Forex

Unbiased review of Pocket Option broker

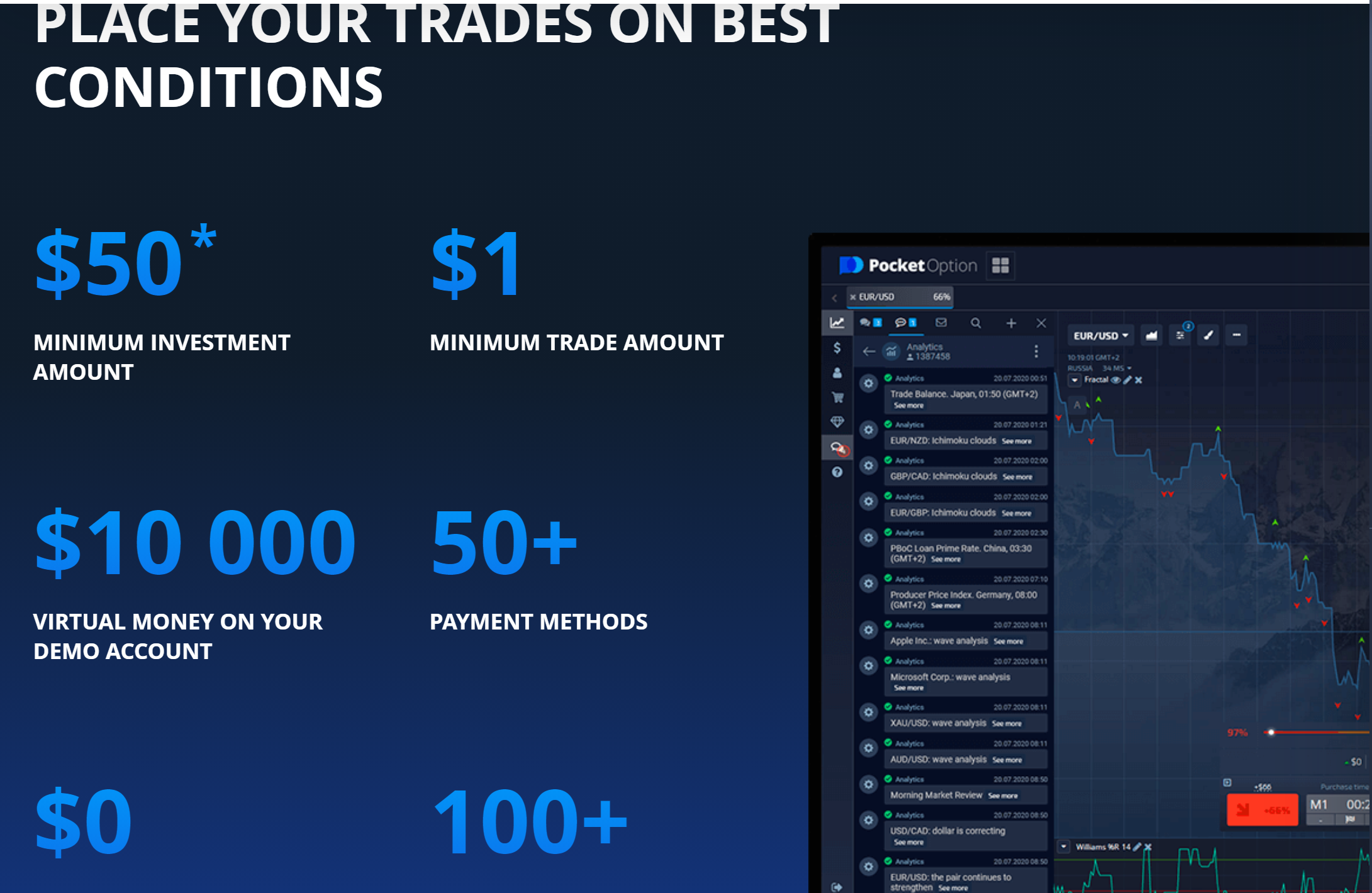

Pocket Option is next, offering its clients more than 100 trading instruments, including the notorious binary options.

A brief history of the broker and awards

Pocket Option was founded relatively recently – in 2016. The main office is based in Cyprus. Pocket Option strategy is to provide customers with a modern trading platform on which any trader can make money through their skills.

Despite its small age, the broker has gained huge popularity. This is due to the active brand promotion on social networks and promotional videos on YouTube from top bloggers. The company is a promising young broker. Pocket Option app is available to users.

What services it offers

The list of services is taken from the official website:

- Demo account and real account.

- Training for novice traders.

- Modern trading platform.

- More than 100 assets for Pocket Option trading including БО.

- OTC-platform (OTC transactions).

- Automated following of other traders.

- Tournaments for Pocket Option trading.

- Bonus system.

- Round the clock technical support.

- Instruments for trading and investing.

Pocket Option trading – work with broker

To start trading, you have to create an account. You will get access to a personal account, where you can make transactions with options and other instruments.

Registration on the official site

The registration procedure is very simple. You need to fill out a small form, provide a correct email address and confirm it. Facebook users can register by simply allowing their profile details to be sent to the company’s website.

Instructions for account opening

To start trading on a real Pocket Option account, it is required to fulfill 2 conditions of the broker:

- pass verification;

- To replenish the balance for the minimum amount.

The verification process means the transfer of personal passport data to the broker. Hardly anybody will check their authenticity, but then the administration may deny the withdrawal of funds from the account, if the data was provided incorrectly.

Pocket Option demo

Pocket Option demo is available right after registration. You can trade on it at any time of the day or night and have unlimited virtual balances. Market liquidity is provided by bots, so virtual accounts may be used for practicing any trading strategies.

Depositing of the account and withdrawal of funds

You can deposit your account by one of 20 methods without any commission. The minimum amount on the Pocket Option is $50. When depositing the account, you need to determine whether you will participate in the bonus program or not. You can withdraw the money using the same methods that you deposited. The minimum amount for withdrawal is $30. Applications for withdrawal are processed manually, the time of receipt of money to the client – from 10 minutes to 3 days, depending on the load of the service.

Here you can also open a short position on the Facebook stock chart. Just a year ago, the company peaked, valued at more than $870 billion, but it has been steadily going down ever since, with Mark losing billions of dollars in pursuit of his meta-universe idea, while his flagship social networks, Facebook and Instagram, are facing growing difficulties. In less than a year, the company has lost $400 billion. Facebook in particular is having its worst time, with audience growth replaced by decline. But you can make money on this on the Pocket Option platform.

Technical support

Technical support is available 24 hours a day. Clients can order a free phone call, send an email with a question, or communicate with an expert in the online chat.

If you are interested in binary options, we recommend Pocket Option.

Forex4 years ago

Forex4 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions