Uncategorized

It’s time to buy the selloff in energy stocks, starting with these 4 names

It’s never really a bear market until all the stragglers get taken out and shot. So it was just a matter of time before energy stocks, the big winners for much of the first half of this year, got nailed.

Now the Energy Select Sector SPDR Fund

XLE,

and the SPDR S&P Oil & Gas Exploration & Production

XOP,

exchange-traded funds (ETFs) are down 27% to 36% from their 2022 peaks – official bear-market territory.

This is an opportunity for anyone who missed the energy rally. The reason: Unfounded fears are driving the declines.

“More to come? We don’t think so,” says Ben Cook, an oil and gas sector expert who manages the Hennessy Energy Transition Fund

HNRIX,

and the Hennessy Midstream Fund

HMSFX,

Cook and I were last bullish on energy together in November 2021. After a little volatility and sideways action, XLE and XOP went on to gain 52% to 58% in eight months.

Now three factors suggest another strong move ahead for energy names, believes Cook: decent underlying fundamentals, good valuations and solid cash flows. Goldman Sachs predicts large-cap energy stocks will gain 30% or more through the end of the year and that its buy-rated stocks could be up 40% or more.

Just remember, no one can ever call the precise bottom in the market or a group. This is not a bet-the-farm-for-instant-riches kind of call.

Here’s a closer look.

1. Favorable fundamentals

U.S. exploration and production stocks have fallen so much that they are pricing in expectations of $50 to $60 a barrel for West Texas Intermediate

CL.1,

says Cook, down from around $100 now. “We think equities are pricing are more dire situation than is currently reflected in market fundamentals,” he adds.

Indeed, the 2023 futures curve for WTI suggests $88 a barrel oil next year.

Prices for future delivery are notoriously fickle. But this oil price “forecast” of $88 for WTI is in line with Goldman Sachs “mid-cycle” oil price forecasts of $85 for WTI and $90 for Brent. It also makes sense for the following reasons.

Supply is constrained. That’s because oil companies have been underinvesting in exploration and production development. This helps explain why inventories are now meaningfully below historical seasonal norms.

“With very little supply cushion available, any further disruption to produced volumes, either geopolitical or storm-related, could send pricing meaningfully higher,” says Cook.

More: U.S. oil has tumbled — What that says about recession fears and tight crude supplies

Plus: U.S. crude-oil stockpiles likely declined in latest Energy Department data, analysts say

Demand will hang in there. The looming prospects of recession have hit the energy group hard. But this may be a false fear. While a recession would lower demand in the U.S. and Europe, demand will grow in China as it continues to lift COVID lockdown restrictions.

Besides, recession is not even necessarily in the cards. “While the odds of a recession are indeed rising, it is premature for the oil market to be succumbing to such concerns,” says Damien Courvalin, the head of energy research and senior commodity strategist at Goldman Sachs. “We believe this move[ in energy-sector stocks] has overshot.”

The global economy is still growing, and oil demand is growing even faster because of reopening in Asia and the resumption in international travel, he notes.

“We maintain a base case view that a recession will be avoided,” says Ruhani Aggarwal of the J.P. Morgan global commodities research team. The bank puts the odds of recession over the next 12 months at 36%.

Russian oil continues to flow. Despite well-founded outrage over Russia’s invasion of Ukraine, the European Union hasn’t been really effective at keeping Russian supply off the market. Europe still buys Russian oil, and any shortfall in demand there will be offset by buying in China and India.

Europe’s latest plan is to set price caps to limit financial gains by Russia. It’s not clear how this will work out. But it could backfire. In a worst-case scenario, Russia retaliates and cuts production enough to send oil to $190 a barrel, writes Natasha Kaneva of the J.P. Morgan global commodities research team. “Russia had already showed its willingness to withhold supplies of natural gas to EU countries that refused to meet payment demands,” says Kaneva.

2. Valuations

As measured by enterprise value to expected cash flows, the energy group is the cheapest sector out there now, says Hennessy’s Cook.

3. Free cash flow

U.S. energy companies continue to return lots of cash to shareholders via dividends and buybacks, notes Cook. This will support stock prices.

The free cash flow yield (cash flow divided by share price ) for the energy companies in the S&P 500 is higher than that of any other S&P sector. Based on consensus analyst estimates for 2022, U.S. energy companies will generate a 15% free cashflow yield, and exploration and production companies will generate a 20% free cashflow yield, says Cook.

These numbers confirm the cheapness of the group.

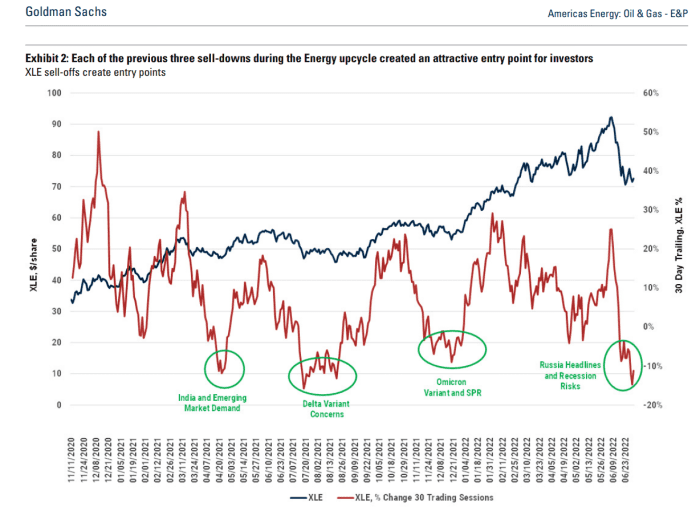

This chart from Goldman Sachs shows that all comparable selloffs in recent years have been buying opportunities, given those underlying bullish factors.

Goldman Sachs

Favored companies

Cook singles out these three companies as favorites.

Exxon Mobil

A blue-chip energy name, Exxon Mobil

XOM,

has a diversified business model that dampens stock volatility, says Cook. It’s a producer, so energy price gains support the stock.

But it also has a petrochemicals division that makes petroleum-based materials like polyethylene used in plastic products like food containers. This business can offset the negative impact from weakness in energy prices.

It also has a liquid natural gas business that exports LNG from the U.S. This division benefits from the sharp spike in LNG prices in Europe and Asia linked to Russian natural gas supply disruptions.

EOG Resources

This U.S. energy producer

EOG,

has some of the highest quality shale basins in the country, says Cook. This gives EOG a cost advantage over peers, and it supports strong cash flow. EOG also has a good track record of delivering productivity gains in wells, and cost cuts.

Cheniere Energy

Like Exxon, this Louisiana-based company

LNG,

exports LNG to Europe and Asia. So it, too, benefits from the dramatic natural gas and LNG price hikes there relative to natural gas prices in the U.S. In the background, Cheniere is paying down its debt, which should allow Cheniere to boost its dividend over the next eighteen months, believes Cook.

Dividend payers

Goldman favors energy companies that pay high dividends and have low beta stocks, meaning their stocks are more stable and move around less than the sector or the overall market. In this group, Goldman’s favorite is Pioneer Natural Resources

PXD,

Goldman likes the company’s huge inventory of undeveloped assets in the Permian basin, and the strong balance sheet and free cash flow supporting the solid 7.8% dividend yield.

Goldman has a 12-month price target of $266 on the stock.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested XOM and LNG in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.

Uncategorized

BofA Securities maintains Amazon.com at ‘buy’ with a price target of $154.00

Uncategorized

Six people in critical condition, one still missing after Paris blast – prosecutor

5/5

© Reuters. French firefighters and rescue forces work after several buildings on fire following a gas explosion in the fifth arrondissement of Paris, France, June 21, 2023. REUTERS/Gonzalo Fuentes

2/5

PARIS (Reuters) – Six people remained in a critical condition and one person was believed still missing on Thursday, one day after a blast ripped through a street near Paris’ historic Latin Quarter, the city’s public prosecution office said. “These figures may still change,” prosecutor Maylis De Roeck told Reuters in a text message, adding that around 50 people had been injured in the blast, which set buildings ablaze and caused the front of one to collapse onto the street. Of two people initially believed missing, one has been found in hospital and is being taken care of, the prosecutor said, adding: “Searches are ongoing to find the second person.” Authorities have not yet said what caused the explosion, which witnesses said had followed a strong smell of gas at the site. The explosion led to scenes of chaos and destruction in the historic Rue Saint Jacques, which runs from the Notre-Dame de Paris Cathedral to the Sorbonne University, just as people were heading home from work. It also destroyed the facade of a building housing the Paris American Academy design school popular with foreign students. Florence Berthout, mayor of the Paris district where the blast occurred, said 12 students who should have been in the academy’s classrooms at the time had fortunately gone to visit an exhibition with their teacher.

“Otherwise the (death toll) could have been absolutely horrific,” Berthout told BFM TV. She said three children who had been passing by at the time were among the injured, although their lives were not in danger.

Uncategorized

4 big analyst cuts: Alcoa & DigitalOcean shares drop on downgrades

© Reuters.

Here is your Pro Recap of the biggest analyst cuts you may have missed since yesterday: downgrades at Alcoa, DigitalOcean, Teleflex, and Xcel Energy.InvestingPro subscribers got this news in rapid fire. Never be left in the dust again.Alcoa stock drops on Morgan Stanley downgrade Alcoa (NYSE:) shares fell more than 3% pre-market today after Morgan Stanley downgraded the company to Underweight from Equalweight and cut its price target to $33.00 from $43.00, as reported in real time on InvestingPro.The firm sees a significant decline in consensus estimates, and as negative earnings revisions materialize, it believes the stock will face downward pressure and underperform.The analyst’s estimates for EBITDA in Q2, 2023, and 2024 are substantially lower than the consensus. The stock is currently trading above its historical average. The firm said its downward revisions in earnings estimates and price target are attributed to the company’s high operating leverage to aluminum prices.DigitalOcean stock plunges on downgradePiper Sandler downgraded DigitalOcean (NYSE:) to Underweight from Neutral with a price target of $35.00. As a result, shares plunged more than 5% pre-market today.The company reported its last month, with revenue beating the consensus estimate, while EPS coming in worse than expected. Furthermore, the company provided a strong outlook, which was above the Street estimates.2 more downgradesTeleflex (NYSE:) shares fell more than 3% yesterday after Needham downgraded the company to Hold from Buy, noting that UroLift expectations may still be too high.According to Needham, their checks indicate that urologists are reducing their use of UroLift due to its retreatment rates, reimbursement cuts, and increasing use of competing procedures. This is also supported by their Google Trends data analysis, which indicates decreasing search interest in UroLift.BMO Capital downgraded Xcel Energy (NASDAQ:) to Market Perform from Outperform and cut its price target to $64.00 from $69.00 to reflect the lower-than-expected terms of the company’s regulatory settlement in Colorado.Amid whipsaw markets and a slew of critical headlines, seize on the right timing to protect your profits: Always be the first to know with InvestingPro.Start your free 7-day trial now.

Forex3 years ago

Forex3 years agoForex Today: the dollar is gaining strength amid gloomy sentiment at the start of the Fed’s week

Forex3 years ago

Forex3 years agoUnbiased review of Pocket Option broker

Forex3 years ago

Forex3 years agoDollar to pound sterling exchange rate today: Pound plummeted to its lowest since 1985

Forex3 years ago

Forex3 years agoHow is the Australian dollar doing today?

Cryptocurrency3 years ago

Cryptocurrency3 years agoWhat happened in the crypto market – current events today

World3 years ago

World3 years agoWhy are modern video games an art form?

Commodities3 years ago

Commodities3 years agoCopper continues to fall in price on expectations of lower demand in China

Economy3 years ago

Economy3 years agoCrude oil tankers double in price due to EU anti-Russian sanctions