Each week we identify names that look bearish and may present interesting investing opportunities on the short side.

Using technical analysis of the charts of those stocks, and, when appropriate, recent actions and grades from TheStreet’s Quant Ratings, we zero in on three names.

While we will not be weighing in with fundamental analysis, we hope this piece will give investors interested in stocks on the way down a good starting point to do further homework on the names.

Best Buy Is Scratched and Dented

Best Buy Co. (BBY) recently was downgraded to Hold with a C+ rating by TheStreet’s Quant Ratings.

Here is another retail name that has taken it on the chin this year. The chart of the electronics and appliance seller is atrocious, with a pattern of lower highs and lower lows plaguing the stock.

Money flow is poor and moving average convergence divergence (MACD) is about to cross for a bearish signal; also, the Relative Strength Index (RSI) cannot seem to get back on track. This channel is well-defined and we could see a move down the $50s before too long.

If short, target that area but place a stop at $74. The cloud is red as can be.

Howard Hughes Struggles

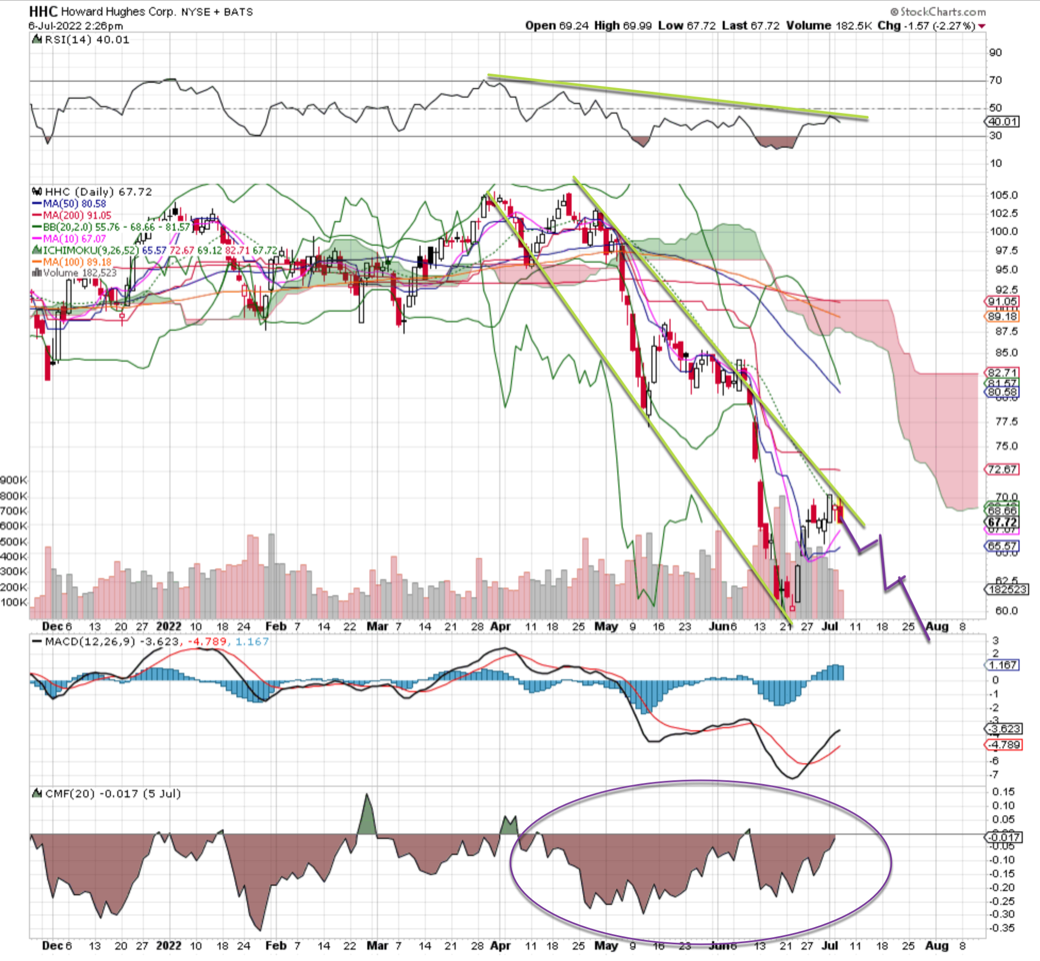

Howard Hughes Corp. (HHC) recently was downgraded to Sell with a D+ rating by TheStreet’s Quant Ratings.

The chart of the real estate developer and manager is very weak, with lower highs and lower lows and exploding money flow. Unfortunately, that is to the downside.

RSI is bending downward at a steep angle, which tells us there is more downside to go before becoming oversold. The channel is pretty well-defined, and we could see a move down toward the mid $50s or so. That big move up into resistance is an ideal spot to get short.

Target that $50s area, but put in a stop at $71 just in case.

Stratasys Droops

Stratasys Ltd. (SSYS) recently was downgraded to Sell with a D+ rating by TheStreet’s Quant Ratings.

The maker of 3-D printing systems has had a few miserable days lately but nothing like this past Wednesday, when the stock was drilled all day long on strong turnover. MACD has rolled over to a sell signal and the RSI has been rejected.

This stock is headed much lower, likely to single digits. The cloud is red, and while some support may be here at $16 that is not likely to hold.

If short, target the $9 area, put in a stop at $22 just in case.

(Real Money contributor Bob Lang is co-portfolio manager of TheStreet’s Action Alerts PLUS. Want to be alerted before AAP buys or sells stocks? Learn more now. )