Stock Markets

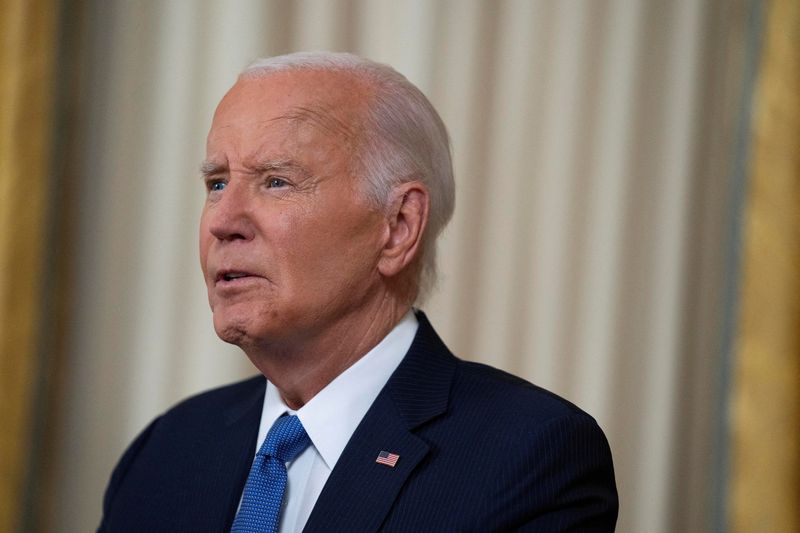

Biden meets Netanyahu on Gaza ceasefire

By Steve Holland and Jeff Mason

WASHINGTON (Reuters) -U.S. President Joe Biden and Israeli Prime Minister Benjamin Netanyahu held White House talks on Thursday on an elusive ceasefire to the 9-month-old Gaza war, with Vice President Kamala Harris due to meet the Israeli leader later in the day.

It was the first face-to-face talks for the two men since Biden traveled to Israel days after Hamas’ Oct. 7 attack, hugged Netanyahu and pledged American support.

The visit coincides with a shift in American politics. On Sunday, Biden stepped aside from the U.S. presidential race under pressure from fellow Democrats and endorsed Harris for the party’s 2024 presidential nomination.

“We’ve got a lot to talk about,” Biden said when he welcomed Netanyahu to the Oval Office.

“I want to thank you for 50 years of public service and 50 years of support for the state of Israel,” Netanyahu told Biden, citing the president’s half-century of public service.

In the late afternoon, Harris will meet the Israeli leader in her ceremonial office at the White House.

The meeting will be closely watched for signs of how Harris, who was the first top U.S. official to call for a ceasefire, could shift U.S. policy toward Israel if she becomes president.

Harris was expected to closely track the administration line in the meeting, a U.S. official said, focusing on the plight of Palestinians while also supporting Israel’s right to self-defense.

Biden and Netanyahu later will meet together with the families of American hostages held by Hamas. The two leaders have had strained relations for months over Israel’s attacks on Gaza, which have killed more than 39,000 people, according to health officials in the Hamas-run Palestinian enclave, and sparked a humanitarian crisis.

The U.S. is a major arms supplier to Israel and has protected the country from critical United Nations votes.

Netanyahu’s visit, his first to Israel’s most important international ally since returning for a record sixth term as prime minister at the end of 2022, comes on the heels of Biden’s dramatic decision not to seek reelection.

Whether Biden, who is now a “lame duck” president, a term used for officials who won’t serve another term, or Harris, who is tied in many election polls with Republican Donald Trump, can have any influence on Netanyahu remains to be seen.

Both Biden and Harris are eager for a ceasefire. Harris has been aligned with Biden on Israel but has struck a tougher tone.

The conflict began on Oct. 7 when Hamas militants attacked southern Israel from Gaza, killing 1,200 people. Israel launched a retaliatory assault.

Hamas-led fighters took 250 captives on Oct. 7, according to Israeli tallies. Some 120 hostages are still being held though Israel believes one in three are dead.

The White House is ringed with extra security fencing to protect against protesters on Thursday.

CLOSING STAGES

Negotiations on a long-sought ceasefire-for-hostages deal in the Gaza conflict appear to be in their closing stages, a senior U.S. official said on Wednesday.

The official, briefing reporters ahead of the talks, said the remaining obstacles are bridgeable and there will be more meetings aimed at reaching a deal between Israel and Hamas over the next week.

U.S. officials have made similar pledges before about a ceasefire which evaporated under last-minute differences.

On Wednesday, Netanyahu gave a defiant speech to the U.S. Congress in which he defended Israel’s attacks on Gaza, saying anti-Israel protesters “should be ashamed of themselves.”

On Friday, he travels to Florida to meet Trump.

The Gaza conflict has splintered the Democratic Party, and sparked months of protests at Biden events. A drop in support among Arab-Americans could hurt Democratic chances in Michigan, one of a handful of states likely to decide the Nov. 5 election.

Biden’s desire for unity in the party in the drive to defeat Trump was cited on Wednesday night in an Oval Office address as a main reason why he decided not to seek reelection but to instead support Harris for the 2024 race.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions