Cryptocurrency

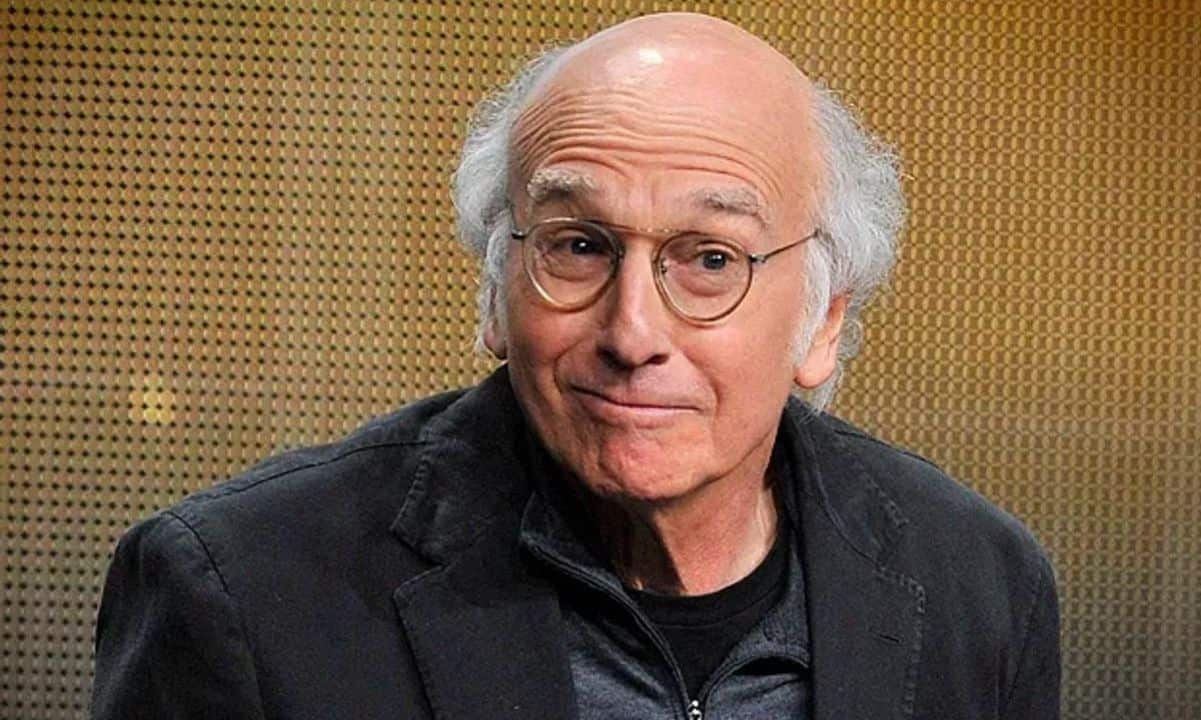

Larry David Expresses Regret Over FTX Ad Amid Founder’s Fraud Conviction

The popular actor and comedian Larry David has expressed remorse over participating in a high-profile 2022 Super Bowl commercial for the now-fallen cryptocurrency exchange FTX.

Notably, Sam Bankman Fried, the FTX founder, was imprisoned after he was found guilty of fraud, conspiracy, and money laundering last year.

Larry David Reflects on FTX Ad Regret

Speaking to The Associated Press at the Los Angeles premiere of the final season of “Curb Your Enthusiasm,” a series he created and stars in, David recounted seeking advice from knowledgeable friends before agreeing to the advertisement.

Despite assurances that it was legitimate, David now reflects on his decision with disappointment, highlighting his participation in the ad that humorously showcased him dismissing significant historical inventions, only to evaluate FTX as “the next big thing skeptically.”

The commercial was directed by Jeff Schaffer, a longtime colleague of David’s known for producing episodes of Seinfeld and Curb Your Enthusiasm and creating The League. In a New York Times profile, Schaffer admitted to having no knowledge about cryptocurrency, further highlighting the unique and somewhat unfamiliar nature of the subject matter explored in the ad.

The commercial has led to a proposed class-action lawsuit, implicating David, former FTX CEO Sam Bankman-Fried, and other celebrities like NFL quarterback Tom Brady and supermodel Gisele Bundchen for their roles in promoting FTX. The legal action accuses them of contributing to the financial losses of investors caught in the exchange’s abrupt downfall.

David, who revealed part of his compensation was in cryptocurrency, thus suffering personal financial losses, expressed his interest in joining the lawsuit. In April 2023, legal documents revealed that David and the other celebrities sought dismissal of the case, arguing they were not responsible for the investors’ losses.

SBF’s Conviction in Historic Fraud Case

Bankman-Fried was convicted on multiple charges related to one of the largest fraud cases in American history, with each of the seven counts of fraud, conspiracy, and money laundering potentially resulting in a maximum of 20 years in prison.

Additionally, he faced convictions for conspiracy to commit commodities fraud and conspiracy to commit securities fraud, each of which could add a maximum of five years to his sentence.

Damian Williams, the U.S. Attorney for the Southern District of New York, emphasized the magnitude of Bankman-Fried’s actions during a news briefing after the verdict. Williams pointed out that while the cryptocurrency industry and its key players, including SBF, might represent a new frontier, the nature of the fraud and corruption he engaged in is a tale as old as time.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Cryptocurrency

Standard Chartered Launches Institutional Spot BTC, ETH Trading

Standard Chartered has become the first internationally recognized financial heavyweight to launch direct spot trading for Bitcoin and Ethereum.

The offering positions the UK-based institution at the forefront of regulated digital asset integration within traditional finance.

Launch Mechanics and Client Access

According to reports, the new service will allow institutional clients, including asset managers, corporations, and large investors, to trade BTC and ETH directly using FX trading interfaces established by the bank.

Standard Chartered stressed that the trades are “deliverable,” meaning that customers will receive actual crypto assets upon settlement rather than mere exposure via derivatives. Additionally, users can choose their own custodian, including Standard Chartered’s in-house service.

At first, the offering will be available during Asian and European trading hours, with potential demand determining whether there will be 24/5 access in the future.

The bank also plans to introduce non-deliverable forwards (NDFs) trading for the two largest crypto assets by market cap. This will further expand risk management tools amid growing institutional appetite for digital assets.

Traditional banks are under increasing pressure to bridge the gap between legacy finance and crypto infrastructure, and Standard Chartered hopes to eliminate a major point of friction for institutional players who were previously forced to navigate a fragmented and often unregulated crypto sector.

A Broader Crypto Strategy

The UK spot trading launch is just one piece of Standard Chartered’s growing arsenal of digital asset solutions. At the beginning of the year, the bank established a dedicated Luxembourg entity to offer regulated crypto custody services within the EU.

Around the same time, it also dipped its feet into stablecoins and tokenization, partnering with Animoca Brands and HKT to develop a Hong Kong dollar-pegged stablecoin.

Compteitors like JPMorgan and Goldman Sachs have taken a more conservative approach to direct crypto spot trading, with Nate Geraci, co-founder of The ETF Institute, decrying this cautious stance.

Recently, while referencing Vanguard, another heavyweight player in the financial management space, he suggested that the refusal by such institutions to offer crypto products could alienate investors seeking exposure to such assets.

“What Vanguard is missing (*huge* miss IMO)…” Geraci posted. “Is there are tons of investors who love Vanguard’s low cost approach to stock & bond investing AND they want to own some btc & crypto.”

Meanwhile, Standard Chartered Group CEO Bill Winters has consistently stated that “digital assets are here to stay.” The company’s aggressive positioning grants it an early-mover advantage in a market where deep-pocketed investors are increasingly demanding secure, compliant crypto exposure amid a shifting regulatory environment and rising BTC adoption.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Cryptocurrency

Is Solana About to Explode Further? Analyst Reveals Next Targets

TL;DR

- Solana breaks above $166 Fibonacci level, with bulls eyeing targets at $171, $179, and $185.

- SOL trades above 9-day SMA, while MFI at 76 signals strong inflows but potential exhaustion.

- SEC ETF reviews add momentum to Solana’s ongoing upward price action.

SOL Chart Points to Bullish Target

Solana (SOL) has broken out of an ascending triangle. The price cleared the $166 mark, which is the 1.272 Fibonacci level. Traders now watch for the next levels at $171, $179, and $185. The structure shows rising lows and growing volume, which supports the move.

“This could be the cleanest breakout I’ve seen all month,” said analyst Ali on X.

If buyers stay in control, the $185 level may be next. But traders also watch for pullbacks, especially as prices move higher into resistance zones.

This could be the cleanest breakout I’ve seen all month! pic.twitter.com/FGWTYaOqDg

— Ali (@ali_charts) July 15, 2025

SMA and MFI Indicate Bullish Momentum

Solana trades above its 9-day simple moving average, which now sits at $158. This shows that buyers are still active. The slope of the line is pointing up, which supports the current direction.

At the same time, the Money Flow Index is at 76.16, which is close to the overbought line. This reading shows that funds have flowed in fast. But it also warns of possible profit-taking or price pauses near this level.

Network Use and ETF Talk Support Momentum

As CryptoPotato reported, the number of active users on Solana’s network has recently ticked up. This rise in activity often helps price moves stay strong. The added use shows interest in Solana is growing.

Meanwhile, the SEC is now reviewing spot ETF filings tied to Solana. These efforts are said to be moving quickly. If approved, they may open more ways for funds to buy SOL directly.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Cryptocurrency

Large Bitcoin Investors Realize $1.54 Billion in Profits but Rally Still Intact: CryptoQuant

Bitcoin’s climb above the coveted $120,000 level was short-lived, as the cryptocurrency pulled back to below $117,000 amidst renewed volatility. Over the past 24 hours, it declined by over 4%.

On-chain signals reveal increased miner activity, which suggests short-term selling pressure.

Miners Cashing Out?

As the price approached new highs, the Miners’ Position Index (MPI) – which gauges the ratio of miner outflows to their one-year moving average – spiked to levels last seen during major sell-off periods. This means that some of them may have begun taking profits into strength, a pattern often seen when the MPI reading rises above 2, hinting at larger-than-usual Bitcoin outflows from miners to exchanges.

While such moves can introduce short-term selling pressure, CryptoQuant explained that historical patterns indicate they do not always derail broader bullish trends when demand from other investor cohorts remains strong.

At the same time, Binance, the world’s largest cryptocurrency exchange, recorded net inflows of nearly 6,000 BTC between July 12 and July 14. This activity reversed a period of predominantly neutral or negative netflows. The sudden influx alongside the recent price rally points to potential arbitrage activity, derivative hedging, or preparations for large-scale transactions rather than outright panic selling.

Considering all these factors together, the uptick in miner activity and increased exchange deposits mean that while some market participants are realizing gains, others may be positioning for continued price action.

Amid these miner outflows and Binance inflows, Glassnode recorded one of the year’s largest profit-taking days.

Bitcoin Logs One of Its Largest Profit-Taking Days

According to the blockchain intelligence platform’s findings, Bitcoin investors collectively realized $3.5 billion in profits over the past 24 hours.

This is one of the largest profit-taking days for BTC this year. Interestingly, long-term holders accounted for approximately $1.96 billion, or 56% of the realized gains, while short-term holders captured around $1.54 billion and accounted for the rest.

The significant wave of profit realization, led predominantly by long-term holders, demonstrated how seasoned investors are seizing the opportunity to lock in gains as Bitcoin hit a fresh peak while still allowing room for fresh capital to enter.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions