Forex

Column-EM has no easy escape from dollar squeeze: McGeever

By Jamie McGeever

ORLANDO, Florida (Reuters) – A strong U.S. dollar and high Treasury yields are posing significant challenges for emerging economies, and policymakers have no easy way to counter this powerful one-two punch.

With American exceptionalism casting a shadow over the rest of the world, many emerging markets (EM) are facing weaker currencies, increased costs to service dollar-denominated debt, depressed capital flows or even capital flight, dampened local asset prices and slowing growth.

Added to that is the uncertainty and nervousness surrounding the incoming U.S. government’s proposed tariff and trade policies.

History has shown that when trends like these take hold in emerging markets, they can create vicious cycles that accelerate rapidly and prove difficult to break.

Unfortunately, there appears to be no simple road map for avoiding this.

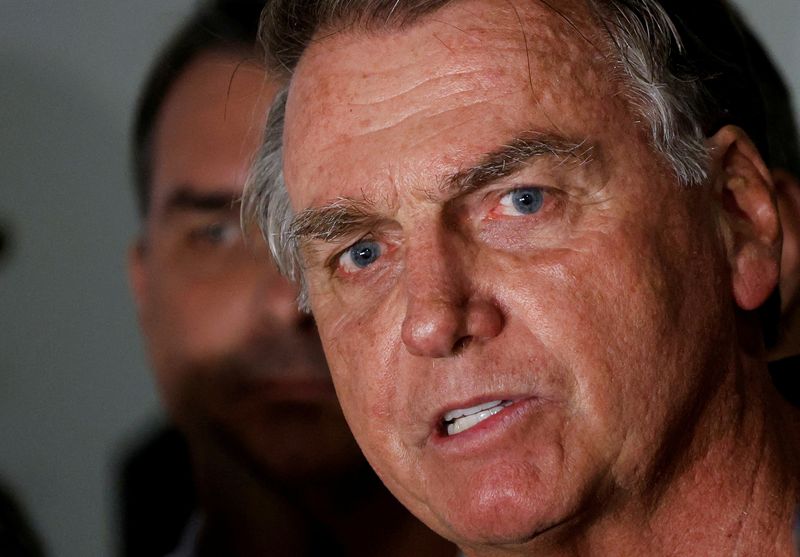

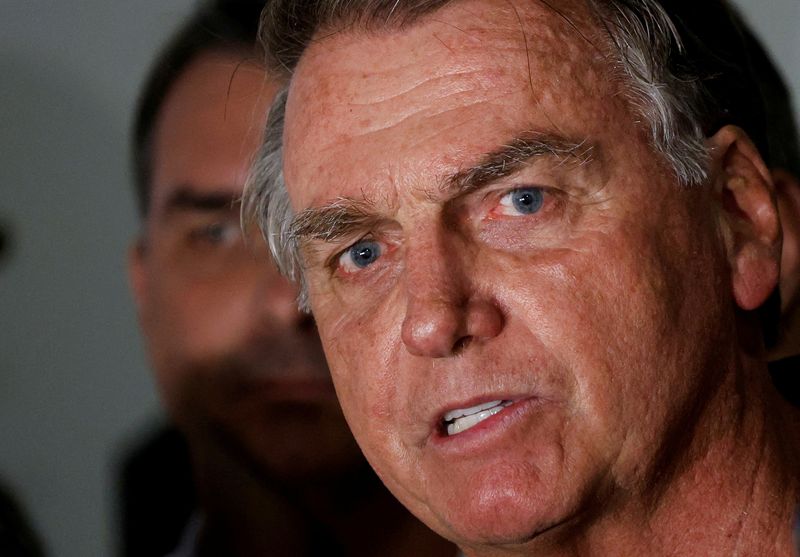

Just look at China and Brazil.

The monetary and fiscal paths being pursued by these two EM heavyweights could not be more different. Beijing is pledging to ease monetary and fiscal policy to reflate its economy; Brasilia is promising substantially higher interest rates and seeking to get its fiscal house in order.

Their divergent paths – and ongoing struggles – suggest that no matter where EM economies are in terms of growth, inflation and fiscal health, they are likely to face a difficult road ahead in the coming years.

GO WITH THE FLOW

Brazil and China are clearly in very different places, not least with regard to inflation. Brazil has lots of it, prompting the aggressive actions and guidance from the central bank. China, on the other hand, is battling deflation, and is starting to finally slash interest rates.

Another difference is the fiscal headroom each has to generate growth. Brazil’s reluctance to cut spending sufficiently is a key cause of the real’s slump and the central bank’s eye-popping tightening. The market is forcing Brasilia’s hand.

The market is also putting pressure on Beijing, but pushing it in the opposite direction. The collective size of the support packages and measures announced since September to revive economic activity run into the trillions of dollars.

But even though the two countries’ tactics are diametrically opposed, the outcomes have thus far been similar: sluggish growth and weak currencies, a picture most emerging countries will recognize. Brazil’s real has never been weaker and the tightly managed yuan is close to the troughs last visited 17 years ago.

As Reuters exclusively reported, China is mulling whether to let the yuan weaken in response to looming U.S. tariffs, and analysts at Capital Economics warn that it could tumble as low as 8.00 per dollar.

But allowing the yuan to depreciate is not without risk. Doing so could accelerate capital outflows, and spark ‘beggar thy neighbor’ FX devaluations across Asia and beyond.

A race to the bottom for EM currencies would be very problematic for the countries involved, as the dollar is now a bigger driver of EM flows than interest rate differentials, according to the Bank for International Settlements. Analysts at State Street (NYSE:) reckon exchange rates explain around 80% of local EM sovereign debt returns.

The Institute of International Finance estimates that capital flows to emerging countries next year will decline to $716 billion from $944 billion this year, a fall of 24%.

“Our forecast is premised on a base-case scenario, but significant downside risks remain,” the IIF said.

FINANCIAL CONDITIONS TIGHTEN

EM countries also face headwinds from higher U.S. bond yields.

While the pile of hard currency sovereign and corporate debt is small compared to local currency debt, it is rising. Total (EPA:) emerging market debt is now approaching $30 trillion, or around 28% of the global bond market. That figure was 2% in 2000.

And the squeeze from higher borrowing costs is being felt in real time. Emerging market financial conditions are the tightest in nearly five months, according to Goldman Sachs, with the spike in recent months due almost entirely to the rise in rates.

Real interest rates are a lot higher now than they were during Trump’s first presidency. But many countries may still struggle to cut them, as doing so “could create financial stability concerns by putting pressure on exchange rates,” JP Morgan analysts warn.

On the positive side, emerging countries do have substantial FX reserves to fall back on, especially China. Most of the world’s $12.3 trillion FX reserves are held by emerging countries, with $3.3 trillion in China’s hands alone.

Finding themselves caught between a rock and a hard currency, EM policymakers may soon be forced to dip into this stash.

(The opinions expressed here are those of the author, a columnist for Reuters.)

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions