Stock Markets

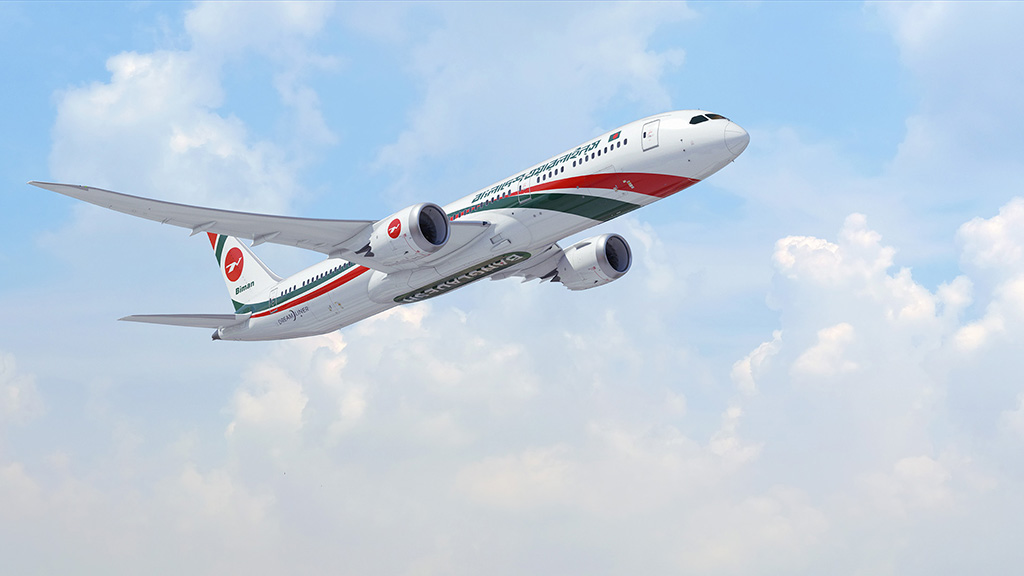

Biman Bangladesh to buy 10 Airbus jets, breaking Boeing reliance

State-owned carrier Biman Bangladesh Airlines has decided to purchase 10 planes from Airbus, in a shift from its Boeing-dominated fleet, the South Asian country’s junior minister for civil aviation told Reuters on Monday.

“As per our requirement, the decision has been taken to purchase 10 aircraft in phases. The technical committee is assessing now,” Mahbub Ali said.

Ali’s comments came after sources said the airline was close to a deal to buy 10 Airbus A350 widebody planes, marking its first order with the French planemaker.

It was not clear whether the deal would be finalised in time for the Paris Airshow, which opens on Monday.

Airbus declined to comment. Biman did not respond to a request for comment.

“Every country has both Airbus and Boeing in their fleet. We didn’t have an Airbus in our fleet,”

Ali said, as the airline looks to break its reliance on the U.S. planemaker that typically dominates widebody orders.

The 51-year-old airline has a fleet of more than 20 mostly Boeing planes, over half of which are widebodies, and some Dash-8 turboprops.

Biman Bangladesh’s demand for more widebody aircraft comes as travel is seeing a strong post-pandemic rebound. The carrier flies non-stop to 20 destinations worldwide including Britain, Malaysia, Thailand and Canada.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex4 years ago

Forex4 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency4 years ago

Cryptocurrency4 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions