Commodities

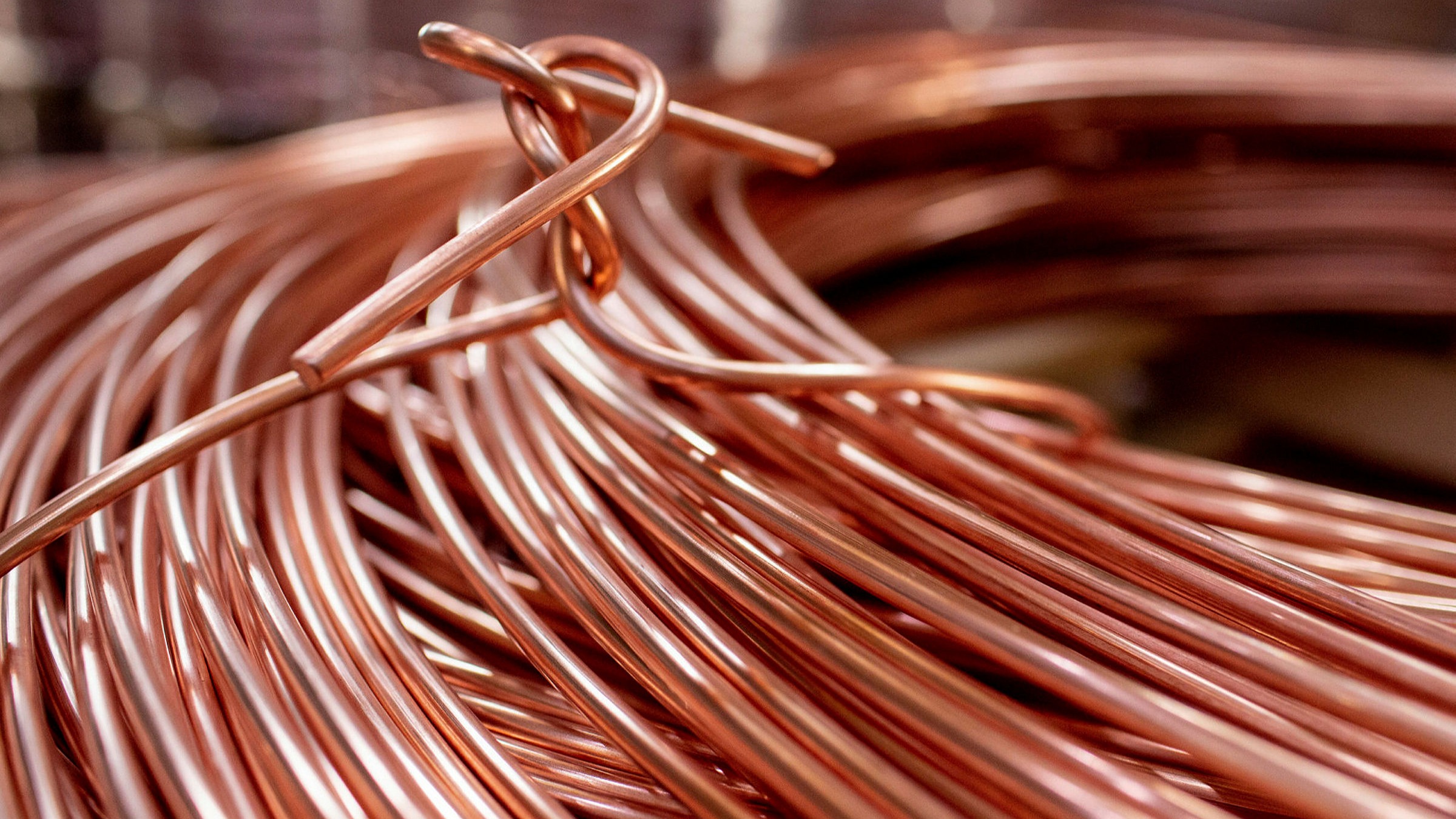

Copper continues to fall in price on expectations of lower demand in China

Futures on copper fell in price to 3.47 dollars per pound on concerns about the decline in demand in China.

Sorreg price is declining for the third trading session in a row on uncertainty in the demand for industrial metals after the release of Chinese industrial statistics, according to trading data.

September futures on copper on the Comex exchange fell by 1.66% to $3.4725 per pound (about 0.45 kilograms). Copper has fallen in price for the third session in a row. During this time, the metal has fallen by a total of 3.3%.

At the end of previous trades on the London Metal Exchange (LME), the cost of a ton of copper with delivery in three months decreased by 1.24% to $7819.5, aluminum – by 2.33%, to $2430.5, zinc – rose by 0.59% to $3328.

China’s manufacturing PMI fell to 50.4 points from June’s 51.7 points, according to business publication Caixin.

China is the largest consumer of copper, so the statistics related to its industry reflects on expectations around demand for the metal.

Commodities

Oil prices rise; U.S. crude inventories plunge, Russia-Ukraine truce eyed

Commodities

India’s Reliance to stop buying Venezuelan oil over US tariffs, sources say

Commodities

Oil prices climb on Venezuela supply worries

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions