Stock Markets

Forex golden cross indicator formed in the market

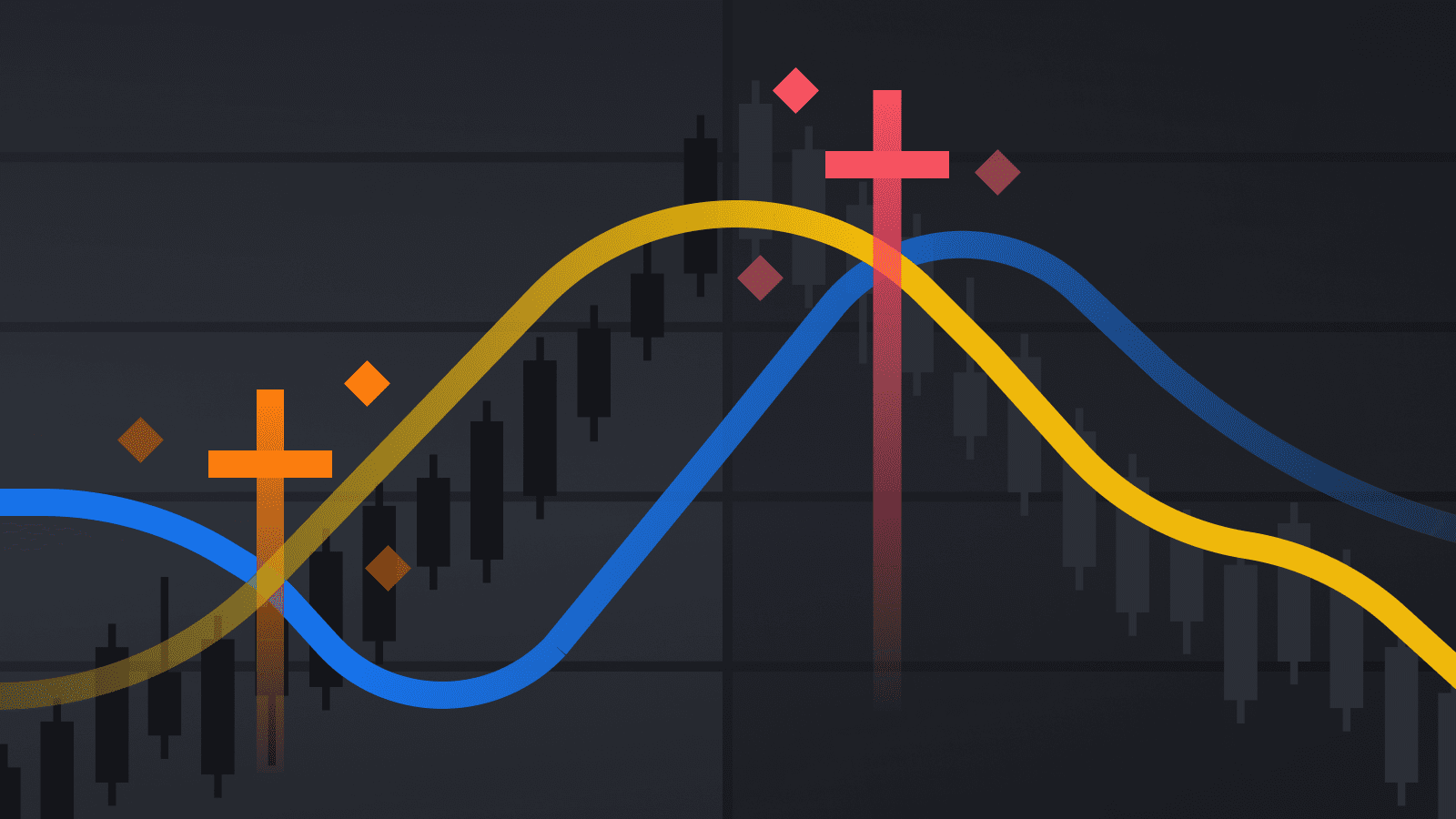

The Dow Jones Industrial Average showed a technical signal to buy on Tuesday, otherwise known as the forex golden cross indicator, which occurs when the 50-day moving average moves above the 200-day moving average, suggesting further growth of the index, strengthening its uptrend, writes Business Insider.

What indicator shows the golden cross? The golden cross pattern is the intersection of short-term and long-term moving averages from bottom to top. A moving average is a line on a chart displaying the average price of an asset over an n-period of time. Read more about Moving Average in our article 5 Key Indicators for Technical Analysis.

Usually a 50-day MA is used as a short-term average and a 200-day MA as a long-term average.

This technical indicator can help securities traders by signaling a strengthening uptrend, and likely a continued rally with rising stock prices.

Earlier, we reported that China asked banks for help to stabilize the Chinese bond market.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions