Cryptocurrency

C1 Fund and Spartan Group Forge Strategic Partnership to Propel Digital Assets Secondary Markets

[PRESS RELEASE – Dubai, United Arab Emirates, January 17th, 2024]

C1 and Spartan Group Unite Forces to Drive Liquidity, Innovation and Growth.

C1 Fund, a $500 million fund dedicated to secondaries in the digital assets space has announced a strategic partnership with the Spartan Group, a prominent Asia-based advisory and asset management firm with an extensive and impressive track record in advising and investing across all verticals in the Web3 sector.

C1 Fund has rapidly emerged as a leading player in the digital assets investment space, leveraging its substantial capital to actively participate in secondary markets, where it identifies and seizes opportunities for investment and growth. With a mission to unlock value in the digital assets ecosystem, C1 Fund strategically acquires stakes from existing investors and provides immediate liquidity.

The partnership with Spartan Group signifies a key milestone for C1 Fund, as Spartan Group brings unparalleled expertise and a proven history of success in advising on multi-billion-dollar M&A transactions and fundraises within the digital assets sector. Spartan Group has consistently demonstrated its commitment to working closely with visionary founders and top-tier management teams, earning a reputation as a trusted advisor to some of the most recognized projects in the Web3 space.

We are thrilled to join forces with Spartan Group, said Dr. Najam Kidwai, CEO & Co-Founder of C1 Fund. “Spartan’s deep understanding of the crypto, Web3 and blockchain landscape, coupled with a track record of successful engagements with industry leaders, aligns seamlessly with our vision for C1 Fund. The synergy between C1 Fund and Spartan Group is a testament to our shared commitment to driving innovation and growth in the digital assets sector.”

This collaboration significantly enhances our ability to identify and seize emerging opportunities, expanding our influence within the dynamic realm of digital assets secondaries.

Spartan Group’s Co-Founder, Casper B. Johansen, expressed equal enthusiasm, stating, “Collaborating with C1 Fund opens up exciting avenues for both organizations. C1 Fund’s focus on digital assets secondaries complements our expertise, creating a synergy that will enhance our ability to drive value for our clients and the broader crypto community. We look forward to a mutually beneficial partnership that pioneers innovation and growth.”

As the crypto ecosystem continues to evolve, this collaboration between C1 Fund and Spartan Group represents a pioneering strategic alliance at the forefront of shaping the industry’s future. Positioned to catalyze transformative developments in the digital assets secondary markets, it aims to foster innovation, enhance liquidity, and contribute to sustained growth of the companies we invest in.

About C1 Fund:

C1 Holdings LLC is a Caymans-based investment company founded and managed by leading digital asset investors and entrepreneurs. C1 provides investment vehicles for investors in secondary transactions investing globally.

About Spartan Group:

Founded in 2017, Spartan Group is the most active and dedicated dealmaker, leading multi-strategy asset manager and venture studio in the Web3 industry. Specializing in M&A, restructuring, token launches and capital raising, Spartan Group has worked with and backed some of the world’s leading Web3 founders and projects.

Contact

Cheriyl Lakshmy

cheriyl@c1fund.com

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

Cryptocurrency

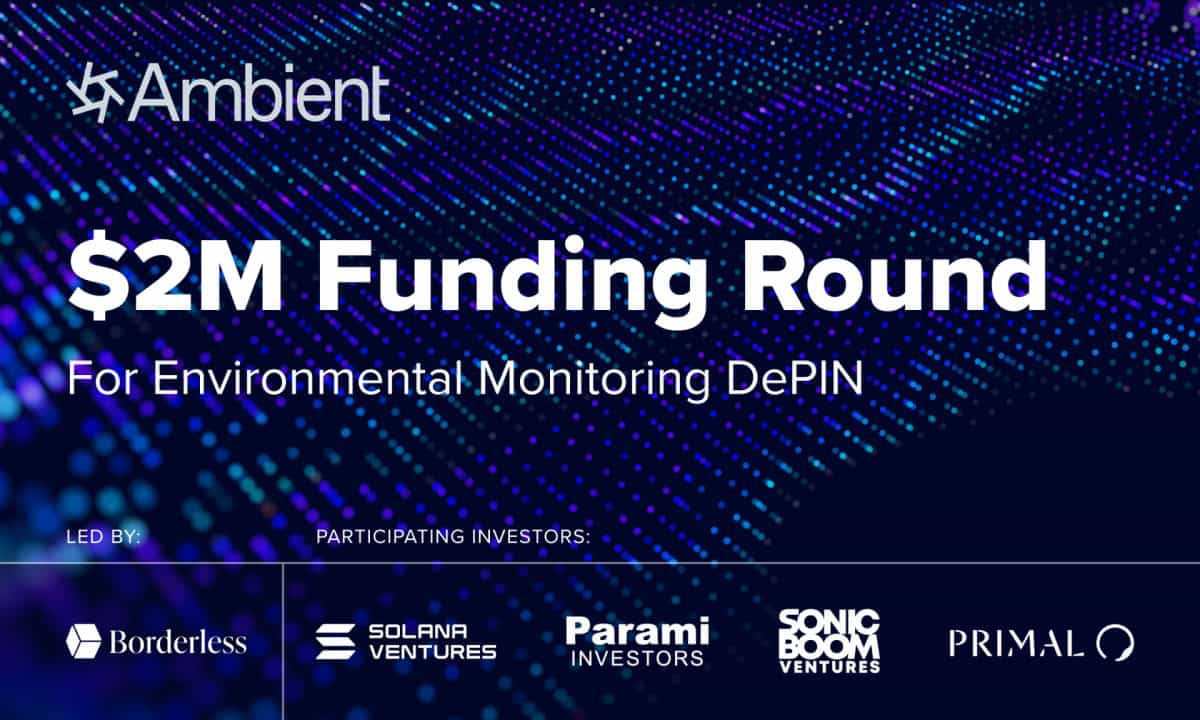

Ambient Secures $2 Million to Scale Up DePIN for Environmental Monitoring Globally

[PRESS RELEASE – London, UK, May 7th, 2024]

With New Investment Round Led by Borderless Capital, The Environmental Data DePin, Eyes Solana Launch and Global Market Expansion

Ambient, the world’s largest decentralized network of environmental sensors and ambient data, today announced the successful closure of an oversubscribed $2 million seed funding round. This round was led by Borderless Capital, with participation from Solana Ventures, Parami Investors, Sonic Boom Ventures, and Primal Capital, among others.

Accurate data is crucial for addressing the challenges of climate change and air pollution, which is the leading environmental cause of illness and premature death. And while the demand for detailed environmental monitoring is projected to reach $40 billion by 2030, there is a tremendous scarcity of real-time and localized data available for a majority of the world. Using the DePIN model, Ambient has become the fastest growing, decentralized network of climate and ambient sensors across more than 20 countries with real-time data feeds every 5 minutes.

“Ambient is positioned to become an indispensable resource as global citizens increasingly seek to understand their environmental conditions and organizations require more accurate data for strategic decisions. Supported by industry leaders, our network of distributed and incentivized sensors drives environmental sustainability and positive impact at a global scale,” said Luca Franchi, Ambient co-founder and CEO.

Ambient plans to broaden its reach and forge strategic partnerships, enhancing its business model and extending its market footprint. The network, which includes over 25,000 sensors across more than 20 countries, and has generated upwards of 10.7 billion data streams. Ambient data can serve multiple use cases, including, and not limited to:

- Monitoring air quality impact of weather changes, wildfires, industrial activities

- Aiding in the development of sustainable buildings and smart cities

- Improving insurance underwriting processes

- Managing health risks more effectively

- Enhancing marketing and advertising decisions through climate-driven data

- Addressing essential considerations in banking and financial sectors

“It is hard to imagine how we will scale fast enough to meet the demands for collecting reliable environmental data without innovative DePIN-aligned networks like Ambient. While some solutions leverage ML-based models to simulate air quality and other ambient information, there is no substitute for more local, real-time data collection. Ambient is demonstrating how it can achieve this globally via shared ownership and built-in economic rewards,” said Alpen Sheth, Partner, Borderless Capital.

Ambient’s impending launch on Solana, a leading blockchain platform known for supporting scalable decentralized projects, will introduce enhanced token economics and governance models to incentivize and reward community contributions.

Ambient’s reimagined platform will allow individuals to join the network, deploy sensors, and even use their smartphones to monitor and report environmental data and earn rewards.

To access Ambient’s data stream API, users can visit https://ambient.network/data

About Ambient

Ambient is at the leading edge of decentralized environmental monitoring, harnessing the power of its vast sensor network to deliver real-time, actionable environmental data. By utilizing distributed technologies and a community-focused participation model, Ambient not only enhances environmental awareness but also drives impactful change across the globe. Ambient Network is operated by the Cayman Foundation company bearing its name, dedicated to the decentralization, adoption, and security of the network.

About Borderless

Borderless is a leading investment management firm focused on Web3 technology, dedicated to supporting the next generation of innovators who are driving the development of groundbreaking technologies that will enable the creation of value without borders. Borderless comprises a team of builders, partners, and investors who adopt a long-term perspective and strive to unleash the full potential of open, community-driven networks. Since 2018, Borderless has invested in 200+ protocols/companies across infrastructure, business applications, and nascent cryptographic protocols, and has played an integral role in the development of some of the most significant and innovative Web3 communities. Borderless has been a pioneer in DePIN, launching the first dedicated fund in 2021 and investing in over 35 DePIN projects since then. For more information, users can visit their website at: www.borderlesscapital.io

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Cryptocurrency

Ethernity Transitions to an AI Enhanced Ethereum Layer 2, Purpose-Built for the Entertainment Industry

[PRESS RELEASE – LOS ANGELES, United States, May 7th, 2024]

Global brands and talent will be able to use Ethernity’s technology to store their IP on-chain and engage with their fans through next-generation content and experiences

Ethernity, the renowned platform for authenticated and licensed NFTs with icons like Lionel Messi and Shaquille O’Neal, announces its groundbreaking evolution into a pioneering Layer 2 solution on the Ethereum blockchain. This evolution is poised to transform the web3 entertainment landscape, directly addressing the challenges faced by major brands like Amazon, Marvel, and Warner Brothers in embracing blockchain technology.

Ethernity’s interactions with global entertainment brands uncovered significant barriers to their adoption of web3, ultimately inspiring the development of the Ethernity Chain. Chief among their concerns were privacy, cost and complicated interfaces, all of which have been addressed by this evolution; Ethernity’s Layer 2 solution enhances security, offers reduced gas fees, and includes a plug-and-play toolkit, making it easier for global entertainment brands to integrate their franchises into the blockchain. To ensure proprietary data and creator IP are protected, the Ethernity Chain incorporates advanced AI capabilities – including comprehensive Digital Rights Management (DRM) controls – that combat counterfeit asset trading and provide a secure environment for both users and brands.

Key Features of the Ethernity Chain

- Enhanced AI Capabilities: Embedded within the Ethernity Chain, AI provides unparalleled security and brand protection through robust Digital Rights Management (DRM) controls, designed to prevent counterfeit asset trading and ensure a secure environment for users and brands alike.

- Plug and Play Toolkit: The Ethernity Plug and Play toolkit provides brands and creators with no-code tools to bring their global entertainment brands onto the blockchain and to quickly and easily ramp up tokens, marketplaces, and web3 applications.

- Eco-Friendly and Low Gas Fees: The Ethernity Chain is designed to minimize environmental impact and lower the barrier to entry for users and developers through significantly reduced gas fees.

- 100% EVM as Standard: The Ethernity Chain seamlessly integrates all current standards, including tokens, NFTs, and DeFi smart contracts.

“Our goal is to revolutionize how entertainment brands engage with their audiences through web3 technologies,” said Nick Rose Ntertsas, Co-Chief Executive Officer at Ethernity. “By evolving into a Layer 2, we are not only expanding our capabilities but also providing a navigable, sustainable and secure environment for brands to create next-gen entertainment products and fan experiences.”

For more information about Ethernity and its transition to Layer 2, please visit https://ethernity.io.

About Ethernity

Ethernity is a leading Cayman Islands based technology company specializing in innovative web3 solutions including their upcoming Ethereum Layer 2 solution specifically built for global entertainment brands aiming to transition their intellectual properties to the blockchain. By capitalizing on our established partnerships, deep expertise, and robust infrastructure, Ethernity is set to spearhead the world’s leading web3 entertainment ecosystem. We offer an AI enhanced, secure, eco-friendly, and intuitive platform that caters to the evolving needs of the next generation of entertainment enterprises and products.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Cryptocurrency

Hong Kong Bitcoin ETFs See First Outflows Since Launch

Hong Kong’s Bitcoin ETFs experienced their first setback after launching on April 30, following their first cumulative daily BTC outflows on Monday.

The outflow came from the China Asset Management Bitcoin ETF, while the other Hong Kong-based products had no flows.

Hong Kong ETFs See Modest Inflows

According to Farside data, the China AMC Bitcoin ETF saw an outflow of $4.9 million on Monday. In contrast, the other Bitcoin and Ethereum ETFs in Hong Kong reported “zero” flows apart from Bosera Ethereum ETF, which saw 3.2 million in inflow on Monday.

Following their launch last week, the three Hong Kong’s Bitcoin ETFs amassed $262 million in assets under management (AUM) within their first week.

Despite these significant AUM figures, the asset inflows for Hong Kong’s Bitcoin and Ethereum ETFs amounted to less than $14 million during their first launch week. This figure pales compared to the billions of dollars that flowed into U.S. spot Bitcoin ETFs back in January.

Meanwhile, the Hong Kong spot Ethereum ETFs, the world’s first of their kind, did not make a significant impact, with a combined $54.2 million in AUM and total inflows of $9.3 million as of May 6.

Hong Kong ETF Performance Concerns

Despite the underwhelming performance of the Hong Kong spot ETFs, Bitcoin experienced a weekend surge, now trading close to $64,000, up from below $57,000 last week.

Senior Bloomberg ETF analyst Eric Balchunas has advised investors not to expect substantial numbers in Hong Kong compared to the U.S. market. He explained that the $310 million AUM of the Hong Kong ETFs is equivalent to $50 billion in the U.S. market. Therefore, these ETFs are already as substantial in their local market as U.S. ones are in theirs.

The Hong Kong equities sector is relatively small, with a total market cap of $4.5 trillion, compared to the $50 trillion worth of listed equities across all U.S. exchanges. In addition, the Hong Kong equities sector faces liquidity challenges due to slower economic growth in mainland China since 2022.

In a recent study conducted by crypto exchange OSL, nearly 80% of crypto-savvy investors in Hong Kong intend to invest in the new spot Bitcoin and Ethereum ETFs. However, these assets are currently inaccessible to mainland Chinese investors unless they also hold Hong Kong residency. Notably, this restriction could lead to lower transaction volumes for the ETFs than the United States.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Forex2 years ago

Forex2 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex2 years ago

Forex2 years agoHow is the Australian dollar doing today?

Forex1 year ago

Forex1 year agoUnbiased review of Pocket Option broker

Forex2 years ago

Forex2 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Cryptocurrency2 years ago

Cryptocurrency2 years agoWhat happened in the crypto market – current events today

World2 years ago

World2 years agoWhy are modern video games an art form?

Stock Markets2 years ago

Stock Markets2 years agoMorgan Stanley: bear market rally to continue

Economy2 years ago

Economy2 years agoCrude oil tankers double in price due to EU anti-Russian sanctions