Stock Markets

Netanyahu says Israel hit Iran hard; Khamenei says damage should not be exaggerated

By Ari Rabinovitch and Adam Makary

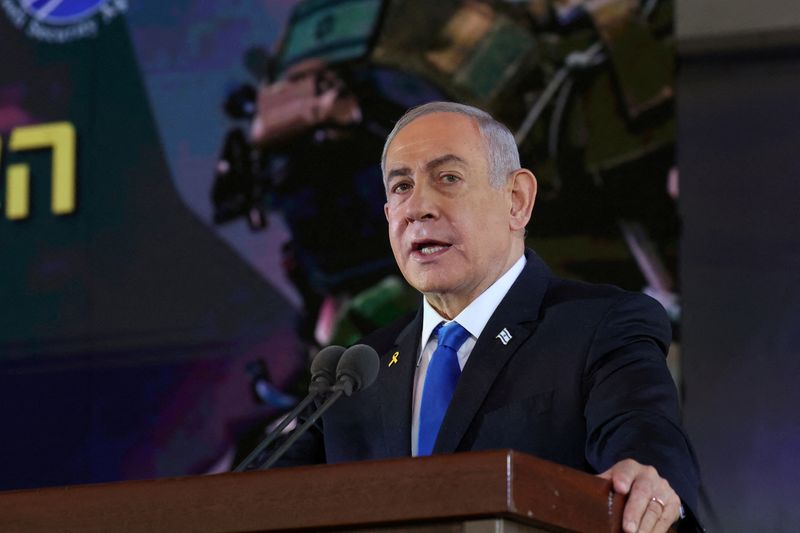

JERUSALEM/CAIRO (Reuters) -Israel’s airstrikes “hit hard” Iran’s defences and missile production, Prime Minister Benjamin Netanyahu said on Sunday, as Iranian Supreme Leader Ayatollah Ali Khamenei said the country was considering its response.

With warfare raging in Gaza and Lebanon, direct confrontation between Israel and Iran risks spiralling into a regional conflagration. But a day after the airstrikes, there was no sign they would spark another round of escalation.

However, heavy fighting in Lebanon between Israeli forces and Iran-backed Hezbollah, which sharply intensified over recent weeks, continued on Sunday with an Israeli airstrike killing eight people in a residential block in Sidon, medics said.

“The air force attacked throughout Iran. We hit hard Iran’s defence capabilities and its ability to produce missiles that are aimed at us,” Netanyahu said in a speech, calling the attack “precise and powerful” and saying it met all its objectives.

The Islamic Republic has not signalled how it will respond to Saturday’s long-anticipated strikes, which involved scores of fighter jets bombing targets near the capital Tehran and in the western provinces of Ilam and Khuzestan.

The U.N. Security Council will likely meet to discuss the attack on Monday, diplomats said.

The heavily armed arch-enemies have engaged in a cycle of retaliatory moves against each other for months, with Saturday’s strike coming after an Iranian missile barrage on Oct. 1, much of which Israel said was downed by its air defences.

Khamenei said Israel’s calculations “should be disrupted”. The attack on Iran, which killed four soldiers and caused some damage, “should neither be downplayed nor exaggerated”, he said.

Iranian President Masoud Pezeshkian said Iran was not looking for war but would give an “appropriate response”.

U.S. President Joe Biden called for a halt to escalation that has raised fears of a wider Middle East war arising from the year-old Israeli-Hamas conflict in Gaza and Israel’s thrust into south Lebanon to stop Hezbollah rocketing northern Israel.

Separately, Israeli Defence Minister Yoav Gallant said Iran was no longer able to use its allies Hamas in Gaza and Hezbollah in Lebanon against Israel. The two groups “are no longer an effective tool” of Tehran, he said in a speech.

Gallant added that Hamas was no longer functioning as a military network in Gaza and that Hezbollah’s senior command and most of its missile capabilities had been eliminated.

Hamas has repeatedly said it is still able to function militarily, and Israel has recently conducted major new operations in devastated north Gaza against what it calls regrouping Hamas militants.

Hezbollah has said its command structure remains intact and that it retains significant missile capabilities.

LEBANON FIGHTING

On Sunday, the Israeli military urged residents of 14 villages in southern Lebanon to evacuate immediately and move north of the Awali river.

An Israeli strike on Sidon, a city in coastal south Lebanon, killed at least eight people and wounded 25 on Sunday, the country’s health ministry said.

Elsewhere in the south, a strike on Zawtar al-Sharkiya killed three people and a Saturday bombing of Marjayoun killed five, it said.

Israel said four of its soldiers were killed in south Lebanon fighting.

Hezbollah also said it had fired a large missile salvo at the Zevulon military industries facility north of Haifa in northern Israel. Hezbollah rockets hit a house and cars and rescue crews responded to put out the fire.

One woman was seriously injured, according to Israel’s ambulance service.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions