Commodities

UBS lifts its forecast for gold prices

Investing.com — UBS has raised its gold price forecasts, anticipating further gains in the precious metal over the next year.

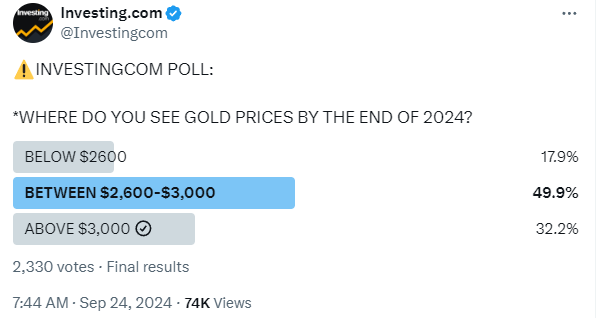

The bank now expects gold to reach $2,750 per ounce by the end of 2024, up from its previous forecast of $2,600.

By mid-2025, UBS projects prices to rise further to $2,850 per ounce, and to $2,900 per ounce by the third quarter of 2025.

This year, gold has surged by 29%, consistently breaking records, UBS noted.

On September 24, the metal hit an all-time high of $2,670 per ounce, driven by concerns over economic growth, geopolitical tensions, and a weakening U.S. dollar. It has broken that level today.

UBS pointed out that historically, gold tends to rally by up to 10% in the six months following the first Federal Reserve rate cut, and the metal’s current upward momentum suggests even more gains are likely.

“We see even higher prices over the next 6-12 months, driven by greater investment demand alongside a drop in U.S. real rates, a seasonal recovery in jewelry consumption, and ongoing central bank purchases,” UBS analysts stated.

The bank also mentioned that despite the rapid rise in prices, pullbacks this year have been “shallow and brief,” forcing investors to chase the market higher.

With the U.S. election approaching, UBS sees increased uncertainty, which could further fuel demand for gold as a safe haven asset.

Additionally, the bank observed that while Swiss gold export data indicates slower demand from China, this is likely due to quota limitations rather than a drop in underlying demand.

UBS continues to recommend a 5% allocation to gold within a balanced USD portfolio, citing the metal’s hedging qualities. It also expressed a positive view on select gold miners as a tactical investment opportunity.

Commodities

Oil prices rise; U.S. crude inventories plunge, Russia-Ukraine truce eyed

Commodities

India’s Reliance to stop buying Venezuelan oil over US tariffs, sources say

Commodities

Oil prices climb on Venezuela supply worries

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions