Forex

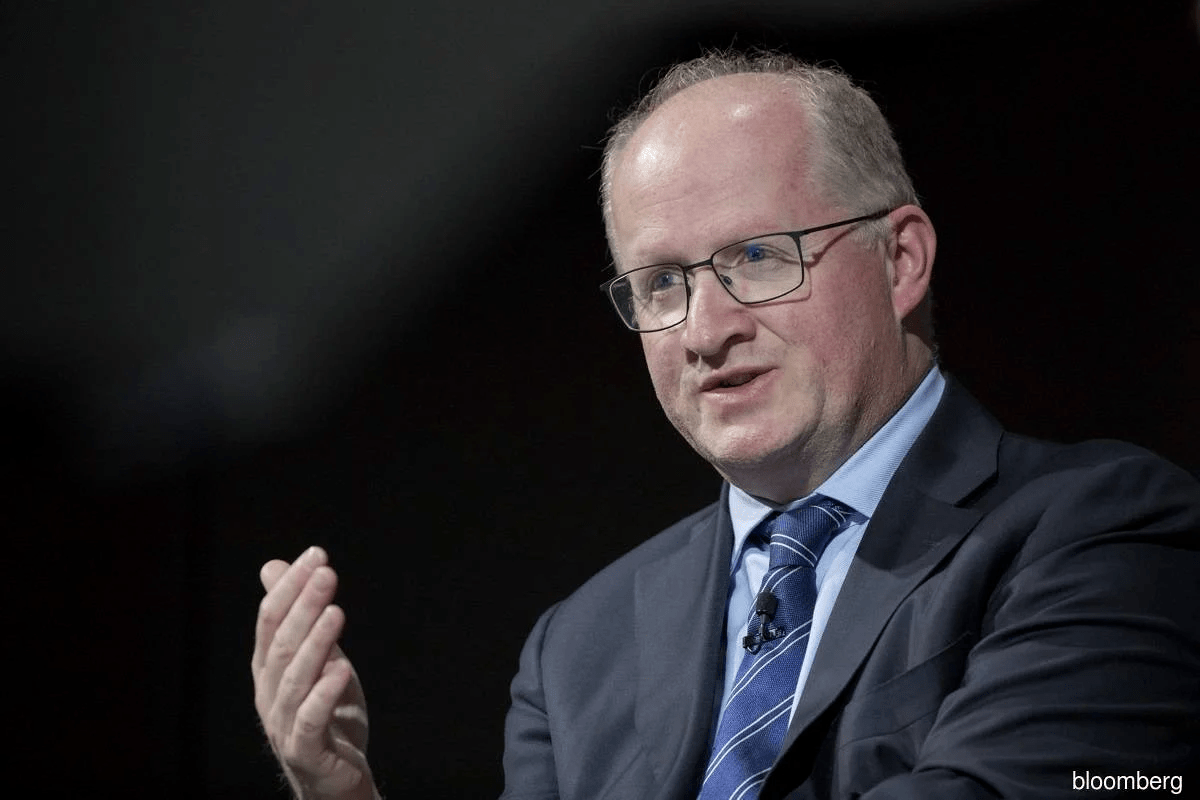

Inflation rate in the eurozone is close to a peak – ECB chief economist

Inflation rates in the eurozone are close to a peak, said Philip Lane, chief economist at the European Central Bank (ECB).

“It is too early to conclude that inflation has peaked, but I can say with confidence that we are close to peaking,” Lane told Italian newspaper Milano Finanza.

“We expect that further interest rate hikes will be needed, but we have already done a lot,” Lane said. – The starting point is different now, given that rates have already been raised by 200 basis points (bps). We will consider the scale of what has already been done.

Euro inflation rate forecast

The ECB raised all three key interest rates by 75 bps at its October meeting. The benchmark lending rate was raised to 2%, the deposit rate to 1.5% and the rate on margin loans to 2.25%. Since July this year, the ECB has raised key rates by 200 bps.

Experts expect that in December the rate on loans will be raised to at least 2% from 1.5%. Today it is worth noting that in the Euro / U.S. Dollar pair the European currency started to strengthen a bit.

According to preliminary data from the Statistical Office of the European Union, inflation in the Eurozone slowed to 10% y/y in November from 10.6% in October. A decrease in the growth rate of consumer prices was recorded for the first time in 1.5 years. According to Lane, an acceleration in inflation in early 2023 cannot be ruled out.

“After the first few months are over, in the spring or summer, we are likely to see a major slowdown in inflation. However, it will take time for it to slow down to the ECB’s 2% target,” Lane said.

Asked whether inflation could slow to 6-7% in 2023, he said that “initial easing as a result of rate hikes will bring the rate of price growth to about that level,” and the slowdown will continue thereafter.

Earlier we reported that the Eurozone unemployment rate fell to 6.5% in October and the EU unemployment rate fell to 6.0%.

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions