Cryptocurrency

Bracket Labs Expands Cross-Chain to Deliver Volatility Trading Product, Passage, to BNB Chain’s 1+ Million Users

[PRESS RELEASE – Panama City, Panama, February 1st, 2024]

Integration Comes on the Heels of $2 Million Investment Led By Binance Labs

Bracket Labs, a leader in on-chain volatility trading, announces the integration of its trading product, Passage, with BNB Chain, expanding Bracket’s simple, one-click trading platform to the most active trading blockchain in Decentralized Finance.

Crypto markets cyclically fluctuate through long periods of sideways trading followed by short periods of volatility. To take advantage of these conditions, Bracket innovates on traditional financial instruments and delivers an all-new leveraged trading product for volatility that is ideal in both sideways and trending markets.

With more than $3.2 billion in total value locked and 1+ million daily active users on BNB Chain, Bracket Labs will have access to increased liquidity for faster transactions and improved pricing. With this launch, Bracket Labs further diversifies its platform for traders with access to cheap fees on BNB Chain.

“We are excited to work with innovative, fully on-chain applications, especially as DeFi continues to grow and flourish. Tackling the problem of volatility or options trading is not easy, but Bracket Labs team has worked really hard to distill a complex topic into something that is fun and easy to use. This is a welcome addition to the BNB Chain ecosystem,” Mehmet Buyu, Global Business Development Manager, BNB Chain.

The latest expansion marks a culminating step in Binance Labs’ incubation and investment in Bracket Labs. The debut of the BracketX platform on BNB Chain follows the completion of a successful $2 million pre-seed fundraising round in January 2024. BracketX will incorporate infrastructure from BNB Chain, including BNB Greenfield, for optimal decentralized storage.

Passage, Bracket Labs’ flagship product, is designed to simplify on-chain volatility trading. The expansion to BNB Chain aligns with Bracket Labs’ commitment to democratizing financial products and fosters innovation in decentralized finance. Passage delivers an all-new volatility model for any market condition, enabling traders to navigate volatility and trade based on sideways or trending markets without a bias for price direction.

“We have worked closely with Binance Labs and BNB Chain for nearly a year to reach this point and we’re excited to finally debut our product for the incredible traders across BNB Chain,” says Pelli Wang, Co-Founder and COO of Bracket Labs. “Our launch on BNB Chain opens up a myriad of opportunities due to their active trading volume and liquidity. We expect many more partnerships in the future.”

Bracket Labs also expects to expand its derivatives trading products to include assets traded primarily on BNB Chain, including Pancake (CAKE) and more. Bracket Labs is also planning to add partnerships with major wallet providers, DEXs, Perpetuals, and Liquid Staking projects to grow its ecosystem with a focus on the international market.

For more information about BracketX and Passage, please visit www.bracketx.fi.

About Bracket Labs

Bracket Labs’ mission is to democratize financial products and introduce on-chain innovations in volatility trading. Domiciled in Panama, the team has deep crypto and traditional finance backgrounds and senior leadership experience at D.E Shaw, Merrill Lynch, Barclays, Bloomberg, Consensys, DeerCreek, and more.

Social Media Links:

Website | Linktree | Twitter | Discord | Telegram

Contact

PR Director

Kyle Heise

SCRIB3

kyle@scrib3.co

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Cryptocurrency

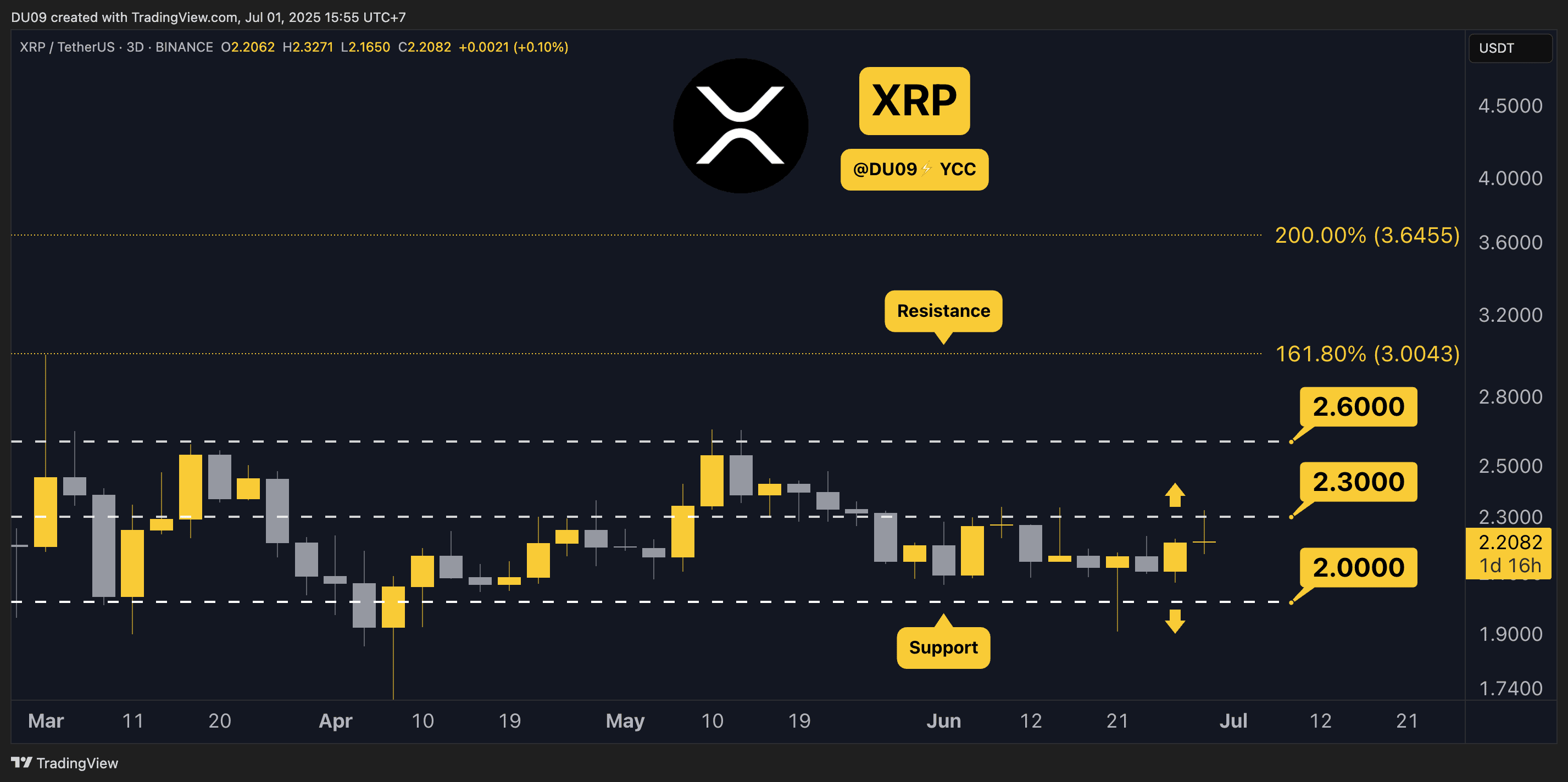

3 Things to Watch in Ripple’s (XRP) Price Today

XRP is testing the resistance at $2.3. Will it break?

Key Support levels: $2

Key Resistance levels: $2.3, $2.6, $3

1. Key Resistance Under Pressure

Yesterday, buyers pushed XRP to the key resistance at $2.3, but sellers returned to stop a breakout. At the time of this post, the price is in a pullback. Nevertheless, this is a positive sign that shows buyers are returning. If this bullish momentum intensifies, then $2.3 could fall and be followed by a test of $2.6 next.

2. Optimism Returns

With the price keen on making higher highs, optimism is returning to this cryptocurrency. This can be seen on the volume profile where buyers have dominated in the last few days. A break above $2.3 will likely see the volume spike and allow further price expansion into new highs.

3. MACD Turning Bullish

After the daily MACD turned positive last week, the 2-day MACD has also turned bullish today. This shows that the buy momentum is slowly creeping into higher timeframes which will build confidence in the price action and attract more buyers. With a positive feedback loop in action, XRP has a good shot at $2.6 or even higher in July.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Cryptocurrency

Bitcoin Traders Wait Important Economic Announcements Today, These Altcoins Plummet (Market Watch)

Bitcoin’s price has retraced by a slight 0.9% in the past 24 hours as traders are expecting a few important economic events during today’s session.

