Stock Markets

US bank regulator Gruenberg to retire in January ahead of Trump presidency

By Pete Schroeder

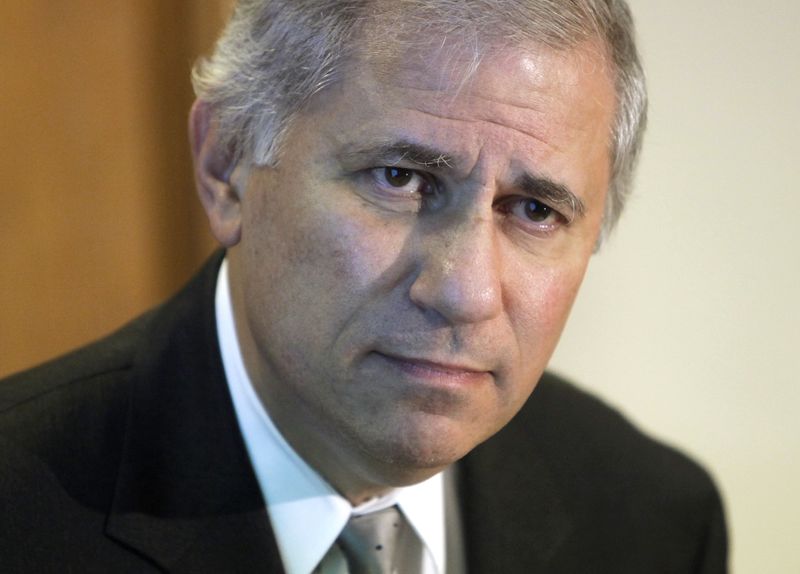

WASHINGTON (Reuters) – U.S. Federal Deposit Insurance Corporation Chairman Martin Gruenberg told colleagues Tuesday he would retire from the agency effective January 19, clearing the way for President-elect Donald Trump to name new leadership to the agency.

In a message sent to employees at the FDIC, one of the country’s top bank regulators, Gruenberg said he had informed President Joe Biden of his decision.

“It has been the greatest honor of my career to serve at the FDIC. I have especially valued the privilege of working with the dedicated public servants who carry out the critically important mission of this agency,” he wrote.

The pending departure of Gruenberg, a Democrat and Wall Street critic who had been a senior leader at the FDIC for nearly two decades, comes at a critical time for the agency – more than 18 months since three big banks failed and and ahead of what is expected to be a major shake up of bank regulation under Trump.

Gruenberg had clung to his job since November 2023 when a Wall Street Journal report exposed widespread misconduct at the FDIC. The report was confirmed by a damning external review which also called into question Gruenberg’s leadership.

Upon his departure, FDIC chair role will pass to Travis Hill, the agency’s vice chair and a Republican who Trump transition officials are also considering for the top job permanently, Reuters reported this month.

Gruenberg, 71, had been at the FDIC since 2005 and is the longest-serving FDIC board member in the agency’s 89-year history. During that time he served as its chair twice – once under President Barack Obama and the second under Joe Biden.

Stock Markets

Suburban Propane director Logan sells $139k in shares

Stock Markets

Stock market today: S&P 500 closes lower, but posts big weekly win

Stock Markets

TD Bank promotes Laura Nitti to retail market president role

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions