Uncategorized

Goldman Sachs: 2 High-Yield Dividend Stocks Worth Investing In Now

Let’s begin with the fact that no investor can get around right now, the current volatile market. In the words of the Goldman Sachs strategist David Kostin, “The first six months of 2022 have been a brutal time to be an investor in public markets.” The losses, which stand at 19% year-to-date on the S&P 500, have been broad-based; barring outliers, neither value nor growth strategies have offered any respite.

Kostin dives into the current conditions, and comes up with some interesting views. He writes, “2022 has been a valuation-driven equity bear market rather than a decline prompted by lower earnings. Despite recession fears, S&P 500 consensus 2022 and 2023 EPS estimates have both been revised up so far this year.” But Kostin does note that there is a strong consensus pointing toward downward EPS revisions by year’s end, recession or no recession.

In this environment, Kostin is recommending that investors should go defensive, favoring stocks with a combination of high dividend yield and growth.

Against this backdrop, the stock analysts at Goldman Sachs have picked out stocks whose dividend payments are yielding above the market average. We’ve used the TipRanks’ database to pull up the data on two of these stocks. Let’s look into the details, along with the commentary from Goldman’s analysts, and find out what else these stocks have to offer.

Pioneer Natural Resources (PXD)

We’ll start with Pioneer Natural Resources, an Irving, Texas based hydrocarbon exploration firm working in the Permian Basin of West Texas. The Permian, in the past decade, has become one of the world’s major oil and gas production regions and has helped to put the Texas oil patch back on the global map. Pioneer’s holdings yielded over 637K barrels of oil equivalent per day in the first quarter of this year, and powered the company to its seventh quarter in a row of sequential revenue gains.

The Q1 top line was reported at $6.17 billion, which was up an impressive 152% from 1Q21; balanced against costs and expenses, this led to a net income of $2.01 billion, or $7.74 per diluted share. In addition to high revenues and earnings, Pioneer also generated plenty of cash, with Q1 free cash flow hitting $2.3 billion.

That last figure is of interest to dividend investors, since Pioneer boasts a high level of cash return to shareholders. The company reported returning 88% of Q1 free cash flow, through a combination of a 78 cent base dividend and a hefty variable dividend, which was set at $6.60 for the quarter. The combined dividend, assuming continued high variable payments for the rest of the year, annualizes to more than $29 per share and yields a powerful 13.7%.

The dividend and high capital return percentages caught the attention of Goldman analyst Neil Mehta, who writes: “We believe PXD is favorably positioned to generate attractive FCF given its differentiated undeveloped inventory (15+ years) in the core of the Permian. Also, given PXD’s strong balance sheet, we expect PXD to allocate the bulk of its FCF towards a capital return program including (1) 75%-80% towards fixed + variable dividend; and (2) remaining towards share repurchase. For 2022E/23E, we see PXD generating 19%/16% FCF yield and distributing a ~16% 1-yr forward dividend yield.”

Unsurprisingly, then, the 5-star analyst has a Buy rating on the stock, which he backs up with a $266 price target, indicating potential for 26% growth in the year ahead. (To watch Mehta’s track record, click here)

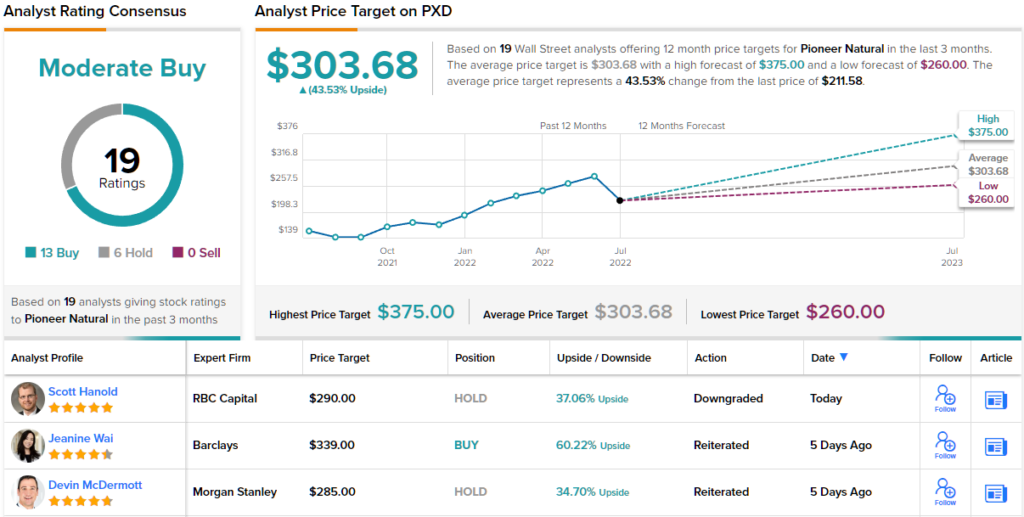

Overall, this stock has picked up a Moderate Buy rating from the Wall Street analyst consensus, based on 19 recent analyst reviews which include 13 Buys and 6 Holds. The shares are trading for $211.37 and the $303.68 average price target suggests a one-year upside of ~44%. (See PXD stock forecast on TipRanks)

Phillips 66 (PSX)

The second dividend stock we’ll look at is one of the oil and gas industry’s major players, Phillips 66. This oil major boasts a $38 billion market cap and more than $111 billion in annual revenues. The company has its hands in multiple aspects of the hydrocarbon business, including the refining, midstreaming, and marketing of a wide range of fuels, fuel oils, and lubricating oils, as well as the industrial chemical industry, including petrochemicals.

Rising oil prices over the past 12 months have been a boon for the industry as a whole, and Phillips 66 has been no exception to that rule. The company’s 2021 revenues were up 75% year-over-year, and the top line in 1Q22, at $36.6 billion, was up 12% from 4Q21 and 70% from 1Q21. Earnings, which are more volatile, came in at an adjusted total of $595 million for the quarter, giving an adjusted EPS of $1.32. While down from the Q4 number of $2.94, the Q1 earnings were a large turnaround from the $1.16 per share loss reported in the year-ago quarter.

On cash flow, Phillips 66 reported a total of $1.1 billion in cash from operations during Q1. This funded some $370 million in capital expenditures and investments – without skimping on the dividend, which was funded to the tune of $404 million. The company, which held $9 billion in cash reserves at the end of the quarter, announced the restart of an existing share repurchase program, with $2.5 billion authorized.

Dividend investors will be pleased to note that Phillips 66 raised its dividend payment in the most recent declaration, to 97 cents per common share, which was paid out on June 1. At the current rate it annualizes to $3.88, and yields 5%, well above the ~2% average yield found among dividend payers in the broader markets.

Checking in with Neil Mehta once again, we find he has published an upbeat view of PSX for Goldman, saying of the company, “Phillips 66 remains our top idea within our US refining coverage. With the stock having underperformed large cap peers MPC and VLO by ~40% over the last 12 months, we do not believe the market is giving credit for the positive inflection in PSX earnings, cash flow, and capital returns we expect to see in 2022/2023…. Overall, we see 38% total return to PSX vs the large cap peer average of 14% and the refining sector average of 20%.”

Mehta’s comments back up his Buy rating on the shares, while his $109 price target implies they have a 40% upside ahead for the next year.

Phillips 66 claims a Strong Buy rating from the analyst consensus, based on 10 reviews that break down 9 to 1 in favor of Buy over Hold. The stock is trading for $77 and the $111.90 average price target suggests a 45% one-year upside potential from current levels. (See PSX stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Uncategorized

BofA Securities maintains Amazon.com at ‘buy’ with a price target of $154.00

Uncategorized

Six people in critical condition, one still missing after Paris blast – prosecutor

5/5

© Reuters. French firefighters and rescue forces work after several buildings on fire following a gas explosion in the fifth arrondissement of Paris, France, June 21, 2023. REUTERS/Gonzalo Fuentes

2/5

PARIS (Reuters) – Six people remained in a critical condition and one person was believed still missing on Thursday, one day after a blast ripped through a street near Paris’ historic Latin Quarter, the city’s public prosecution office said. “These figures may still change,” prosecutor Maylis De Roeck told Reuters in a text message, adding that around 50 people had been injured in the blast, which set buildings ablaze and caused the front of one to collapse onto the street. Of two people initially believed missing, one has been found in hospital and is being taken care of, the prosecutor said, adding: “Searches are ongoing to find the second person.” Authorities have not yet said what caused the explosion, which witnesses said had followed a strong smell of gas at the site. The explosion led to scenes of chaos and destruction in the historic Rue Saint Jacques, which runs from the Notre-Dame de Paris Cathedral to the Sorbonne University, just as people were heading home from work. It also destroyed the facade of a building housing the Paris American Academy design school popular with foreign students. Florence Berthout, mayor of the Paris district where the blast occurred, said 12 students who should have been in the academy’s classrooms at the time had fortunately gone to visit an exhibition with their teacher.

“Otherwise the (death toll) could have been absolutely horrific,” Berthout told BFM TV. She said three children who had been passing by at the time were among the injured, although their lives were not in danger.

Uncategorized

4 big analyst cuts: Alcoa & DigitalOcean shares drop on downgrades

© Reuters.

Here is your Pro Recap of the biggest analyst cuts you may have missed since yesterday: downgrades at Alcoa, DigitalOcean, Teleflex, and Xcel Energy.InvestingPro subscribers got this news in rapid fire. Never be left in the dust again.Alcoa stock drops on Morgan Stanley downgrade Alcoa (NYSE:) shares fell more than 3% pre-market today after Morgan Stanley downgraded the company to Underweight from Equalweight and cut its price target to $33.00 from $43.00, as reported in real time on InvestingPro.The firm sees a significant decline in consensus estimates, and as negative earnings revisions materialize, it believes the stock will face downward pressure and underperform.The analyst’s estimates for EBITDA in Q2, 2023, and 2024 are substantially lower than the consensus. The stock is currently trading above its historical average. The firm said its downward revisions in earnings estimates and price target are attributed to the company’s high operating leverage to aluminum prices.DigitalOcean stock plunges on downgradePiper Sandler downgraded DigitalOcean (NYSE:) to Underweight from Neutral with a price target of $35.00. As a result, shares plunged more than 5% pre-market today.The company reported its last month, with revenue beating the consensus estimate, while EPS coming in worse than expected. Furthermore, the company provided a strong outlook, which was above the Street estimates.2 more downgradesTeleflex (NYSE:) shares fell more than 3% yesterday after Needham downgraded the company to Hold from Buy, noting that UroLift expectations may still be too high.According to Needham, their checks indicate that urologists are reducing their use of UroLift due to its retreatment rates, reimbursement cuts, and increasing use of competing procedures. This is also supported by their Google Trends data analysis, which indicates decreasing search interest in UroLift.BMO Capital downgraded Xcel Energy (NASDAQ:) to Market Perform from Outperform and cut its price target to $64.00 from $69.00 to reflect the lower-than-expected terms of the company’s regulatory settlement in Colorado.Amid whipsaw markets and a slew of critical headlines, seize on the right timing to protect your profits: Always be the first to know with InvestingPro.Start your free 7-day trial now.

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions