Stock Markets

Carl Icahn’s firm cuts dividend by 50% after short-seller attack, shares slump

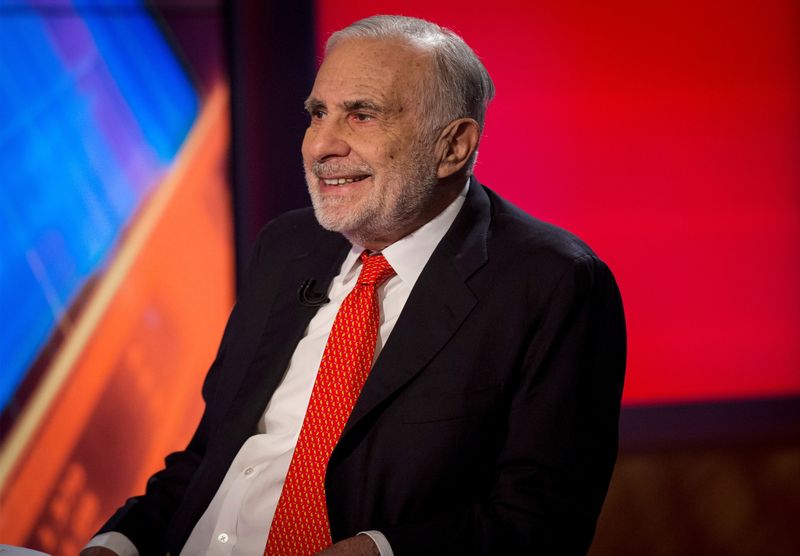

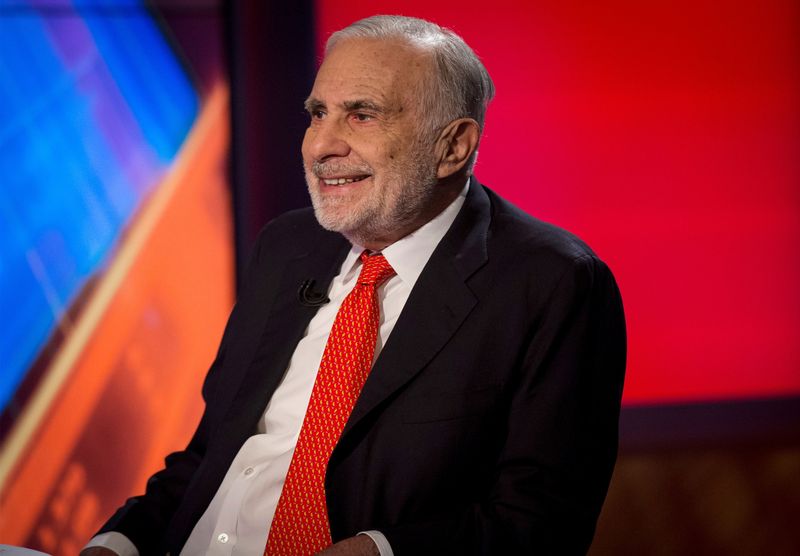

© Reuters. FILE PHOTO: Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network’s Neil Cavuto show in New York February 11, 2014. REUTERS/Brendan McDermid/File Photo

By Niket Nishant

(Reuters) – Carl Icahn-owned investment firm Icahn Enterprises on Friday halved its quarterly payout, months after short-seller Hindenburg Research accused it of operating a “Ponzi-like” structure to pay dividends.

The company’s shares tumbled 34% in early trading, set to add to the 35% drop since the short seller disclosed its position on May 2.

Hindenburg said on Friday it remained short on the company, in a post on messaging platform X, formerly known as Twitter.

Icahn is one of the industry’s best-known activist investors as he has taken on numerous companies that he believed to be overvalued, but Hindenburg’s attack represented a rare challenge to his own company.

“Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance,” Hindenburg said when it had announced its short position.

Icahn Enterprises said on Friday it would distribute $1 per depositary unit to its investors for the second quarter, lower than its usual payout of $2 per unit.

Icahn has denied the allegations and has vowed to “fight back” against the short seller’s report, and on Friday took another jab at Hindenburg.

“We do not intend to let a misleading Hindenburg report interfere with this practice (of distributing dividends),” Icahn Enterprises said in a statement.

The billionaire last month disclosed he had restructured $3.7 billion in personal loans to remove a link between his obligation to post collateral and his holding company’s share price, in a bid to undo the damage done by the short seller.

The company reported a net loss of $269 million, or 72 cents per depositary unit, for the three months ended June 30, much higher than the $128 million, or 41 cents per unit loss, a year earlier.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions