on Ethereum, is gaining traction in its presale phase.

And three big-name traders reckon PLAY could produce some explosive gains by 2025.

PlayDoge – Where Memes Meet Nostalgia

PlayDoge is bringing together meme coins, P2E gaming, and ‘90s nostalgia.

Its main feature is a mobile game that’s like a crypto-powered Tamagotchi – but for the Web3 era.

Here’s how it works: Players get their own virtual Doge pet to take care of.

They can feed it, play with it, and train it, all rendered in 8-bit graphics.

As players interact with their Doge, they’ll earn PLAY tokens.

And these tokens aren’t for show – they’re real crypto that players can trade or stake.

Players can boost their PLAY income in various ways, such as through side-scrolling mini-games or ranking on the monthly leaderboard.

The whole ecosystem is designed to be easy to pick up and play while on the go.

It’s also suited to both beginners and crypto veterans.

On top of PlayDoge’s P2E game, there’s also a staking program for PLAY holders.

Right now, those who stake PLAY will receive annual yields of 84% – far higher than what most staking coins offer.

Top Crypto Traders Bet Big on PlayDoge’s 10x Potential

Three big names in the crypto world are betting on PlayDoge – and their predictions are turning heads.

First up, we’ve got YouTuber Jacob Bury.

He’s eyeing a potential 10x gain for PLAY, citing its combo of P2E gaming and meme coin appeal.

Bury reckons this combo could be a recipe for explosive growth.

The traders over at 99Bitcoins are similarly optimistic.

They’re also talking about a potential 10x price pump, but they’re most excited about PlayDoge’s retro aesthetic.

Seems like they believe nostalgia could be a powerful demand driver.

Meanwhile, YouTube trader Crypto Wire is bullish for a different reason.

He’s excited about the dual-earning potential in the PlayDoge ecosystem since players can earn PLAY tokens both by playing the game and through staking.

These three endorsements are helping ramp up the enthusiasm about PlayDoge.

The project’s Twitter and Telegram channels are blowing up, with hundreds of new followers piling in daily.

And it’s not just social media buzz.

PLAY was also ranked fifth on CoinSniper.net, a platform that reviews upcoming crypto launches.

PlayDoge Aims to Be More Than Just a Meme Coin with Ambitious Roadmap

Looking ahead, PlayDoge’s team has a packed roadmap that’s got early investors buzzing.

Right now, the project is in Phase 1.

PlayDoge’s smart contracts have been audited by SolidProof, and the token presale is in full swing.

Next up, the team is looking to launch PLAY on a DEX.

That’s when things could really start heating up.

Down the line, the team has their sights set on beta testing for mini-games, potential listings on CEXs, and even a community airdrop.

As for PlayDoge’s tokenomics, it’s worth noting that 50% of the 9.4 billion PLAY supply has been set aside for the presale.

That’s half of the tokens going directly to early supporters.

There’s also a 12% chunk for staking rewards and 10% for marketing purposes.

Ultimately, PlayDoge’s mix of gaming and nostalgia is what sets it apart from the competition.

It’s not just another useless meme coin – it’s bringing something completely new to the table.

This focus on actual utility could give it an edge in the long run.

So, while nothing’s guaranteed in crypto, PlayDoge’s fun vibes and P2E gameplay might just be the recipe for success that investors are looking for.

Disclaimer: The above article is sponsored content; it’s written by a third party. CryptoPotato doesn’t endorse or assume responsibility for the content, advertising, products, quality, accuracy, or other materials on this page. Nothing in it should be construed as financial advice. Readers are strongly advised to verify the information independently and carefully before engaging with any company or project mentioned and do their own research. Investing in cryptocurrencies carries a risk of capital loss, and readers are also advised to consult a professional before making any decisions that may or may not be based on the above-sponsored content.

Readers are also advised to read CryptoPotato’s full disclaimer.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Cryptocurrency

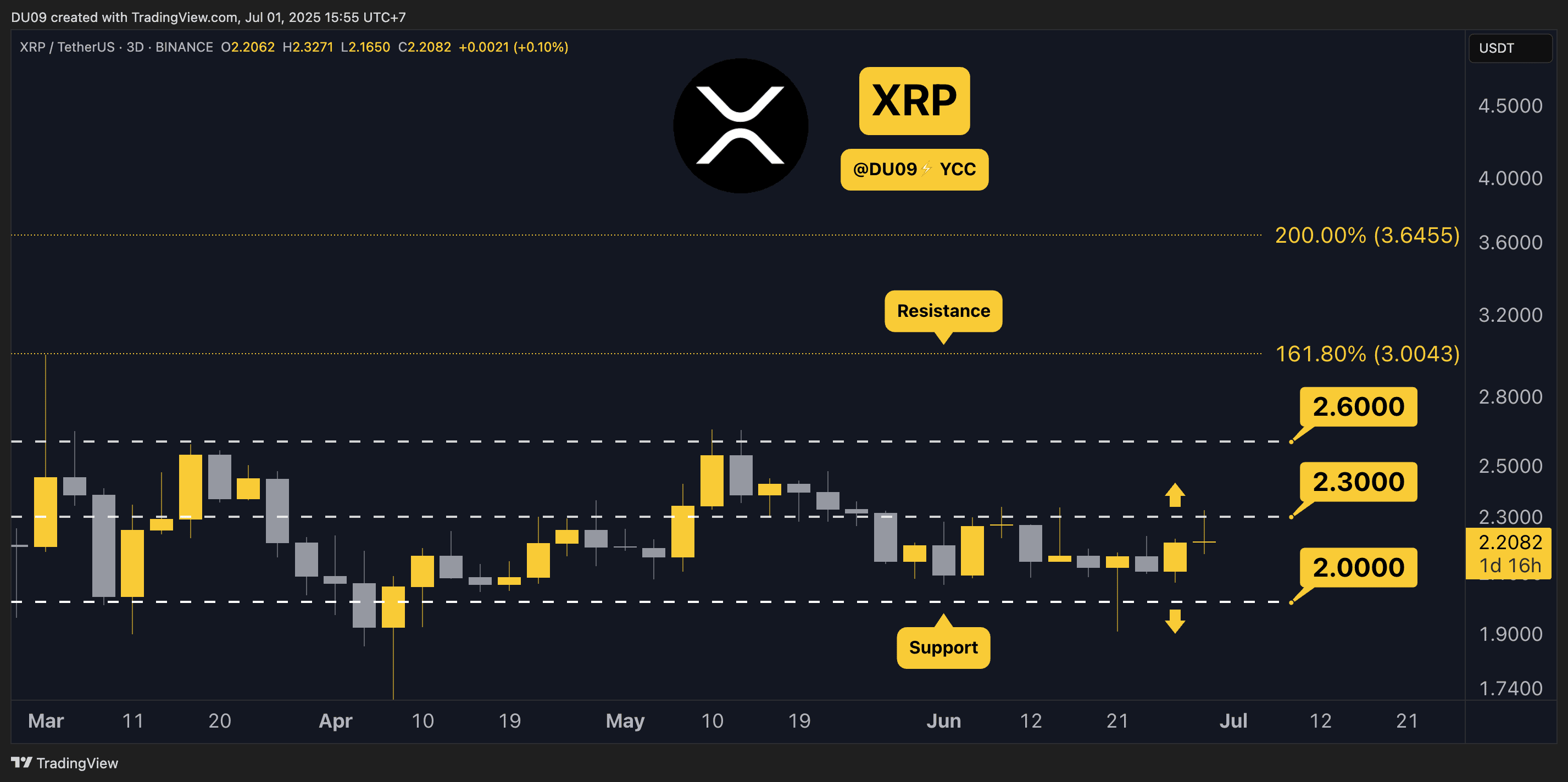

3 Things to Watch in Ripple’s (XRP) Price Today

XRP is testing the resistance at $2.3. Will it break?

Key Support levels: $2

Key Resistance levels: $2.3, $2.6, $3

1. Key Resistance Under Pressure

Yesterday, buyers pushed XRP to the key resistance at $2.3, but sellers returned to stop a breakout. At the time of this post, the price is in a pullback. Nevertheless, this is a positive sign that shows buyers are returning. If this bullish momentum intensifies, then $2.3 could fall and be followed by a test of $2.6 next.

2. Optimism Returns

With the price keen on making higher highs, optimism is returning to this cryptocurrency. This can be seen on the volume profile where buyers have dominated in the last few days. A break above $2.3 will likely see the volume spike and allow further price expansion into new highs.

3. MACD Turning Bullish

After the daily MACD turned positive last week, the 2-day MACD has also turned bullish today. This shows that the buy momentum is slowly creeping into higher timeframes which will build confidence in the price action and attract more buyers. With a positive feedback loop in action, XRP has a good shot at $2.6 or even higher in July.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Cryptocurrency

Bitcoin Traders Wait Important Economic Announcements Today, These Altcoins Plummet (Market Watch)

Bitcoin’s price has retraced by a slight 0.9% in the past 24 hours as traders are expecting a few important economic events during today’s session.

Meanwhile, the broader cryptocurrency market is also reflecting the uncertainty as the majority of altcoins are trading in the red with some charting a lot bigger declines than others.

Bitcoin Price Waits for News

The deep involvement of corporate Bitcoin buyers and institutions has surely played a major role in its price increase over the past year but it’s also the reason why the crypto market has been largely correlated to traditional ones.

A few years ago, literally nobody cared about metrics such as CPI, PMI, and whatnot, but now every crypto trader has them on their watchlist.

As such, today is also shaping up to be a volatile experience with a few important economic events on the calendar.

First, Jerome Powell will speak in the afternoon, followed by data for job openings, PMI, and ISM manufacturing – all indicators that shape policymaking, especially when gauging the strenght of the local economy.

That said, Bitocin’s price is down about 1% on the day and is currently trading at around $106,500 after having tested $109,000 yesterday. It’s interesting to see if the bulls have it in them to push bakc towards the upper boundary of the recent trading range or if the bears will send the price back below $105K.

Altcoins in Red, Some More Than Others

As you can clearly see in the heatmap below, the altcoins are also not having a great day. This is, perhaps, to be expected – Bitcoin’s dominance over the market has been rising gradually over the past many months and whenever BTC slips, altcoins crash.

The past 24 hours have hardly been a crash, though, but it’s clear that most of them are charting more considerable declines.

This is especially true for TKX, ARB, SPX6900, SEI, and others, that are down between 8% and 15% on the day.

Believe it or not, Bitcoin Cash (BCH) is today’s best performer, gaining more than 6%. Who would have thought?

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Cryptocurrency

How Much You Should Invest in Bitcoin (BTC)? Veteran Trader Peter Brandt Weighs in

TL;DR

- The expert advises monthly investments in SPY and BTC for long-term success.

- The leading cryptocurrency is up 6% this week and trades near $108,000. Analysts are split – some see a breakout to $130K – $200K if key resistance levels are cleared, while others warn of a possible drop to $100K or even $95K if momentum fades.

‘Trading is the Wrong Path’

Besides its fundamentals and ability to transform the global financial system, Bitcoin (BTC) has proven to be an excellent investment opportunity.

At least, that was the case in the past few years: the asset went through multiple bear and bull markets to eventually cross the $100,000 mark. Currently, it trades at around $108,000 (according to CoinGecko’s data), representing a 75% increase on a yearly scale and a substantial 43,000% jump compared to its valuation a decade ago.

But does the leading cryptocurrency remain a good investment after this major rally over the years, and how much should people allocate to it? That’s a question many people are trying to figure out.

It seems that there isn’t a direct answer, and it all depends on the risk profile of the investors, as well as other important factors. However, one can turn to certain experts who are experienced enough to give guidance.

An example is the veteran trader Peter Brandt, who recently suggested that approximately 95% of people fail when trading. Instead, he advised them to excel in their regular jobs, prioritize their families, and invest in homeownership. Last but not least, Brandt recommended making monthly investments, allocating 80% of the amount to SPY (the ETF that tracks the S&P 500 Index) and 20% to BTC.

Trading is the wrong path for 95% of ppl

Most would be better off becoming excellent at a day job (engineer, plumber, welder, vet, sales)

Live economically

Get married, have kids

Buy a twin home – rent out one of them

Invest monthly – 80% in $SPY and 20% in Bitcoin— Peter Brandt (@PeterLBrandt) June 29, 2025

The Next Potential Targets

Let’s now take a closer look at BTC’s recent performance and explore its chances for a further pump in the short term. The asset has increased in value by approximately 6% over the past week, with numerous analysts predicting a surge to a new all-time high if certain conditions are met.

The X user Cipher X believes “a strong weekly close” above $107,720 could open the door to a further rally to as high as $130,000-$135,000 in Q3 2025.

“Just look at Q4 2024 chart and you’ll see what happened when BTC had its biggest weekly close,” they added.

Merlijn The Trader thinks the final pump for this bull run is coming, envisioning a fresh ATH of around $200,000 towards the end of the year. At the same time, he advised investors to take profits, anticipating a drastic pullback to $95,000 shortly after that.

On the contrary, Ali Martinez argued that the cryptocurrency currently faces a key rejection while the stochastic RSI flashes a death cross on the daily chart. The analyst thinks a plunge to $100,000 is not out of the question unless “we get a sustained close” above $109,000.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions