Forex

Dollar edges lower, but on course for eighth straight winning week

© Reuters

Investing.com – The U.S. dollar edged lower in early European trade Friday, but remains on track for an eighth straight winning week as U.S. economic resilience brings further Federal Reserve rate hikes into question.

At 03:10 ET (07:10 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.2% lower to 104.807, but remains not far from the previous session’s six-month high of 105.15.

Further Fed rate hikes ahead?

Data released this week has painted an upbeat picture of the U.S. economy, as the unexpectedly gained steam in August while hit their lowest level since February.

The is still widely expected to hold steady on rates when it meets later this month, but this economic resilience is creating uncertainty about what the Fed might do later this year.

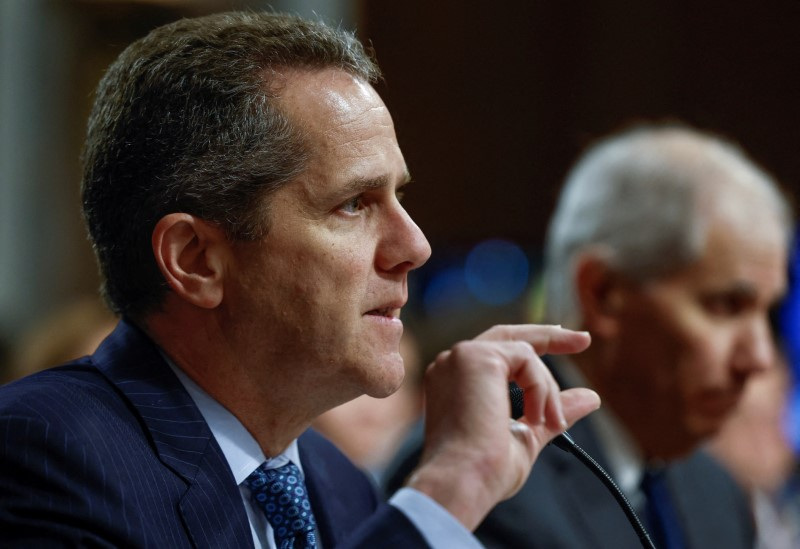

Dallas Federal Reserve Bank President said on Thursday that while “forecasts are inherently uncertain. My base case, though, is that there is work left to do,”

Her colleague, Federal Reserve Bank of New York President on Thursday said of the current setting of monetary policy, “it’s pretty clear we’re restrictive” but it’s “still an open question as we go forward.”

European economies struggle

By contrast, the economic news out of Europe has been generally more depressing.

in the eurozone grew just 0.1% in the second quarter compared to the previous three months, with the dominant German manufacturing sector struggling badly.

There was some good news Friday as grew 0.8% on the month in July, substantially better than the 0.1% growth expected and the prior month’s drop of 0.9%.

The has raised rates at each of its past nine meetings, but the region’s economic slowdown is pointing to a pause next week even if inflation remains elevated.

rose 0.2% to 1.0715, recovering to a degree having fallen to a three-month low of 1.0686 on Thursday, while rose 0.1% to 1.2483, having also hit a three-month low the previous session.

Chinese yuan falls to lowest level since 2008

In Asia, rose 0.3% to 7.3487, with the yuan slipping to its weakest level against the dollar since February 2008, weighed by rising diplomatic tensions between Beijing and Washington as well as concerns over a Chinese economic slowdown.

traded lower at 147.28, with the yen near a 10-month low after the Japanese government downgraded its initial growth estimate for second quarter .

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions