Cryptocurrency

Disappointing Launch Day for Hong Kong’s Bitcoin, Ethereum ETFs as BTC Slumps Below $61K

Hong Kong’s debut of six new spot Bitcoin and Ethereum exchange-traded funds (ETFs) marked a trading volume of HK$87.5 million ($11.2 million). This volume was significantly below the inaugural trading of 11 spot Bitcoin ETFs in the U.S., which achieved a staggering $4.6 billion.

Meanwhile, bitcoin’s price dumped below $61,000, having experienced a 2.3% decline within the last 24 hours and an 8% decrease over the past week.

Hong Kong’s ETFs Record Low Volumes

The Hong Kong Stock Exchange (HKEX) data indicates that the performance and interest in the six Bitcoin and Ethereum ETFs managed by China Asset Management, Harvest Global, Bosera, and HashKey were relatively low after debuting in Hong Kong today.

The Bosera HashKey Bitcoin ETF recorded HK$249,000 in first-day trading volume, while the Bosera HashKey Ether ETF saw HK$99,000 in trading volume at the closing bell.

In contrast, the China Asset Management (CAM) Bitcoin ETF performed better, generating HK$4.6 million in trading volume at the closing bell. The CAM Ether ETF also had a trading volume of HK$4.6 million.

Bitcoin Falls Below $62,000

Even with the introduction of Bitcoin and Ethereum ETFs in Hong Kong, the overall sentiment in the crypto market remains negative. Perhaps driven by the disappointing numbers coming from Asia, BTC reacted in a negative manner and dumped below $61,000 for the first time in 11 days.

Bitcoin started last week with some positive momentum, briefly surpassing $67,000. However, it failed to sustain this upward trend and began to lose value, reaching a low of $60,700 on Monday.

Following a brief recovery to $64,800, bitcoin faced another rejection, struggling to maintain even a minor rally. Meanwhile, the rest of the crypto market followed suit, with the market capitalization dropping 3% over the last 24 hours to $2.35 trillion.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

Cryptocurrency

Polimec Brings Decentralized Fundraising to Polkadot

[PRESS RELEASE – Zug, Switzerland, May 20th, 2024]

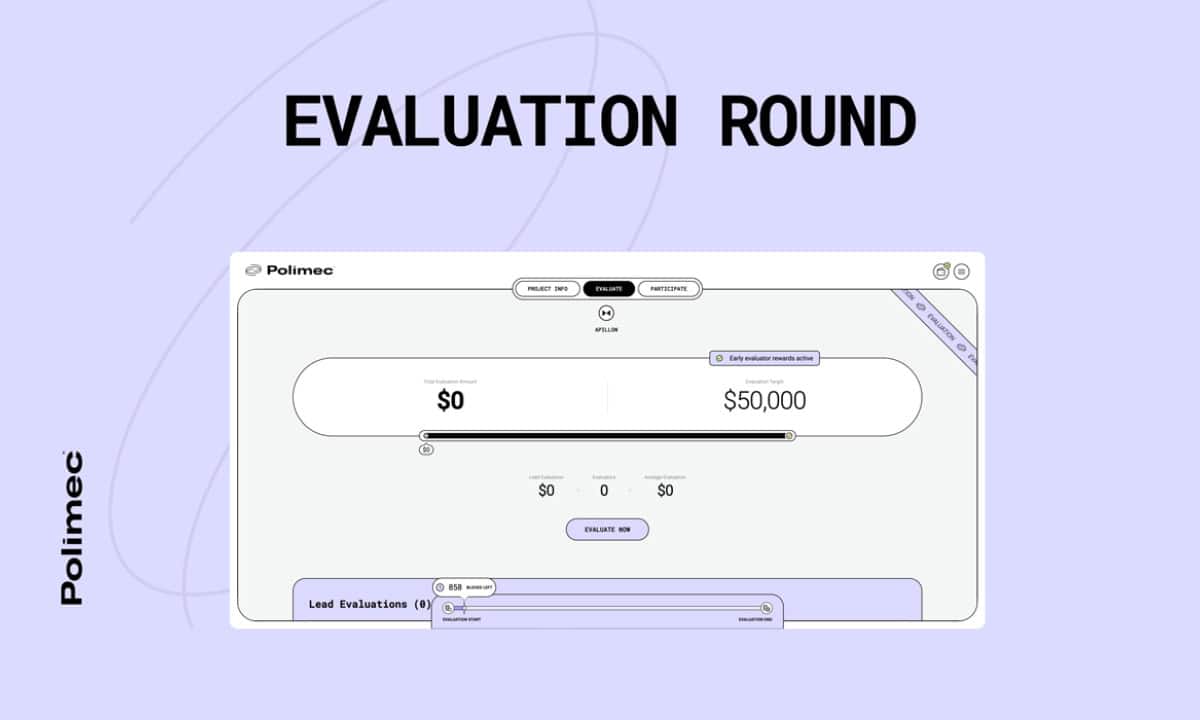

Decentralized funding protocol Polimec has launched with the goal of kickstarting a new era of community-funded Polkadot projects. The protocol provides a transparent way for teams to raise funds and issue tokens while maintaining regulatory compliance.

The first project to feature on Polimec is Apillon, an infrastructure solution for web3 developers. With the start of the first Evaluation Round on Polimec, investors get the opportunity to appraise projects and decide whether they should advance to the Funding Round. Other projects that are set to raise funds on Polimec include Mandala Chain, Gotem, and ImpactScope.

Polimec is designed to maintain the decentralization integral to web3, providing a regulatory-compliant environment that connects investors and startups globally. To participate in a project on Polimec, users must obtain a Deloitte KYC Credential, which if eligible grants access to funding information, evaluation of projects and participation in funding rounds.

Projects can conduct single or multiple funding rounds using Polimec, while investors can participate in rounds that meet their criteria. Protocol governance is determined by the PLMC holders, an on-chain council and technical committee. Any PLMC holder can submit a proposal, which results in a token-holder vote provided it gets the required backing.

Polimec enables emerging web3 projects, focused on the Polkadot ecosystem, an opportunity to achieve their funding goals. This will maximize their prospects of developing transformative blockchain solutions and increasing adoption by solving real-world problems. Polimec simultaneously gives web3 investors of all kinds access to projects committed to fundraising on a transparent and compliant basis.

The first Evaluation and Funding Rounds to be performed on Polimec will give the Polkadot community an opportunity to experience the future of web3 fundraising and to appraise some of the most innovative projects currently seeking capital to turn their ideas into reality.

About Polimec

Polimec is a permissionless fundraising infrastructure protocol providing an automated framework for projects to raise funds within a broad and diverse investor base with transparent and fair access for all. The protocol allows access to fundraising and governs the issuance, distribution, and conversion of tokens to mainnet.

The protocol maximizes value creation for Web3 projects, allows different stakeholders to participate in funding rounds, and minimizes information asymmetry between participants and issuers to grow their community. The underlying reward mechanism ensures that the interests of the various participants and projects are aligned for sustainable fundraising.

Learn more:

Webpage: https://www.polimec.org/

Knowledge Hub: https://hub.polimec.org/

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Cryptocurrency

Max Keiser Explains How Tether and El Salvador Will Send Bitcoin (BTC) Price to $220K

American broadcaster and Bitcoin proponent Max Keiser believes the stablecoin issuer Tether and El Salvador, as well as the declining United States dollar (USD), will push BTC’s price to $220,000 in no distant time.

In a Saturday tweet, Keiser said the USD is doomed because inflation will “sky harder,” while this happens, BTC will be well on its way to $220,000.

The USD Is “F****d”

In comments sent to CryptoPotato, Keiser explained that Tether’s stablecoin business is strengthening Bitcoin and weakening the USD, which forces the U.S. government to keep raising interest rates.

According to the Bitcoin bull, every country in the BRICS union, including China and Russia, has understood that the United States is dying in a debt trap of its making, possibly leading to hyperinflation in the printing of USD. As a result, China and Russia are discarding the USD as the world reserve currency and conducting bilateral deals instead.

Worse still, BRICS is reportedly launching a new, gold-backed digital currency later this year, putting “the final nail” into the dollar and the North Atlantic Treaty Organization (NATO).

While BRICS continues its fight against the U.S., American financial services firm Cantor Fitzgerald and Tether have an ongoing speculative attack against the dollar, Keiser added. Unfortunately, the attack would hasten the demise of the fiat currency.

Tether’s Role in The Dollar’s Demise

Millions of crypto users swap fiat money for Tether (USDT), and the stablecoin company, in turn, swaps the fiat for U.S. treasuries at Cantor, using the interest paid by the firm to buy more BTC. With the increasing rates in the U.S., Tether’s profits are rising, as are the company’s BTC purchases.

“It’s a USD doom loop that can’t be stopped,” Keiser said.

Besides Tether, Michael Saylor’s business intelligence firm MicroStrategy is part of the speculative attack, according to Keiser. The broadcaster said the difference between the two firms is that MicroStrategy has to “dilute shareholders with serial issuance of preferreds,” while Tether does not need to pay any interest.

With time, the pace of BTC purchases from several entities, including Tether, MicroStrategy, and El Salvador, will explode, Keiser noted. Speaking about the first country to legalize BTC as a legal tender, Keiser, who has had several meetings with the nation’s President, said:

“El Salvador is always looking to increase its bitcoin position, substantially so.”

On the other hand, the dollar will implode, and soon, no market participant will accept fiat for BTC. The rise in BTC purchases would push the asset’s value to $220,000, he asserted.

By the time the U.S. launches their central bank digital currency, it would be too late, as the BRICS currency will be the world reserve currency, Bitcoin will be the world’s reserve asset, and Tether will be the global replacement for the SWIFT network.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Cryptocurrency

Will This Week’s Economic Events Rattle Crypto Markets?

The highlights of the economic week ahead are the Federal Reserve meeting minutes and a big earnings report from semiconductor giant Nvidia.

There are also reports on global manufacturing and services indexes and consumer inflation expectations which could influence markets a little.

Economic Calendar May 20-24

Last week saw the U.S. Dow Jones Industrial Average (DJIA) cross the 40,000 mark for the first time. The stock rally was boosted by favorable figures in the CPI report, which ignited speculation that the US economy is cooling and that the central bank may cut rates in the next few months.

The minutes of the Federal Reserve FOMC May meeting will be revealed on Wednesday this week. These may offer more insight into monetary policy going forward and a projected rate-cut timeline.

On Thursday, May’s Global Manufacturing PMI preliminary report will be released, capturing business conditions in the manufacturing sector.

May 23 also sees a similar PMI report for the services sector. This is a crucial leading indicator since the services sector is responsible for over 70% of the total US GDP and a signal for changing economic conditions.

Friday, we will see May’s Michigan Consumer Sentiment Index, which measures inflation expectations. These reports portray the results of a monthly survey of consumer confidence levels in the country.

Key Events This Week:

1. Nvidia reports Q1 2024 earnings – Wednesday

2. Existing Home Sales data – Wednesday

3. Fed Meeting Minutes – Wednesday

4. New Home Sales data – Thursday

5. Durable Goods Orders data – Friday

6. Total of 18 Fed speaker events this week

All eyes are…

— The Kobeissi Letter (@KobeissiLetter) May 19, 2024

Wednesday also has a highly-anticipated quarterly revenue report from semiconductor giant Nvidia which could keep tech stocks and crypto on a roll.

“Bulls want Nvidia to extend the run into record highs, and bears want Nvidia to mark the top,” commented the Kobeissi Letter on May 19.

Markets in Asia ticked up on Monday, May 20, tracking Wall Street gains. Investors in the region are awaiting their own sets of economic data this week with eyes on Japan for inflation data and South Korea for a rates decision.

Crypto Market Impact

With no major economic events this week, it is unlikely that crypto markets will be heavily impacted, and volatility is likely to remain low.

Crypto markets were buoyed last week, with total capitalization topping $2.5 trillion and holding gains over the weekend. They have dipped a little over the past 24 hours, however, with a 1.2% decline.

Bitcoin fell to an intraday low of $66,000 but found support there and returned to $67,000 at the time of writing during Monday morning’s Asian trading session.

Ethereum has dropped 1.3% on the day in a fall back to $3,078 after reaching a weekend high of $3,142. The altcoins were predominantly in the red this Monday morning.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Forex2 years ago

Forex2 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex2 years ago

Forex2 years agoHow is the Australian dollar doing today?

Forex1 year ago

Forex1 year agoUnbiased review of Pocket Option broker

Forex2 years ago

Forex2 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Cryptocurrency2 years ago

Cryptocurrency2 years agoWhat happened in the crypto market – current events today

World2 years ago

World2 years agoWhy are modern video games an art form?

Stock Markets2 years ago

Stock Markets2 years agoMorgan Stanley: bear market rally to continue

Economy2 years ago

Economy2 years agoCrude oil tankers double in price due to EU anti-Russian sanctions