Meanwhile, the broader cryptocurrency market is also reflecting the uncertainty as the majority of altcoins are trading in the red with some charting a lot bigger declines than others.

Bitcoin Price Waits for News

The deep involvement of corporate Bitcoin buyers and institutions has surely played a major role in its price increase over the past year but it’s also the reason why the crypto market has been largely correlated to traditional ones.

A few years ago, literally nobody cared about metrics such as CPI, PMI, and whatnot, but now every crypto trader has them on their watchlist.

As such, today is also shaping up to be a volatile experience with a few important economic events on the calendar.

First, Jerome Powell will speak in the afternoon, followed by data for job openings, PMI, and ISM manufacturing – all indicators that shape policymaking, especially when gauging the strenght of the local economy.

That said, Bitocin’s price is down about 1% on the day and is currently trading at around $106,500 after having tested $109,000 yesterday. It’s interesting to see if the bulls have it in them to push bakc towards the upper boundary of the recent trading range or if the bears will send the price back below $105K.

Altcoins in Red, Some More Than Others

As you can clearly see in the heatmap below, the altcoins are also not having a great day. This is, perhaps, to be expected – Bitcoin’s dominance over the market has been rising gradually over the past many months and whenever BTC slips, altcoins crash.

The past 24 hours have hardly been a crash, though, but it’s clear that most of them are charting more considerable declines.

This is especially true for TKX, ARB, SPX6900, SEI, and others, that are down between 8% and 15% on the day.

Believe it or not, Bitcoin Cash (BCH) is today’s best performer, gaining more than 6%. Who would have thought?

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Cryptocurrency

How Much You Should Invest in Bitcoin (BTC)? Veteran Trader Peter Brandt Weighs in

TL;DR

- The expert advises monthly investments in SPY and BTC for long-term success.

- The leading cryptocurrency is up 6% this week and trades near $108,000. Analysts are split – some see a breakout to $130K – $200K if key resistance levels are cleared, while others warn of a possible drop to $100K or even $95K if momentum fades.

‘Trading is the Wrong Path’

Besides its fundamentals and ability to transform the global financial system, Bitcoin (BTC) has proven to be an excellent investment opportunity.

At least, that was the case in the past few years: the asset went through multiple bear and bull markets to eventually cross the $100,000 mark. Currently, it trades at around $108,000 (according to CoinGecko’s data), representing a 75% increase on a yearly scale and a substantial 43,000% jump compared to its valuation a decade ago.

But does the leading cryptocurrency remain a good investment after this major rally over the years, and how much should people allocate to it? That’s a question many people are trying to figure out.

It seems that there isn’t a direct answer, and it all depends on the risk profile of the investors, as well as other important factors. However, one can turn to certain experts who are experienced enough to give guidance.

An example is the veteran trader Peter Brandt, who recently suggested that approximately 95% of people fail when trading. Instead, he advised them to excel in their regular jobs, prioritize their families, and invest in homeownership. Last but not least, Brandt recommended making monthly investments, allocating 80% of the amount to SPY (the ETF that tracks the S&P 500 Index) and 20% to BTC.

Trading is the wrong path for 95% of ppl

Most would be better off becoming excellent at a day job (engineer, plumber, welder, vet, sales)

Live economically

Get married, have kids

Buy a twin home – rent out one of them

Invest monthly – 80% in $SPY and 20% in Bitcoin— Peter Brandt (@PeterLBrandt) June 29, 2025

The Next Potential Targets

Let’s now take a closer look at BTC’s recent performance and explore its chances for a further pump in the short term. The asset has increased in value by approximately 6% over the past week, with numerous analysts predicting a surge to a new all-time high if certain conditions are met.

The X user Cipher X believes “a strong weekly close” above $107,720 could open the door to a further rally to as high as $130,000-$135,000 in Q3 2025.

“Just look at Q4 2024 chart and you’ll see what happened when BTC had its biggest weekly close,” they added.

Merlijn The Trader thinks the final pump for this bull run is coming, envisioning a fresh ATH of around $200,000 towards the end of the year. At the same time, he advised investors to take profits, anticipating a drastic pullback to $95,000 shortly after that.

On the contrary, Ali Martinez argued that the cryptocurrency currently faces a key rejection while the stochastic RSI flashes a death cross on the daily chart. The analyst thinks a plunge to $100,000 is not out of the question unless “we get a sustained close” above $109,000.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions