Stock Markets

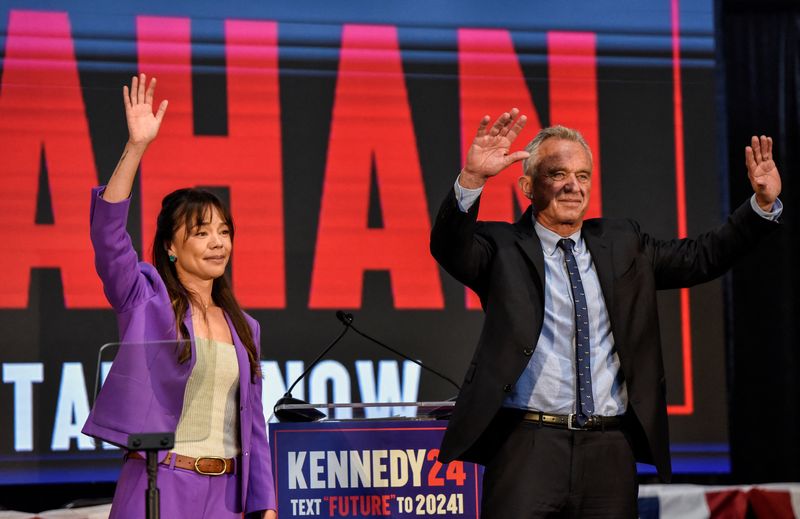

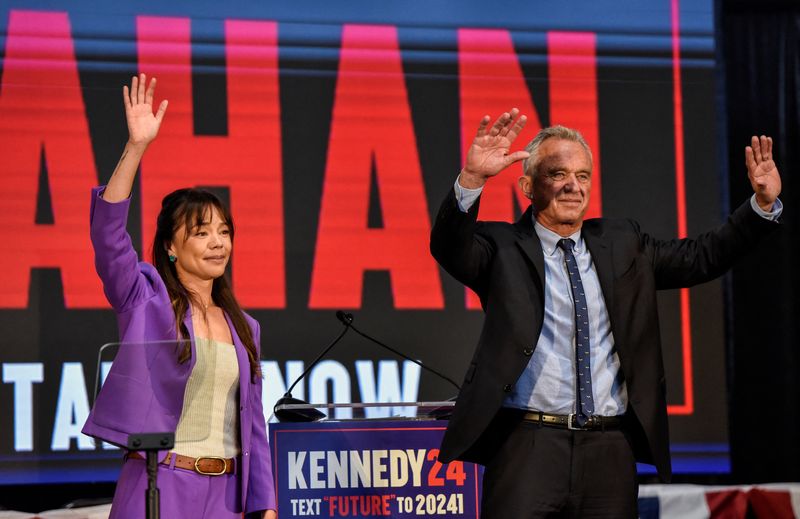

RFK Jr running mate injects needed cash in independent’s campaign

By Stephanie Kelly

(Reuters) – The role Robert F. Kennedy Jr.’s running mate, Nicole Shanahan, will play in his White House bid is coming into focus, as the wealthy lawyer injects millions of dollars into their independent campaign and amplifies their stances on social media.

Shanahan, a political neophyte tapped in March to be the independent candidate Kennedy’s vice presidential pick, gave $2 million one day after her candidacy was announced, campaign filings showed this week.

That money allowed the campaign to stay out of the red during an expensive push to be listed on state election ballots alongside Democratic President Joe Biden and Republican candidate Donald Trump. Kennedy’s campaign raised $5.4 million in March and spent $4.5 million, the filings showed.

Shanahan, the former wife of Google (NASDAQ:) co-founder Sergey Brin, previously gave $4 million to a pro-Kennedy super PAC, an outside spending group that has no contribution limits, to help fund an ad in this year’s NFL Super Bowl, she told the New York Times.

The dual role being played by Shanahan of both messenger and financial powerhouse is unique. “I can’t think of instances where the vice presidential candidate has been a major donor,” said Joel Goldstein, a professor at Saint Louis University School of Law.

Still largely unknown, Shanahan has gradually offered more of her policy stances on social media and in podcasts, but since her elevation to the ticket has not apparently conducted interviews with traditional news outlets. The Kennedy campaign declined a request for an interview with Shanahan.

She was a guest on Stanford University Professor Jay Bhattacharya’s podcast earlier this month to discuss chronic diseases, fertility issues and the free-speech rights of advocates who opposed pandemic-era lockdowns.

Shanahan writes frequently on social media platform X about health-related issues, including skepticism around the safety of COVID-19 vaccines.

A variety of institutions, including the World Health Organization and the Centers for Disease Control and Prevention, deem the vaccines safe.

Kennedy, known for his anti-vaccine advocacy, has used podcasts like “The Joe Rogan Experience” and social media in a bid to attract younger voters dissatisfied by the choice between Biden and Trump, who are 81 and 77 years old, respectively.

Kennedy is backed by 15% of registered voters, versus 39% for Biden and 38% for Trump, according to a recent Reuters/Ipsos poll.

Shanahan will join Kennedy in a virtual event on Monday for Earth Day, where they will discuss “why protecting the environment is essential to protecting the health of Americans,” Shanahan said on X.

She traveled earlier this month to Yuma, an Arizona town on the Mexico border, and afterwards detailed the campaign’s emphasis on border security, along with pathways for legal immigration. In another post, she highlighted her own mother’s emigration from China to the U.S.

On abortion, a key issue for many voters after the 2022 Supreme Court ruling overturning Roe v. Wade, Shanahan wrote on X earlier this month that the idea that anyone could control her body is “wrong,” but that she would “not feel right terminating a viable life living inside of me, especially if I am both healthy and that baby is healthy.”

Stock Markets

Sow Good sets price for 1.2 million share offering

IRVING, Texas – Sow Good Inc. (OTCQB to NASDAQ: SOWG), a company specializing in freeze-dried candies and treats, announced today the pricing of its public offering of 1.2 million shares at $10 each. The offering, which is expected to close on May 6, 2024, could bring in $12 million before deductions for expenses and underwriting discounts.

The announcement follows the company’s recent approval to list its common stock on the Nasdaq Capital Market, with trading commencing today. Shareholders are not required to take any action regarding the uplisting, and the ticker symbol “SOWG” will remain the same.

Sow Good has granted underwriters a 30-day option to buy up to an additional 180,000 shares. Roth Capital Partners is the sole book-running manager, with Craig-Hallum acting as co-manager for the offering.

The company plans to use the net proceeds for various corporate purposes. These include expanding production capacity, funding working and growth capital, enhancing sales and marketing efforts, and reducing certain debt tranches.

This press release contains forward-looking statements regarding the company’s strategy, plans, and objectives, including the offering’s anticipated benefits, growth expectations, and future capital expenditures. However, these statements involve risks and uncertainties that could cause actual results to differ materially.

The offering is made only through a prospectus filed with the U.S. Securities and Exchange Commission (SEC), available from Roth Capital Partners or the SEC’s website.

Sow Good Inc. is known for its innovative approach to transforming traditional candy into a new subcategory of confectioneries through proprietary freeze-drying technology.

This news article is based on a press release statement.

remove ads

.

InvestingPro Insights

As Sow Good Inc. (OTCQB to NASDAQ: SOWG) embarks on its latest public offering, investors are keenly observing the company’s financial metrics and market performance. According to real-time data from InvestingPro, Sow Good Inc. has a market capitalization of approximately $96.2 million, which reflects the market’s current valuation of the company.

Despite a challenging week with a price total return of -31.72%, the company has demonstrated a strong return over the last year, with a 158.35% increase.

InvestingPro Tips indicate that Sow Good Inc. stock trades with high price volatility and has experienced significant price movements. This could be an important consideration for investors who are sensitive to short-term market fluctuations.

The company’s stock has fared poorly over the last month, with a -21.57% price total return, but it’s worth noting that it has had a high return over the last year and a large price uptick over the last six months, reflecting a longer-term positive trend.

Investors should also be aware that Sow Good Inc. operates with a moderate level of debt and has liquid assets that exceed short-term obligations, which could be seen as a positive sign of the company’s financial health. Yet, the company is not profitable over the last twelve months, as indicated by its negative P/E ratio of -19.41 and an even more pronounced adjusted P/E ratio of -51.8 for the last twelve months as of Q4 2023.

For those looking to delve deeper into the company’s financials and performance, InvestingPro provides a wealth of additional tips. To explore these insights and to make more informed investment decisions, interested readers can take advantage of a special offer: use coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription. With 15 more InvestingPro Tips available, investors can gain a comprehensive understanding of Sow Good Inc.’s position in the market.

remove ads

.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Stock Markets

Boeing stock price target cut, maintains Buy rating on debt offering closure

On Thursday, an analyst from Jefferies revised the stock price target for Boeing (NYSE: NYSE:), bringing it down to $270 from the previous $300, while still holding a Buy rating on the stock. The adjustment follows Boeing’s recent closure of a new $10 billion debt offering.

The offering, which matures in 2042, carries an average interest rate of 6.6%, subsequently increasing Boeing’s annual interest expense by $660 million. This additional cost is expected to impact earnings per share (EPS), with a projected decrease of $0.60 in 2024 and $0.90 in 2025.

The new debt is anticipated to provide Boeing with significant operational flexibility in the near term, including the potential acquisition of SPR. However, the financial maneuver has led to a downward revision of the company’s free cash flow (FCF) estimates. The analyst now expects Boeing’s FCF to be $1.2 billion in 2024 and $5.3 billion in 2025, a decrease from the previously estimated $1.6 billion and $5.8 billion, respectively.

Boeing’s net debt (ND) to EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio is projected to end 2024 at 7.9 times, based on deflated EBITDA. This ratio is expected to decrease significantly to 2.0 times by the end of 2026, following an anticipated $12.6 billion debt paydown over the period.

The company’s recent financial activities, including the substantial debt offering, are part of Boeing’s broader strategy to strengthen its balance sheet and ensure operational stability as it navigates the current market environment. Despite the reduced price target, the maintained Buy rating indicates a continued positive outlook on the company’s stock by the analyst at Jefferies.

remove ads

.

InvestingPro Insights

Recent data from InvestingPro paints a nuanced picture of Boeing’s financial standing. With a market capitalization of $108.84 billion, the company is a significant player in the Aerospace & Defense industry. Yet, Boeing’s P/E ratio stands at a negative -50.08, reflecting the challenges it faces. The company’s revenue over the last twelve months as of Q1 2024 is reported at $76.44 billion, with a growth rate of 8.37%, indicating some resilience in their operations.

InvestingPro Tips highlight that Boeing is not expected to be profitable this year, which aligns with the analyst’s concerns about the company’s increased interest expenses and revised EPS. Additionally, Boeing’s stock price has shown considerable volatility, with a 3-month total price return of -18.11%. This volatility is a critical factor for investors to consider, especially in light of the company’s recent debt offering and the impact on its financial projections.

For investors seeking a deeper analysis, there are additional InvestingPro Tips available at https://www.investing.com/pro/BA, which could provide further insight into Boeing’s financial health and stock performance. Use the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription, unlocking more valuable tips to inform your investment decisions.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Stock Markets

MGP Ingredients announces dividend of $0.12 per share

ATCHISON, Kan. – MGP Ingredients , Inc. (NASDAQ:), a prominent producer of distilled spirits and food ingredient solutions, has declared a quarterly dividend of $0.12 per share on its common stock. The dividend is set to be distributed on May 31, 2024, to shareholders who are on record as of May 17, 2024.

The company, with a history dating back to 1941, is recognized for its extensive portfolio of premium branded and distilled spirits, including bourbon and rye whiskeys, gins, and vodkas. MGP Ingredients operates distilleries in Kentucky and Indiana, along with bottling facilities spread across Missouri, Ohio, and Northern Ireland, positioning it as one of the largest distillers in the United States.

MGP Ingredients also boasts a branded spirits portfolio that encompasses a range of brands, including those from Luxco, a subsidiary known for its award-winning spirits. Luxco’s offerings feature brands like Ezra Brooks, Rebel, and Blood Oath, among others, produced at various distilleries such as Lux Row Distillers and Limestone Branch Distillery.

Aside from spirits, MGP Ingredients’ Ingredient Solutions segment provides specialty proteins and starches derived from plants, catering to a broad spectrum of food products and emphasizing functional, nutritional, and sensory benefits.

The announcement of the dividend reflects the company’s continued commitment to delivering value to its shareholders. This financial decision is based on the company’s performance and strategic initiatives aimed at maintaining its position in the market.

The information for this report is based on a press release statement from MGP Ingredients, Inc.

InvestingPro Insights

MGP Ingredients, Inc. (NASDAQ:MGPI) has recently affirmed its shareholder commitment with the announcement of a quarterly dividend, echoing the company’s stable financial standing and strategic market positioning. Here are some insights based on real-time data from InvestingPro that provide a deeper understanding of the company’s financial health and stock performance:

remove ads

.

InvestingPro Data shows that MGP Ingredients has a market capitalization of $1.72 billion and is trading with a P/E ratio of 16.36, which adjusts to a more attractive 13.4 based on the last twelve months as of Q4 2023. The company’s revenue, during the same period, grew by 6.92%, indicating a steady financial trajectory.

Despite analysts anticipating a sales decline in the current year, MGP Ingredients has demonstrated a capacity to cover its interest payments with its cash flows. Moreover, the company’s liquid assets surpass its short-term obligations, showcasing a solid liquidity position.

Notably, MGP Ingredients is trading near its 52-week low, presenting a potential opportunity for investors considering the company’s historical profitability and high return over the last decade. It’s also worth mentioning that the company operates with a moderate level of debt and has been profitable over the last twelve months.

InvestingPro Tips suggest that while there are downward revisions on earnings for the upcoming period, the company is expected to remain profitable this year. For investors seeking a more comprehensive analysis, there are 6 additional InvestingPro Tips available at https://www.investing.com/pro/MGPI, which can be accessed with an additional 10% off a yearly or biyearly Pro and Pro+ subscription using the coupon code PRONEWS24.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Forex2 years ago

Forex2 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex2 years ago

Forex2 years agoHow is the Australian dollar doing today?

Forex1 year ago

Forex1 year agoUnbiased review of Pocket Option broker

Forex2 years ago

Forex2 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Cryptocurrency2 years ago

Cryptocurrency2 years agoWhat happened in the crypto market – current events today

World2 years ago

World2 years agoWhy are modern video games an art form?

Stock Markets2 years ago

Stock Markets2 years agoMorgan Stanley: bear market rally to continue

Economy2 years ago

Economy2 years agoCrude oil tankers double in price due to EU anti-Russian sanctions