Uncategorized

Down More Than 50%: Analysts Say Buy These 3 Beaten-Down Stocks Before They Rebound

Now that we’re into the second half of 2022, with the Independence Day holiday behind us, we can take stock of the changes that the last six months have brought. And those changes have been dramatic. As this year got started, the S&P 500 was coming off of a 27% annual gain. Today, the index is down 20%, putting it into a bear market.

The losses have been broad-based, and have left many otherwise sound equities languishing at low prices. It’s a circumstance that has a lot of unhappy investors wondering what the options are – but it has also opened opportunities for anyone willing to shoulder some added risk in a difficult investing environment.

With this in mind, we’ve used the TipRanks database to pinpoint three stocks that have shown hefty losses this year, on the order of 50% to 75%, but each also features a Strong Buy analyst consensus rating and a powerful upside potential. Let’s take a deeper dive in.

PLBY Group (PLBY)

The first stock, the PLBY Group, defines itself, without irony, as a ‘pleasure and leisure’ company. Founded by Hugh Hefner in 1953, the PLBY Group owns Playboy, one of the world’s most distinctive and recognizable brands. While the magazine is the company’s most immediately recognizable product, Playboy also boasts over 1 million active digital customers, more than 50 million global social media fans, and activities in over 180 countries. The company’s products include style and apparel, gaming and lifestyle, and beauty and grooming products.

The company’s strong brand supports its growing revenue stream. Playboy reported 63% year-over-year revenue growth in its recent 1Q22 report, with $69.4 million at the top line. This was driven by a 125% increase in direct-to-consumer revenue, which hit $49.6 million. At the bottom line, the company reported a 12 cent profit per share, a sharp turnaround from the 15-cent per-share loss reported in 1Q21.

Despite solid results, PLBY saw its shares fall 76% since the start of the year. In the last 12 months, the company has been making moves to expand, acquiring new subsidiaries and moving into the Chinese and Indian markets. Playboy already boasts a $1 billion e-commerce spend in China, as part of its move into that country, and the company has been working to put a virtual version of the legendary Playboy Mansion online in the Metaverse.

What this means, in the eyes of Craig-Hallum analyst Alex Fuhrman, is a clear opportunity for investors seeking a ground-floor entrance.

“PLBY is undervalued and the company continues to perform well. Q1 revenue was ahead of our estimate and adj. EBITDA was within a few hundred thousand dollars of our estimate – an impressive result at a time when many other e-commerce retailers are missing estimates and/or lowering guidance,” Fuhrman opined.

“Despite strong performance and owning one of the most recognized brands in the world, PLBY trades at a meaningful discount to peers. Given the years-long opportunity for the Playboy brand to catch up from years of poor management and under-monetization, we view this discount as an attractive buying opportunity,” the analyst added.

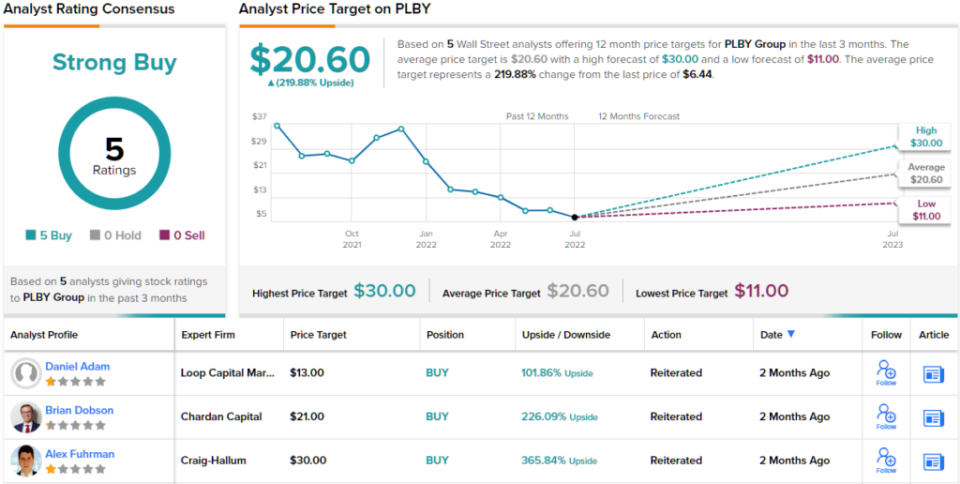

These comments back up the analyst’s Buy rating, and quantified by his $30 price target, which indicates his confidence in a whopping 366% upside for the next 12 months. (To watch Fuhrman’s track record, click here)

Sometimes, a company’s product inspired unanimity from the Street’s analysts – PLBY does just that. All 5 of the recent analyst reviews are positive, making the Strong Buy consensus rating unanimous. The average price target of $20.60 suggests ~220% upside from the current trading price of $6.44. (See PLBY stock forecast on TipRanks)

Ambarella (AMBA)

The next beaten-down stock we’ll at is Ambarella, a semiconductor chip maker. The company operates in the fabless niche, meaning the company designs, promotes, markets, and sells its chip products, and produces small numbers of prototypes for testing purposes, but contracts with the large chip foundries for full-scale production orders. Ambarella’s chips are designed for video applications, and are specialized for advanced image processing and high-resolution video compression. The chipsets have found application in a wide range of small camera systems, including wearable cameras, vehicle dashboard cams, pocket video cameras, and even drones. The common denominator here is low-power, high-definition video.

So far this year, Ambarella’s shares have fallen approximately 68%. A large part of that drop, some 31%, came at the end of February, when the company reported revenue guidance of $88.5 million to $91.5 million; at the midpoint of $90 million, this came in below the ~$91 million forecast. Management predicted lower margins through the rest of the calendar year, which did not help matters.

The company is facing headwinds from the general market environment, but also from the semiconductor chip shortage. As a fabless company, Ambarella depends on its foundries, and they are heavily backlogged.

Ambarella did meet its guidance, however, when it released its Q1 report for fiscal 2023, the quarter ending on April 30. The company reported $90.3 million at the top line, or a 29% year-over-year gain. At the bottom line, non-GAAP EPS came in at 44 cents per diluted share, almost double the 23 cents reported in the year-ago quarter.

On a positive note for the company, Ambarella announced in June a new partnership with Inceptio, a pioneer in autonomous trucking. Under the agreement, Ambarella will provide chips for an automotive grade central computing platform capable of simultaneously processing no fewer than seven 8MP cameras for surround perception and collision avoidance.

This chip company and its automotive applications has attracted attention from 5-star analyst Gary Mobley of Wells Fargo, who writes: “We view AMBA as one of the purest ways in the chip sector to play the AI/ML computer vision at the edge, and one of the best ways to play growing L2+ ADAS/AV functions in the automotive market (e.g., computer vision processing and sensor fusion). We view AMBA as a strategically important asset for automotive OEMs wishing to support L2+ ADAS/AV as well as incumbent auto chip suppliers focused on MCUs and sensor technology (e.g. image & radar).”

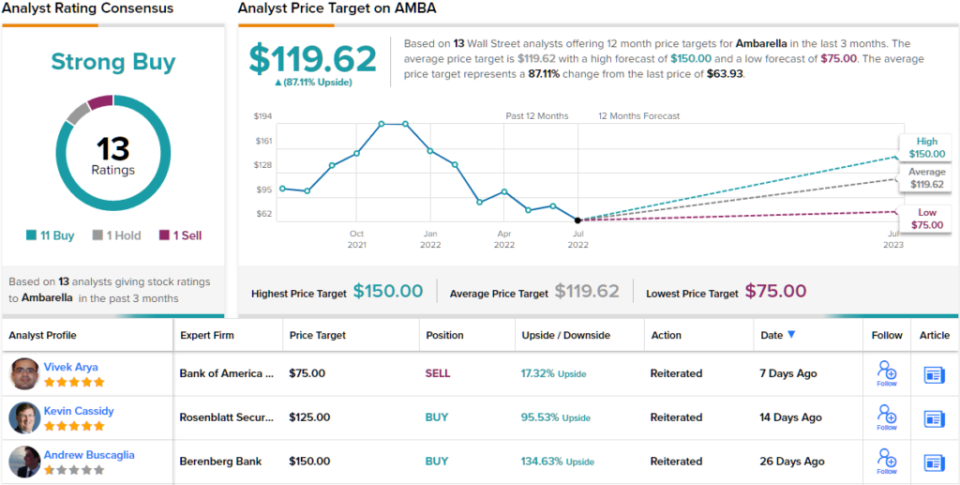

Mobley doesn’t stop with upbeat comments, he also gives AMBA stock an Overweight (i.e. Buy) rating, along with a $110 price target that implies a 72% one-year upside potential. (To watch Mobley’s track record, click here)

Wall Street is clearly interested in this stock, and has given it 13 recent analyst reviews. These break down to 11 Buys, 1 Hold, and 1 Sell, for a Strong Buy consensus rating. The shares are selling for $63.93 and their $119.62 average price target suggests an 87% gain this year. (See Ambarella stock forecast on TipRanks)

Ichor Holdings (ICHR)

Last on our list, Ichor Holdings, has a stable of subsidiaries in the field of critical systems engineering and manufacturing. Ichor operates in the semiconductor, manufacturing, and integrated solutions niches, where it provides equipment and processes as varied as gas modules and chemical process subsystems. The company’s products are also found in the manufacturing process of alt energy sources, biomedical gear, and LED displays.

A wide ranging, highly varied business is an advantage for manufacturer, especially when it comes to the manufacture of specialty products. Ichor has seen its revenues generally grow over the past two years, and the most recent print, for 1Q22, came in at just over $293 million. This was up 11% year-over-year, and the best result of the past 9 quarter. Non-GAAP EPS, however, was reported at 70 cents, down from 1Q21’s 76 cents, and well below the 90-cent forecast.

The disappointing earnings put investors on edge, with shares slipping 52% year-to-date.

The weakness in the recent earnings report hasn’t bothered DA Davidson analyst Thomas Diffely, who wrote of the stock: “Despite a challenging operating environment, market demand remains robust, in fact the company increased investment in direct labor and manufacturing capacity. Further, ICHR is once again set to outpace 2022 WFE growth (~15%) thanks to its leverage to key tool segments (etch and dep). As such, our bullish thesis on ICHR remains intact.”

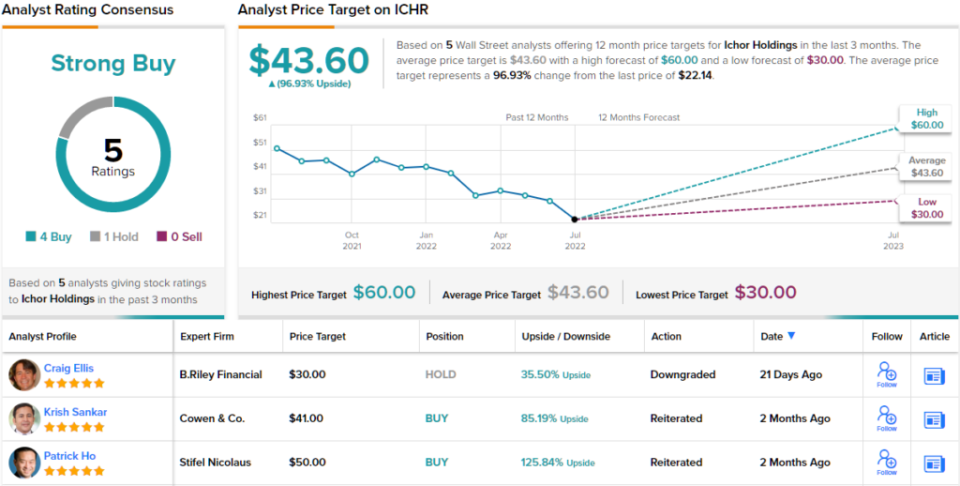

To this end, the 5-star analyst rates ICHR shares a Buy while setting a $60 price target to suggest an impressive potential one-year gain of 171%. (To watch Diffely’s track record, click here)

All in all, out of 5 analyst reviews on file for ICHR, 4 rate it a Buy, giving the stock a Strong Buy analyst consensus. The shares are trading for $22.14 and their $43.60 average price target implies an upside of ~97% over the coming year. (See Ichor stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Uncategorized

BofA Securities maintains Amazon.com at ‘buy’ with a price target of $154.00

Uncategorized

Six people in critical condition, one still missing after Paris blast – prosecutor

5/5

© Reuters. French firefighters and rescue forces work after several buildings on fire following a gas explosion in the fifth arrondissement of Paris, France, June 21, 2023. REUTERS/Gonzalo Fuentes

2/5

PARIS (Reuters) – Six people remained in a critical condition and one person was believed still missing on Thursday, one day after a blast ripped through a street near Paris’ historic Latin Quarter, the city’s public prosecution office said. “These figures may still change,” prosecutor Maylis De Roeck told Reuters in a text message, adding that around 50 people had been injured in the blast, which set buildings ablaze and caused the front of one to collapse onto the street. Of two people initially believed missing, one has been found in hospital and is being taken care of, the prosecutor said, adding: “Searches are ongoing to find the second person.” Authorities have not yet said what caused the explosion, which witnesses said had followed a strong smell of gas at the site. The explosion led to scenes of chaos and destruction in the historic Rue Saint Jacques, which runs from the Notre-Dame de Paris Cathedral to the Sorbonne University, just as people were heading home from work. It also destroyed the facade of a building housing the Paris American Academy design school popular with foreign students. Florence Berthout, mayor of the Paris district where the blast occurred, said 12 students who should have been in the academy’s classrooms at the time had fortunately gone to visit an exhibition with their teacher.

“Otherwise the (death toll) could have been absolutely horrific,” Berthout told BFM TV. She said three children who had been passing by at the time were among the injured, although their lives were not in danger.

Uncategorized

4 big analyst cuts: Alcoa & DigitalOcean shares drop on downgrades

© Reuters.

Here is your Pro Recap of the biggest analyst cuts you may have missed since yesterday: downgrades at Alcoa, DigitalOcean, Teleflex, and Xcel Energy.InvestingPro subscribers got this news in rapid fire. Never be left in the dust again.Alcoa stock drops on Morgan Stanley downgrade Alcoa (NYSE:) shares fell more than 3% pre-market today after Morgan Stanley downgraded the company to Underweight from Equalweight and cut its price target to $33.00 from $43.00, as reported in real time on InvestingPro.The firm sees a significant decline in consensus estimates, and as negative earnings revisions materialize, it believes the stock will face downward pressure and underperform.The analyst’s estimates for EBITDA in Q2, 2023, and 2024 are substantially lower than the consensus. The stock is currently trading above its historical average. The firm said its downward revisions in earnings estimates and price target are attributed to the company’s high operating leverage to aluminum prices.DigitalOcean stock plunges on downgradePiper Sandler downgraded DigitalOcean (NYSE:) to Underweight from Neutral with a price target of $35.00. As a result, shares plunged more than 5% pre-market today.The company reported its last month, with revenue beating the consensus estimate, while EPS coming in worse than expected. Furthermore, the company provided a strong outlook, which was above the Street estimates.2 more downgradesTeleflex (NYSE:) shares fell more than 3% yesterday after Needham downgraded the company to Hold from Buy, noting that UroLift expectations may still be too high.According to Needham, their checks indicate that urologists are reducing their use of UroLift due to its retreatment rates, reimbursement cuts, and increasing use of competing procedures. This is also supported by their Google Trends data analysis, which indicates decreasing search interest in UroLift.BMO Capital downgraded Xcel Energy (NASDAQ:) to Market Perform from Outperform and cut its price target to $64.00 from $69.00 to reflect the lower-than-expected terms of the company’s regulatory settlement in Colorado.Amid whipsaw markets and a slew of critical headlines, seize on the right timing to protect your profits: Always be the first to know with InvestingPro.Start your free 7-day trial now.

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions