Stock Markets

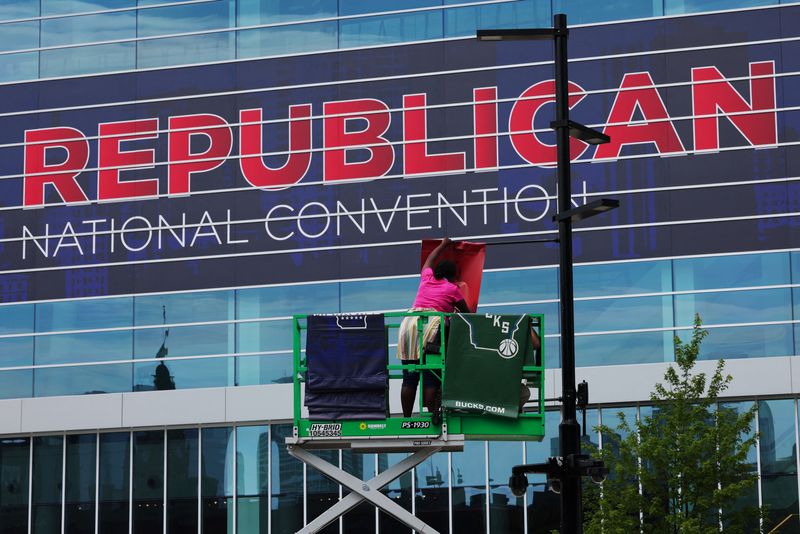

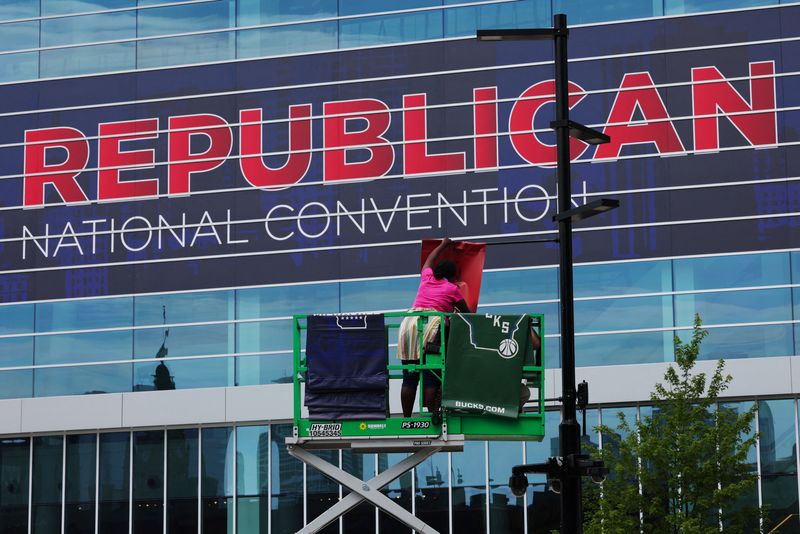

Factbox-Who is speaking at the Republican National Convention?

By Helen Coster

(Reuters) -This week’s Republican National Convention, overshadowed by an assassination attempt on Donald Trump, will feature televised speeches from business leaders, celebrities, officials and everyday Americans culminating with the former president’s formal acceptance of his nomination for president.

The four-day event in Milwaukee, Wisconsin, begins on Monday. Nightly themes include crime, the economy and global conflicts, all issues driving the run-up to Trump’s Nov. 5 election rematch with President Joe Biden, his Democratic rival.

Here are some of the expected speakers:

DAVID SACKS

Entrepreneur and investor David Sacks is part of a group of wealthy, high-profile Silicon Valley venture capitalists and investors who have thrown their support behind Trump.

In June, Sacks and his wife Jacqueline hosted a Trump fundraiser at their home in the Pacific Heights neighborhood of San Francisco, raising $12 million. Ohio Republican Senator J.D. Vance, who has worked in venture capital and is on Trump’s vice president short list, helped organize the fundraiser.

Sacks, a close friend of Elon Musk, was previously the chief operating officer of PayPal (NASDAQ:). He was an early investor in companies including Airbnb, Facebook (NASDAQ:), Palantir (NYSE:), SpaceX and Uber (NYSE:).

TRENT CONAWAY

The mayor of East Palestine, Ohio, will speak on Wednesday, part of a lineup that will include Trump’s pick for vice president and his eldest son, Donald Trump Jr. East Palestine, located on the state’s border with Pennsylvania, is the site of a toxic train derailment in February 2023 that sparked a health and environmental crisis.

Trump visited East Palestine about two weeks after the derailment and criticized Biden for not traveling to the working-class community of 4,700 citizens.

The White House noted at the time that federal agents were on the scene almost immediately after the derailment. Biden eventually visited East Palestine in February 2024.

Conaway, a conservative who does not support Biden, extended the invitation to visit to the president, saying it would be good for his community.

AMBER ROSE

Rose, a biracial, millennial model and reality television personality who once dated rapper Kanye West, is making her RNC debut in a speech next week.

In May, Rose, who has more than 24 million followers on Instagram, endorsed Trump, himself a former reality TV star, in a post featuring her standing alongside Trump and his wife Melania, with the comment “Trump 2024.”

On July 2 she posted a photo of herself wearing a red Make America Great Again baseball hat and a white bikini.

Rose called Trump an “idiot” in a 2016 interview with The Cut, adding: “He’s so weird. I really hope he’s not president.”

RON DESANTIS

Florida Governor Ron DeSantis, once considered a top contender for the 2024 Republican nomination and a political heir to Trump before his campaign floundered, is scheduled to speak on Tuesday.

DeSantis, who endorsed Trump after dropping out of the primary race, has become a leading figure within the Republican Party for his conservative stance on hot-button social issues involving schools, gender and abortion. He is also a staunch critic of Biden’s immigration policies.

During DeSantis’ presidential primary bid, Trump relentlessly attacked the governor.

DANA WHITE

The chief executive of Ultimate Fighting Championship will speak ahead of Trump on Thursday. Trump has had a long relationship with White, who also spoke at the 2016 and 2020 Republican conventions in support of Trump’s candidacy.

Trump hosted UFC events at his since-bankrupt Taj Mahal casino in Atlantic City decades ago when the sport was spurned by most venues, White said in a 2018 interview with The Hill.

Trump’s alignment with White and UFC helps his appeal with young men in particular.

The Republican presidential candidate attended a UFC match in Newark, New Jersey, on June 1 in his first public appearance after being convicted on 34 felony counts relating to a scheme to a cover up an alleged affair with a porn star. White and clips from that appearance were featured in Trump’s first post on TikTok, a video that has garnered 7.7 million likes.

TRUMP FAMILY MEMBERS

Donald Trump Jr. and Eric Trump, the former president’s oldest sons, as well as daughter-in-law Lara Trump and Donald Jr.’s fiancee, Kimberly Guilfoyle, will be speaking at the convention. Donald Trump Jr. and Eric Trump run the Trump Organization; Lara Trump is co-chair of the Republican National Committee.

SEAN O’BRIEN

O’Brien is president of the International Brotherhood of Teamsters, the 1.3 million-member labor union which endorsed Biden in 2020 and has yet to endorse a candidate in this year’s presidential election.

Last month a spokesperson for the union said that O’Brien asked to speak at both the RNC and the Democratic National Convention, which will be held in Chicago in August.

Trump and Biden are both courting votes from rank-and-file members of organized labor, whose support in the Nov. 5 election could be crucial in battleground states that decide elections, including Michigan, Pennsylvania and Wisconsin.

BOB UNANUE

Unanue is chief executive of Goya Foods, the largest Hispanic-owned U.S. food company and a popular brand among Latino Americans. In 2020 the New Jersey-based company became the target of a boycott campaign on social media sparked by Unanue effusively praising Trump at the White House.

The hashtags #Goyaway and #BoycottGoya began trending on Twitter after Unanue appeared with Trump for the signing of an executive order creating an advisory panel for bolstering Hispanic prosperity. Trump and his daughter Ivanka Trump later rallied support for Goya Foods on Twitter.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions